Strategic Shifts in iShares MSCI ACWI ex U.S. ETF's Global Portfolio

Highlighting Key Moves with Taiwan Semiconductor Manufacturing Co Ltd

The iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio), known for its strategic investments in large- and mid-cap international equities, has recently disclosed its N-PORT filing for the second quarter of 2024. This ETF aims to mirror the performance of the MSCI ACWI ex USA Index, which represents a broad global equity market excluding the United States, covering about 85% of the equity opportunity set outside the U.S. across both developed and emerging markets.

Summary of New Buys

In its latest filing, iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio) expanded its portfolio by adding 19 new stocks. Noteworthy new additions include:

Screen Holdings Co Ltd (TSE:7735), purchasing 14,300 shares, which now represent 0.03% of the portfolio, valued at 1.48 billion.

Rexel SA (XPAR:RXL), with 33,386 shares, making up about 0.02% of the portfolio, valued at 865,360.

Ades Holding Co (SAU:2382), adding 48,828 shares, accounting for 0.01% of the portfolio, valued at ?260,110.

Key Position Increases

The ETF has also increased its stakes in several key holdings, including:

Haleon PLC (LSE:HLN), where it boosted its position by 264,565 shares, bringing the total to 1,222,043 shares. This adjustment increased the share count by 27.63%, impacting the portfolio by 0.03%, with a total value of 5,161,100.

Zomato Ltd (NSE:ZOMATO), with an additional 167,973 shares, bringing the total to 1,091,177 shares, valued at ?2,518,360.

Summary of Sold Out Positions

The ETF has completely exited positions in 56 stocks during the quarter, including:

Algonquin Power & Utilities Corp (TSX:AQN), selling all 120,297 shares, impacting the portfolio by -0.02%.

Naturgy Energy Group SA (XMAD:NTGY), liquidating all 25,709 shares, also impacting the portfolio by -0.02%.

Key Position Reductions

Significant reductions were made in several holdings, notably:

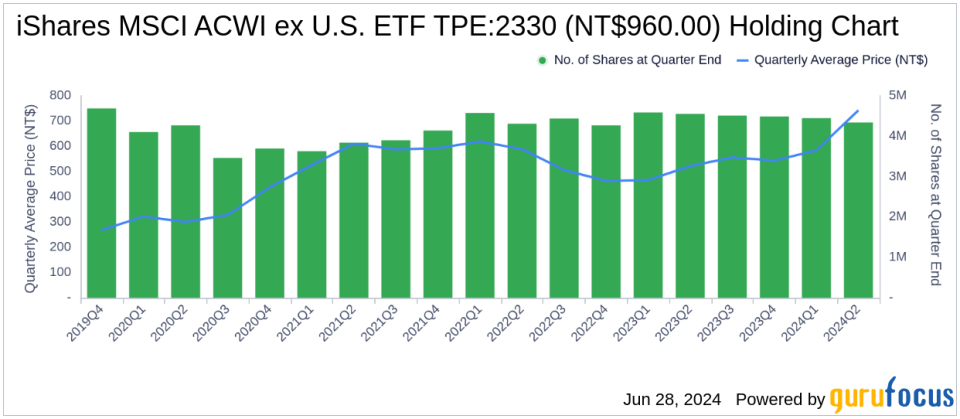

Taiwan Semiconductor Manufacturing Co Ltd (TPE:2330), where 107,000 shares were sold, decreasing the stake by 2.41% and impacting the portfolio by -0.05%. The stock had an average trading price of NT$742.29 during the quarter and has seen a return of 23.71% over the past three months and 63.27% year-to-date.

Shell PLC (LSE:SHEL), reducing the position by 52,506 shares, a 4.35% decrease, impacting the portfolio by -0.04%. The stock traded at an average price of 26.26 during the quarter, with returns of 8.69% over the past three months and 11.65% year-to-date.

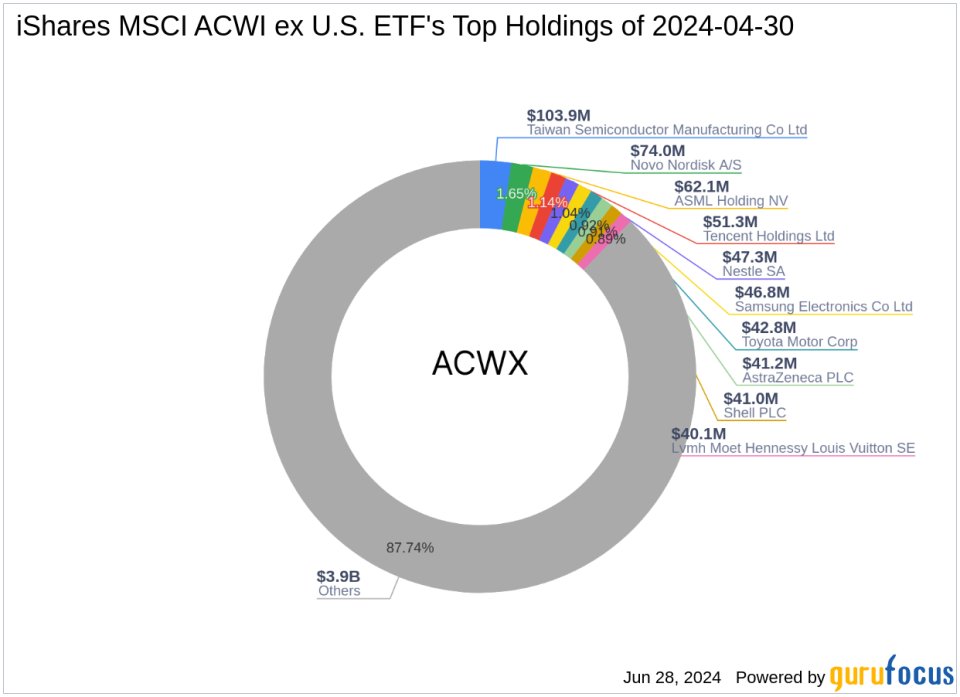

Portfolio Overview

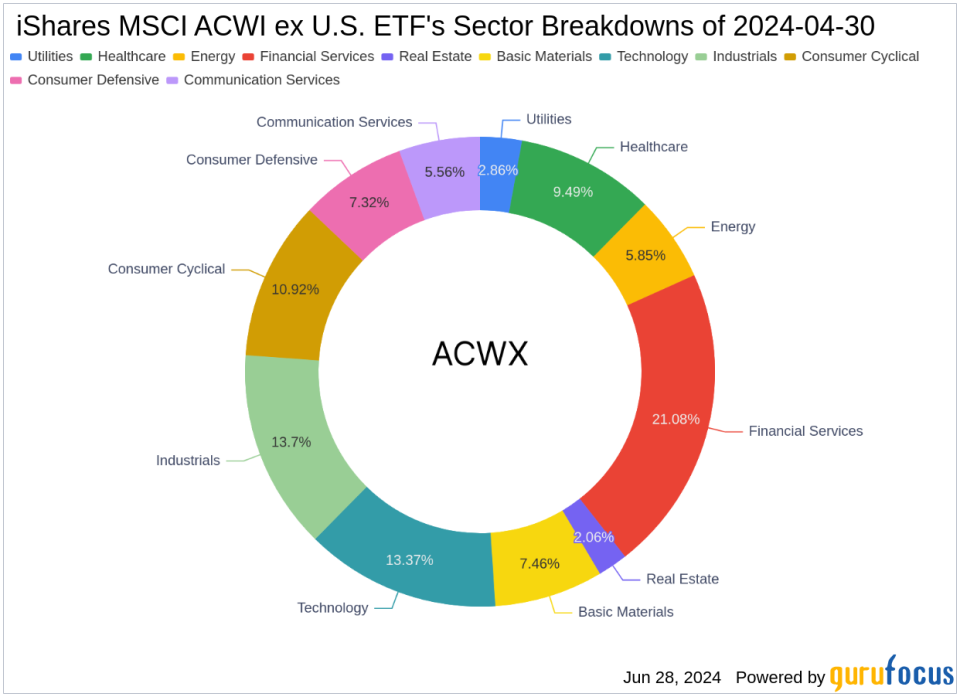

As of the second quarter of 2024, the iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio)'s portfolio included 1,842 stocks. The top holdings comprised 2.32% in Taiwan Semiconductor Manufacturing Co Ltd, 1.65% in Novo Nordisk A/S, 1.39% in ASML Holding NV, 1.14% in Tencent Holdings Ltd, and 1.05% in Nestle SA. The investments are well-diversified across all 11 industries, including Financial Services, Industrials, Technology, and Healthcare, among others.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance