Stryker (SYK) Hits New 52-Week High: What's Driving It?

Shares of Stryker Corporation SYK reached a new 52-week high of $280.94 on Sep 8, before closing the session marginally lower at $280.09.

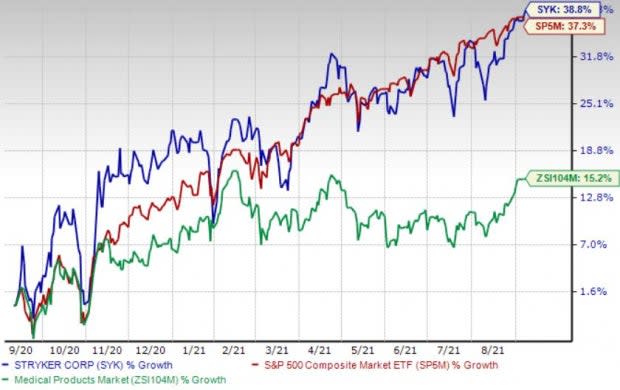

Shares of the company have gained 38.8% in the past year compared with the industry’s 15.2% growth and the S&P 500's 37.3% rise.

Stryker is witnessing an upward trend in its stock price, prompted by its strength in robotics. The company’s solid performance in the second quarter of 2021 and its diversified product portfolio buoy optimism. Lower demand for healthcare products and integration risks are major downsides.

Image Source: Zacks Investment Research

Let's delve deeper.

Key Growth Drivers

Strong Q2 Results: Stryker reported better-than-expected results in second-quarter 2021. The company witnessed growth across Orthopaedics, and Neurotechnology and Spine segments in the quarter. Improvement in international sales is also a positive. Expansion in both margins in the reported quarter raises optimism. Stryker remains committed to advancement of its new product pipelines. Per management, it expects the business momentum gained in the first half of 2021 to continue, backed by the Wright Medical buyout that is advancing ahead of expectations.

Strength in Robotics: Mako, Stryker’s robotic-arm assisted surgery platform, displayed strength in the second quarter (following up an equally strong first-quarter 2021 performance) including an uptick in international installations, raising investors’ optimism. In recent times, Stryker launched the robotic-arm assisted total knee arthroplasty application for use with its Mako System. Mako Total Knee utilizes both Stryker’s robotic platform and its Triathlon Total Knee System, guided through CT-based 3D modeling of bone anatomy.

Moreover, the company continues to witness strong demand for Mako on the back of its unique features and healthy order book despite financial constraints stemming from the COVID-19 pandemic.

Broad Array of Services: Investors are upbeat about Stryker’s diversified product portfolio. Its significant exposure in robotics, Artificial Intelligence for health care, and Medical Mechatronics has provided the company with a competitive edge in the MedTech space. Stryker’s portfolio includes products like Hip, Knee, and Mako Robotic-Arm Assisted Surgeries. Apart from these, Stryker has been one of the early adopters of the 3D printing technology. The company’s FDA-approved Tritanium TL Curved Posterior Lumbar Cage is a 3D-printed interbody fusion cage intended for use as an aid in lumbar fixation.

Meanwhile, Stryker’s exclusive navigation platform provides streamlined software solutions that allow surgeons to accurately track, analyze, and monitor instrumentation pertaining to a patient’s anatomy during surgical procedures to enhance patient outcomes. The company’s navigation software platform includes Cranial, Hip, ENT, and Knee and Spine Navigation software. In July, the company officially launched the Tornier shoulder arthroplasty portfolio and introduced its first new Tornier product — the Perform Humeral Stem.

Downsides

Lower Demand for Healthcare Products: Stryker continues to be challenged by lower demand for health care products. Additionally, lower reimbursements for medical products and services may impose downward pressure on the prices for the company’s products. It might also lead to longer sales cycles and slower adoption of new technologies, which will ultimately affect the top line.

Integration Risks: Stryker continues to acquire a large number of companies. While this improves revenue opportunities, it adds to integration risks thereby putting gross and operating margins under pressure. Frequent acquisitions may impact the company’s balance sheet in the form of a high level of goodwill and intangible assets.

Zacks Rank & Key Picks

Currently, Stryker carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC, IDEXX Laboratories, Inc. IDXX and Intuitive Surgical, Inc. ISRG.

Henry Schein’s long-term earnings growth rate is estimated at 13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDEXX’s long-term earnings growth rate is estimated at 19.9%. It currently has a Zacks Rank #2.

Intuitive Surgical’s long-term earnings growth rate is estimated at 9.7%. It currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance