US stocks rise as weak inflation threatens interest rate hike plans; strong Chinese manufacturing data lifts FTSE 100

Bank of England policymaker Michael Saunders continues to back interest rate rise despite softer inflation data

Stronger-than-expected Chinese manufacturing figures lift FTSE 100 miners; overall index underperforming European indices

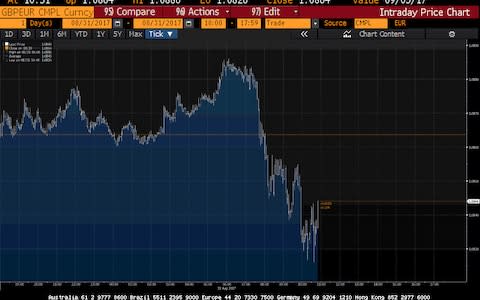

Pound retreats against the dollar as robust US data pulls dollar higher; trading at below $1.29

Oil prices struggle in the aftermath of Hurricane Harvey; US refining hub hit, weakening demand for crude

US markets rise as weak inflation threatens interest rate hike plans

Markets wrap: Pound's partial recovery against the dollar not enough to deter the FTSE 100

Today's weak inflation figures has dampened hopes of an interest rate hike in the US before the end of the year

Weak inflation figures in the US have turned the momentum in the pound's favour against the dollar this afternoon but it hasn't been enough to deter the buoyant FTSE 100 from recording a 0.9pc rise today.

While stubbornly low inflation in the US knocking interest rate hike odds has helped the pound pare some of its early losses against the dollar, sterling is still trading 0.3pc lower for the day at $1.2888 against the greenback.

In addition to the boost London's exporters receive on a weaker pound, stronger-than-expected manufacturing figures dropping in China overnight has lifted the blue-chip index's huge miners.

Beyond the mining stocks, a sector note from UBS on the UK's troubled outsourcers has stoked much of the movement with the broker's star pick Serco enjoying its best day of trading in over a year and G4S, which UBS deemed as now fairly priced following its turnaround, falling to the bottom of the FTSE 100.

Here's Spreadex analyst Connor Campbell's take on today's action:

"Elsewhere the FTSE continued to steadily widen its gains, climbing nearly 1% thanks to a drastic sharp turnaround from Brent Crude. The black stuff is now up almost 3% and back above $52 per barrel, having started the day tickling $50.50, leading Shell and BP 0.5% and 1% higher respectively. As for the Eurozone, the DAX and CAC remained pleased with the euro’s dollar-losses, with the indices rising 0.7% apiece."

Melrose's Brush troubles overshadow turnaround of Nortek

Brush has been hit by the low oil price which has seen capex reduced

“Dreadful, horrible” conditions in the oil and gas markets have seen investors shy away from engineering turnaround investor Melrose.

The company, whose strategy is to buy, improve and sell under-performing businesses, said Brush, its investee company which produces generators, is suffering because the continued low oil price means customers’ capital expenditure has been slashed.

Posting half year figures, Simon Peckham, chief executive of the FTSE 250-listed Melrose, said Brush represents about 5pc of its overall operations but had been the focus of the company’s performance in the six months to the end of June.

“The market is dreadful, horrible, awful,” he said. “It’s not just us, everyone in the sector is suffering and there is no light at the end of the tunnel.”

Read Alan Tovey's full report here

McColl's sales jump thanks to new stores

McColl's boss Jonathan Miller

Convenience chain McColl's has recorded a 31pc lift in sales after a boost from its acquisition of 298 Co-operative shops earlier this year.

The retail chain said that it had completed integrating the new stores by the middle of July, which had helped to bolster the business.

Like-for-like sales, which measure shops open for more than a year, were up by 0.7pc during the three months to August 27. This was largely driven by 0.7pc growth at its 1,300 convenience stores and 0.3pc at its 350 older newsagent shops.

McColl's recently signed a new supply deal with Morrisons in a move that will resurrect the Safeway brand and mean the convenience chain will benefit from the supermarket's fresh food offer and bigger purchasing power with consumer giants.

Read Ashley Armstrong's full report here

IP Group passes 90pc support for hostile Touchstone takeover

David Newlands, chair of Touchstone's board, has repeatedly criticised IP's offer for 'undervaluing' the company

A bitter hostile takeover by IP Group of rival science investor Touchstone Innovations is set to go through after it secured more than 90pc support for the deal.

The FTSE 250 suitor has won enough backing from Touchstone investors to make the offer unconditional, pending the outcome of a Competition and Markets Authority review expected to be complete by the end of October.

The milestone comes despite the all-share offer sliding in value since it was raised to £490m in mid-July. It has since fallen due to a 16pc drop in IP’s share price over the intervening period and was worth £413m in late afternoon trading today. IP shares were up 2pc for the day at 155p.

IP is offering 2.2178 of its own shares for each Touchstone share, up from an earlier offer of 2.1575 and representing a 33.9pc stake in the combined group.

Read Iain Withers' full report here

Euro knocked by concerns that its strength will slow ECB tapering plans

Reports this afternoon indicate that the ECB is worried that the euro's strength will delay its tapering plans

The euro has struggled this afternoon against most currencies (except the pound) after it was reported by Reuters that the ECB is worried that the currency's recent gains on the dollar could slow the pace of its quantitative easing tapering plans.

The report said:

Pressure is building for a gentle rather than a rapid reduction in the pace of asset buying from some policymakers, particularly in the bloc’s weaker economies, who are concerned that the strong euro could dampen inflation and hamper growth by making exports dearer, the sources said.

“The exchange rate has become a bigger issue,” one of the sources told Reuters. “It is now less favorable for an exit and a stronger argument for a muddle-through option.”

Meanwhile in the US, markets have been open for an hour now and stocks stateside have followed Europe into positive territory with the healthcare sector leading the way in New York.

Equities stateside have been boosted by the latest batch of economics data in the US showing that persistently weak inflation will continue to be a concern for the Fed over whether to hike interest rates with stocks benefiting from cheaper borrowing costs.

Hays pays first special dividend as international job markets boom

Hays has invested in its German and Australian businesses in particular

Recruitment firm Hays has hailed a "milestone" year for the firm, declaring its first special dividend on the back of strong international fees, despite a steep fall in the UK market.

Hays’ UK business experienced a “marked step-down” after the European Union referendum last June, with jobs in the private sector hit particularly hard.

Fees for the UK business in the year to June 30 fell by 7pc to £252.9m, despite what the firm called “modest signs of improvement” in the second half.

The company's finance director Paul Venables had warned last month that while employment in the UK was relatively stable, companies were reluctant to commit to any major hiring sprees while there was political and economic uncertainty.

However, more resilient international markets meant that the company’s operating profit for the year to June 30 was more than £200m - for the first time since 2008. Pre-tax profits were £204.6m, and the firm’s fees for the year stood at £954.6m, up 17.8pc on the previous year.

Read Rhiannon Bury's full report here

Pound reverses momentum against the dollar as US inflation remains weak

The Federal Reserve in its latest policy meeting minutes was split over whether hiking interest rates would kill off inflation

The dollar's momentum against the pound has finally shifted on the forex markets after fresh data showed that core inflation in the US remains stubbornly low at 1.4pc.

Elsewhere the batch of economics figures landing in the US this afternoon is a little more encouraging. Personal spending growth on a month-on-month basis picked up to 0.2pc in July after flatlining the previous month while wage growth rose ahead of expectations to 0.4pc.

That concerning inflation figure could be the focal point for the Federal Reserve, however, according to Capital Economics' US economist Paul Ashworth.

The Fed's policymakers in its latest policy meeting minutes were surprisingly divided over inflation is too weak to handle another interest rate hike before the end of the year.

Mr Ashworth added:

"While the Fed will be happy with the strength of real consumption and incomes, the weakness of inflation remains a concern.

"Both the headline and core PCE deflators increased by a muted 0.1% m/m in July and the core PCE inflation rate slipped to a 19-month low of 1.4%, from 1.5%, leaving it even further below the 2% target."

Ahead of markets opening in the US, sterling is 0.5pc down against the dollar for the day, trading at $1.2874.

How Jack Grealish cost Ladbrokes Coral £1.5m with just one goal

A season of bookie-friendly results was upset by Jack Grealish's equaliser against Brighton

I must admit I had forgotten all about ex-'next big thing' and Aston Villa midfielder Jack Grealish but he will live long in the memory at Ladbrokes Coral, according to the bookie's interim results today.

Grealish's 89th minute equaliser against Brighton to hand Newcastle United the Championship title cost the company £1.5m alone, Ladbrokes said.

The bookie explained:

"Even when it looked as if results were going to do the bookies a favour, ante-post favourite backers had a dramatic late twist with pre-season bankers Newcastle winning the Championship title in the last minute of the season as Brighton conceded an 89th minute equaliser to Aston Villa.

"Newcastle, Sheffield United and Portsmouth were all heavily backed in a large number of League winner multiple bets and Jack Grealish's goal is conservatively estimated to have cost us around £1.5m."

Bradley Gerrard's full report on Ladbrokes' results can be read here

French supermarket Carrefour's 15pc plunge hits London-listed grocers

Tesco has suffered most on the read across from Carrefour's results

The UK's big three listed supermarkets, Tesco, Sainsbury's and Morrisons, are having a tough time of it this week with the trio again retreating into the red on a read across from French peer Carrefour's 15pc share price plunge over in Paris this morning.

Carrefour is on course for its worst ever day of trading after issuing a profit warning and predicting a tough second half of the year.

The grim outlook has played into fears that the UK's big bricks and mortar supermarkets will soon be on the decline with the trio slipping earlier this week on fears that the price drop at Amazon's newly acquired Whole Foods marks the online giant's foray into the battle for market share.

Here's Bernstein analyst Bruno Monteyne's take on Carrefour's plunge:

"Carrefour combined several disappointments: an 8% miss on H1, guided materially higher profit drop for H2, lack of visibility on how the company will be run in the future, and lack of future profitability guidance (was this the kitchen sink? Or is there another one coming?).

"All this in a context where the price of Organic Kale in Boston can wipe off billions of food retail market cap across the world. While the 'future potential' is still there, that will be nobody's concern right now and the shares will take more time to find their bottom"

Raise rates to stop inflation surging, says Bank of England policymaker

Michael Saunders was one of two MPC members to vote for a rise at the last policy meeting

Interest rates should go up to prevent inflation rising too far, Bank of England Policymaker Michael Saunders has warned.

A slightly higher interest rate would still provide stimulus to the economy but at a lower level, he said, and would not risk squashing economic growth.

“We do not need to be putting the brakes on so much that the economy weakens sharply. But our foot no longer needs to be quite so firmly on the accelerator in my view,” said Mr Saunders, who voted to raise rates from 0.25pc to 0.5pc in August's policy meeting.

“A modest rise in rates would help ensure a sustainable return of inflation to target over time.”

Read Tim Wallace's full report here

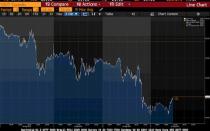

Lunchtime update: Mining stocks and stronger dollar lift FTSE 100

The miners are lifting stock markets in Europe most this morning

The dollar's climb against the pound and rallying mining stocks have propelled the FTSE 100 into positive territory this morning as returning risk appetite continues to help equity markets.

Stronger-than-expected Chinese manufacturing data dropping overnight has lifted the UK's big miners with their heavy weighting on the FTSE 100 supporting the index's broad-based push higher.

At the other end, security firm G4S and recently demoted lender Provident Financial are the biggest laggards on the blue-chip index with oil shares continuing to struggle despite a small rebound in crude prices.

On the currency markets, the pound has overcome some of its earlier woes against the euro as chief Brexit negotiators David Davis and Michel Barnier speak to the media on the latest round of talks but against the dollar, sterling has continued to sink, trading 0.5pc lower at $1.2865.

Here's the current state of play in Europe:

FTSE 100: +0.74pc

DAX: +0.66pc

CAC 40: +0.74pc

IBEX: +0.85pc

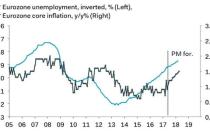

Eurozone unemployment figures tell a story of divergence in the region

Core inflation tends to lag unemployment rates, says Pantheon Macro

Looking under the bonnet of today's eurozone unemployment figures highlights the story of divergence in the region with Germany's record low rate of 3.7pc offsetting rising rates in France and Italy, says Pantheon Macro chief eurozone economist Claus Vistesen.

He added that those two economies should experience similar dips soon, however:

"Robust GDP growth across the euro area in the first half of 2017 suggest that unemployment, even in France and Italy, will edge lower soon.

"The labour market and inflation are long-lagging indicators in the euro area, which means that unemployment likely will fall further and core inflation should edge higher too in response to solid GDP growth."

European equities helped by stronger dollar

$USD soars on surprise data, risk-on$EUR correction could lose pace$Gold in positive trend above $1’280https://t.co/pEAvLSAFChpic.twitter.com/Nqs9VEJp2s

— Ipek Ozkardeskaya (@IpekOzkardeskay) August 31, 2017

European stocks have been helped this morning by the dollar duffing up the pound and the euro on the back of yesterday's strong economics data, according to Spreadex analyst Connor Campbell.

The FTSE 100 has gone from strength to strength today after a sluggish start with only the oil giants and retailers pulling down the index.

Mr Campbell added on the dollar's chances to advance further this afternoon:

"If the dollar is still hungry for data then it has a 5 course meal to dine out on this afternoon. Arguably the most important item is the core PCE price index reading, given that it is reportedly the Fed’s favourite inflation measurement; the dollar likely won’t find much joy here, however, considering its expected to remain unchanged at 0.1%.

"Elsewhere the personal spending and jobless claims numbers come out before the bell, with the Chicago PMI and pending home sales figures released once things have are up and running on Wall Street."

Brent crude snaps losing streak as US refining hub is taken out of action

Flooding has hit one of the US' oil refining hubs

Oil prices have snapped a three-day losing streak this morning and started to slowly claw back some of the ground lost in the aftermath of Hurricane Harvey.

The severe flooding in Texas following the hurricane has hit one of the US' major oil refining hubs and the drop in oil demand as a fifth of the country's refining capacity is taken out of action has fed through to crude prices. Brent crude has retreated to just over $51 per barrel this week, a 2.6pc decline.

Swissquote analyst Yann Quelenn believes that prices could soon begin to rally, however:

"Hurricane Harvey has yet to boost crude oil prices, but if the US Gulf Coast refinery shutdowns continue for more than a week, they will push up petroleum. Inventories published by the U.S Energy Department declined by 5.932 million barrels during the week ending August 25.

"This is the ninth consecutive week of decline, and crude oil is now challenging its 6-week low price. We believe upside pressures on oil are likely. Not only from Harvey, but from seasonal effects. September demand for petroleum is likely to increase with the end of summer, and overproducing oil is definitely not a viable long-term project. At the same time, at the next OPEC meeting in November, we expect no production cuts to be announced."

Will the oil market start to ignore what will be very distorted data on US stocks from the API and EIA following the hurricane? The weekly US oil stocks figures are usually one of the key drivers of oil prices but one would imagine that the data will be skewed for quite some time.

Brent crude has snapped a three-day losing streak 11:00AM

Pound having tough morning on the currency markets

The pound has reversed some early gains against the euro with stronger-than-expected eurozone inflation data also contributing

The pound is having a tough morning on the currency markets as Brexit talks come back into focus. Sterling has retreated 0.3pc against the euro today and 0.4pc against the rebounding dollar.

The usual Brexit-related uncertainty is continuing to weigh on the pound, according to ETX Capital analyst Neil Wilson, with a media briefing from chief Brexit negotiators David Davis and Michel Barnier due in about an hour's time.

Mr Wilson added:

"Messrs Barnier and Davis are due to talk later and markets expect more deadlock.

"The longer the talks seem to go nowhere the worse it gets for sterling. Theresa May’s comments on no deal being better than a bad deal, whether accurate, have also rattled investors a touch as it goes against the language we’ve been hearing over the summer."

I can't imagine the inevitable mud-slinging match and posturing from prime ministerial wannabes that will follow Theresa May signalling this morning that she wants to be Tory leader at the next election will lift sentiment.

Eurozone CPI reaction: ECB won't announce tapering plan until next month

#Eurozone : #CPI actual 1.5%. #ECB’s next policy announcement scheduled for Sept. 7. pic.twitter.com/onhMGbkTKC

— Marc-Andre Fongern (@SkandiStreet) August 31, 2017

Despite today's pick-up in inflation, the ECB won't announce its plan to begin tapering its asset purchasing stimulus programme until next year, according to Capital Economics.

Its chief European Economist Jennifer McKeown said that the ECB needs to tread carefully given the still low inflation expectations and recent strength of the euro.

She added that the core figure should soon begin to strengthen as well:

"There are reasons to expect the core rate to pick up a little in the months ahead. The economy is performing well and spare capacity should be eliminated next year. The labour market remains in pretty good health, with other data this morning revealing that the unemployment rate held at 9.1% in July, its lowest since February 2009.

"Admittedly, the number of unemployed people rose slightly, but the series is fairly volatile and surveys point to renewed falls to come. This should prompt a modest increase in wage growth from recent subdued rates. In all, then, the data suggest that the ECB’s strong policy support is becoming less necessary."

Pound dips against euro as eurozone inflation picks up to 1.5pc

Eurozone #CPI rises to 1.5% in August, more than expected.

I repeat: the #ECB should reduce emergency liquidity measures. pic.twitter.com/86t1gDRZTw— jeroen blokland (@jsblokland) August 31, 2017

With the ECB's monetary policy meeting next Thursday, some quite interesting inflation figures have just landed from the eurozone.

Inflation in the currency bloc picked up to 1.5pc in August, exceeding economists' expectations and a 0.2 percentage point jump from July's figure.

Stronger inflation has been highlighted by the ECB as one of the prerequisites for tightening monetary policy and, with its president Mario Draghi ducking the subject at last week's Jackson Hole central banking conference, analysts have pencilled in next week's meeting as a possible time for him to signal the winding down of the ECB's quantitative easing programme.

Higher energy prices were the main driver behind the pick-up

Higher energy prices were the main driver behind the pick-up but it should be noted that core CPI remained steady at 1.2pc. With the euro's recent strength a possible hindrance to inflation and the core figure remaining stubbornly low, are the recent economic figures strong enough for the ECB to start tightening policy?

On the currency markets, against the euro, the pound has taken a small knock from the figures, trading 0.3pc lower at €1.0836.

Frankie & Benny's owner the Restaurant Group' pre-tax profit dives by 30pc

The company has just appointed a new chief financial officer, Kirk Davis from Greene King, to help the turnaround

Restaurant Group reported a 30.4pc drop in underlying first-half pretax profit on Thursday, as slowing consumer spending weighed on sales.

Britain’s restaurant and pub operators have seen customers cut down on spending as inflation has risen.

Restaurant Group is also facing increased competition from food-focused pubs and a drop in visitors to retail shopping parks, where many of its outlets are located.

It said in March it had put the brake on expansion plans until it could verify its brand and location strategy was “sufficiently robust”.

Restaurant Group has rolled out a new menu for its Frankie & Benny’s chain focused on lower-cost meals, price reductions on several items and more items targeted at families.

Report by Reuters

888 fined a record £7.8m by Gambling Commission for ‘failing vulnerable customers’

888’s “lack of interaction” with this player “raised serious concerns about 888’s safeguarding of customers at risk of gambling harm”, the Commission said

888, one of the UK’s biggest gambling companies, has been fined a record £7.8m for allowing 7,000 vulnerable customers who had taken a “time out” to continue playing.

An investigation by the Gambling Commission found that a “technical failure” in 888’s systems allowed players who had “self-excluded” from the company’s casino, poker and sport games to continue to access their accounts on the bingo platform.

The oversight continued for 13 months, allowing those customers to deposit up to £3.5m in their accounts.

“While 888 did have self-exclusion procedures in place, they were not robust enough and failed to protect potentially vulnerable customers,” the Commission said.

888 also failed to “recognise visible signs of problem gambling behaviour” in one individual, who staked £1.3m in repeated bets over the course of 13 months. At least £55,000 of this money had been stolen from the player’s employer, the Commission found.

Read Jon Yeomans' full report here

Miners race ahead on FTSE 100 on strong Chinese data

The stronger-than-expected data out of China has lifted miners across Europe

The miners are racing ahead on a slightly sluggish FTSE 100 this morning with huge miner Glencore jumping 2.5pc and peer Rio Tinto advancing 2pc on the back of strong manufacturing figures dropping in China overnight.

The Asian powerhouse's manufacturing purchasing managers' index rose to 51.7, a slightly higher than expected reading with any figure over 50 indicating growth. The separate steel industry's PMI advanced to an impressive 57.2, its highest since April 2016, with iron ore prices surging on the back of the figures.

Liberum analyst Richard Knights commented:

"The Chinese steel PMI data implies another strong month ahead for the miners with our Restocking Indicator delivering a reading of 1.26, comfortably above the 1.1 Buy threshold.

"All key components continue to point to bullish industrial commodity prices for the month ahead - new orders were up at 66, finished steel inventories are expected to de-stock with a reading of 43 and iron ore will restock with a reading of 53."

Saunders' continued support for a hike significant given recent soft inflation data

The Bank of England's Monetary Policy Committee split 6-2 in favour of keeping interest rates at 0.25pc at the last meeting

Bank of England MPC member Michael Saunders' call for an interest rate rise has done little for the pound this morning, which has just retreated back below $1.29 against the dollar, but his continued support for a hike is somewhat significant given the softening inflation figures in the last couple of months.

Mr Saunders and his colleague Ian McCafferty were the only policymakers to vote for a rise in the last meeting with other MPC members nervy that a hike could kill off growth.

Monetary policy hawks Mr Saunders and Mr McCafferty believe that controlling inflation should take precedent when deciding the central bank's stance on interest rates but the recent dip in inflation has taken the heat off Mark Carney and his dovish peers.

Mr Saunders said that inflation, which surprisingly held at 2.6pc in July, is being helped by "swings in petrol prices, which are often volatile".

Bank of England policymaker calls for a "modest rise" in interest rates

Diolch/Thanks @swaleschamber@atradiusUK for hosting Michael Saunders from @bankofengland Monetary Policy Committee. Good backdrop too! pic.twitter.com/403dads63J

— BoEWales/Cymru (@BoEWales) August 30, 2017

Bank of England policymaker Michael Saunders' speech in Wales is the highlight of a very light economics schedule today and, unsurprisingly given that he has voted for an interest rate rise in the last two MPC meetings, he has said that a "modest rise" in interest rates is needed to control high inflation.

Mr Saunders, an external member of the MPC and one of two to vote for a hike in the last meeting, said:

"In the exceptional circumstances since the EU referendum, the MPC has sought the appropriate tradeoff between above-target inflation and below-potential output.

"The terms of that tradeoff have shifted markedly in recent quarters. Inflation has risen well above target, while spare capacity in the economy has been absorbed faster than expected. The jobless rate is now slightly below our estimate of equilibrium...

"A modest rise in rates would help ensure a sustainable return of inflation to target over time."

He added:

"I do not want to dismiss risks that the Brexit process might be bumpy, and could undermine business and consumer confidence. In such a scenario, inward migration might also be lower, limiting labour supply and demand. I presume asset markets would also adjust, including sterling.

"The monetary policy implications of this scenario are not automatic, could in theory go either way, and would depend on the combined effects on demand, supply, and the exchange rate. In my view, we should not maintain an overly loose stance as insurance against this scenario. Rather, we should be prepared to respond as needed if it happens."

Michael Saunders speaking in Cardiff. But can he tempt the rest of the MPC off the mainline to go down Saunders Road? pic.twitter.com/io7NyvPjYV

— Andy Bruce (@BruceReuters) August 31, 2017

That looks like a cul-de-sac to me Andy, possible not the strongest metaphor...

Agenda: Strong Chinese manufacturing data supports FTSE 100; oil prices fall following Hurricane Harvey

Chinese manufacturing PMI figures coming in stronger than expected has lifted the big miners on the FTSE 100

The FTSE 100 is lagging behind its rebounding European peers this morning with blue-chip stocks going ex-dividend and the two oil giants struggling being the main pulls on the index early on.

Robust metal prices and Chinese manufacturing PMI data coming in stronger than expected means the UK's international miners are dominating the FTSE 100 leaderboard but weakening oil prices in the aftermath of Hurricane Harvey is keeping heavily weighted BP and Shell in flat territory.

Asia stocks mixed despite strong global data. US Q2 GDP growth revised up from 2.6% to 3% on better consumption. China mfg PMI beat at 51.7. pic.twitter.com/eACneyDjCn

— Holger Zschaepitz (@Schuldensuehner) August 31, 2017

The Restaurant Group's interim results are the highlight on the corporate calendar with its shares jumping 12pc as faith builds in the Frankie & Benny's owner's turnaround.

With a dearth of economics data today, Bank of England policymaker Michael Saunders' speech in Wales is the main macro highlight in the UK while on the continent CPI figures are the focal point with the pound struggling early on after advancing on the dollar and euro yesterday.

Interim results: The Restaurant Group, Alpha Bank, Ladbrokes Coral Group, Chesnara, Total Produce, BBGI Sicav S.A., Arrow Global Group, Alfa Financial Software Holdings, STV Group Full-year results: Hays

AGM: Simian Global, Highlands Natural Resources

Economics: GfK Consumer Confidence (UK), Unemployment Claims (US) Personal Spending m/m (US), Personal Income m/m (US), Pending Home Sales m/m (US), CPI Flash Estimate y/y (EU), Unemployment Rate (EU), Retail Sales m/m (GER), Unemployment Change (GER)

Yahoo Finance

Yahoo Finance