Here is How to Find 'Strong Buy' Stocks for May

The stock market finally appeared to awake from its recent slumber on Tuesday as Wall Street braces for reports and guidance from Microsoft, Meta, Amazon, and tons of other economic bellwethers in the final week of April. The Nasdaq was down 1.5% through early afternoon trading, with the S&P 500 1.3% lower.

The next several weeks could be absolutely critical to determining the near-term outlook for the stock market. By the end of the second week of May, investors will know a lot more about the earnings picture, as well as inflation. Fed’s next two-day FOMC meeting ends on May 3, with the April CPI report due out May 10.

If the stock market is able to hold up through this stretch and just chop around that would likely be viewed as bullish since many are starting to grow concerned that a pullback is due. But it is difficult to be bearish just yet, with the S&P 500 and the Nasdaq both still trading solidly above their 50-day and 200-day moving averages, having moved roughly sideways since early February.

All of the unknowns don’t mean investors should stay on the sidelines since market timing is extraordinarily difficult. Investors with long-term horizons are best severed to stay exposed to stocks at almost all times.

With this in mind, investors can utilize the Filtered Zacks Rank 5 Stock Screen to help find potentially winning stocks for May and beyond that have boosted their earnings guidance even as the larger EPS outlook fades.

Zacks Rank #1 (Strong Buy) stocks outperform the market in both good and bad times. However, there are over 200 stocks that earn a Zacks Rank #1 at any given time. Therefore, it’s helpful to understand how to apply filters to the Zacks Rank in order to narrow the list down to a more manageable and tradable set of stocks.

Parameters

Clearly, there are only three items on this screen. But together, these three filters can result in some impressive returns.

• Zacks Rank equal to 1

Starting with a Zacks Rank #1 is often a strong jumping off point because it boasts an average annual return of roughly 24.4% per year since 1988.

• % Change (Q1) Est. over 4 Weeks greater than 0

Positive current quarter estimate revisions over the last four weeks.

• % Broker Rating Change over 4 Week equal to Top # 5

Top 5 stocks with the best average broker rating changes over the last four weeks.

This strategy comes loaded with the Research Wizard and is called bt_sow_filtered zacks rank5. It can be found in the SoW (Screen of the Week) folder.

Here are two of the five stocks that qualified for the Filtered Zacks Rank 5 strategy today…

Portillo's Inc. (PTLO)

Portillo’s started as a tiny hot dog joint in the Chicagoland area back in the early 1960s. The company now boasts around 70 restaurants across 10 states, many of which are packed to the brim inside and full of long lines at the drive-thru window. Portillo’s also offers food shipping to all 50 states, including nearly all of PTLO’s favorites such as Chicago-style hot dogs, Italian beef sandwiches, chocolate cake, and beyond.

The fast-casual restaurant chain went public in the fall of 2021 and priced its IPO at $20 per share. Portillo’s skyrocketed on its first day of trading and for a few weeks until it got caught up in the wave of market-wide selling. PTLO shares have climbed 23% in 2023 to trade right around $20 per share.

Image Source: Zacks Investment Research

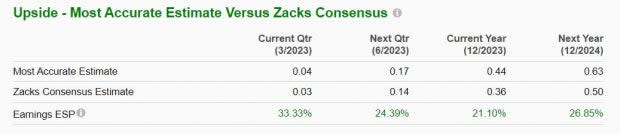

Portillo’s earnings outlook has soared, with its FY23 and FY24 consensus estimates up over 30% since its last report. Better yet, PTLO’s most recent EPS estimates came in over 20% higher than the current consensus to help it land a Zacks Rank #1 (Strong Buy). Zacks estimates call for its revenue to climb 17% in 2023 and 12% in FY24 to boost its earnings by 44% and 37%, respectively.

PTLO is part of the highly-ranked Retail – Restaurants industry. Plus, it is currently trading 44% under its average Zacks price target, and all five of the brokerage recommendations Zacks has are either “Strong Buys” or “Buys.” Portillo’s is set to release its quarterly financial results on Thursday, May 4.

Primerica, Inc. (PRI)

Primerica is a s a leading provider of financial services to middle-income households in North America. The Duluth, Georgia-headquartered firm boasts that through its insurance company subsidiaries it was the No. 2 issuer of Term Life insurance coverage in the U.S. and Canada in 2021. Primerica has grown its revenue at an impressive clip over the past decade.

Looking ahead, Zacks estimates call for PRI’s revenue to climb 4% in 2023 and another 6% in 2024 to reach $3 billion. Meanwhile, its adjusted earnings are projected to soar 33% this year and 11% higher in FY24. Primerica’s bottom line outlook has continually improved over the last few months to help it land a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Primerica shares have surged 25% YTD. The stock is also up 430% in the last 10 years to blow away its Life Insurance industry’s 40% and the S&P 500’s 155%. Despite the huge run, PRI shares trade at a 12% discount to its own 10-year median and 33% below its own highs at 11.4X forward earnings.

Get the rest of the stocks on this list and start looking for the newest companies that fit these criteria. It's easy to do. And it could help you find your next big winner. Start screening for these companies today with a free trial to the Research Wizard. You can do it.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance/

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Portillo's Inc. (PTLO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance