Strong pound takes toll on British firms' dividend growth

Dividends have crept up among British-listed companies, as the stronger value of sterling over the dollar masked growth.

The UK Dividend Monitor, carried out by Link Asset Services, found that in the first three months of this year the total amount paid out increased by just 1.2pc year-on-year, after large one-off payments were stripped out.

This slower rate of growth was partly due to the strength of the pound against the US dollar, in which more than 20pc of dividends were paid out in the first quarter.

Sterling was 12pc stronger than the dollar, compared to the same period last year, and this lowered the sterling value of payouts made in dollars by £879m.

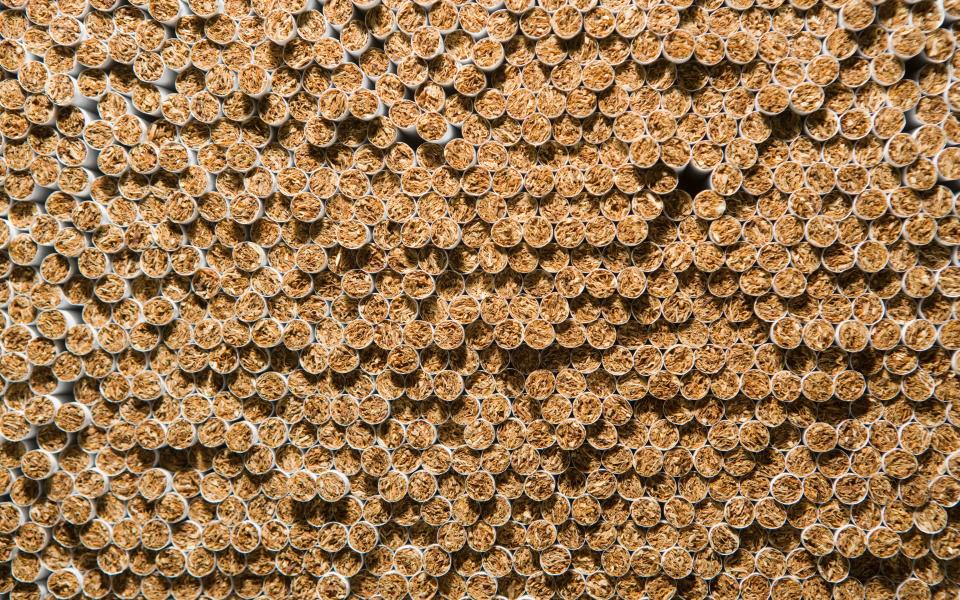

The quarter’s overall total was distorted by the £1bn one-off payment by British American Tobacco, which switched to quarterly dividends after it acquired Reynolds.

If that payout is included, the total increases to £16.7bn, which is up 7.6pc on last year.

The growth was also boosted by the pre-takeover special dividend from Sky.

Yahoo Finance

Yahoo Finance