Student loans: mother threatens court action which could save graduates thousands

Students paying eye-watering rates of interest on their student loans could gain a reprieve as the Government faces possible legal action.

After taking advice, a mother of two, whose twin daughters both went to university, has written to education secretary Damian Hinds challenging the official interest rate. She suggests the current rates could be a breach of the law.

The highest rate, which is linked to the retail prices index (RPI), a popular but discredited measure of inflation, is set to rise from 6.1pc to 6.3pc in September. Fiona Kirton cites the Teaching and Higher Education Act 1998 when making her case, reports the Times.

According to pro-bono legal advice provided by law firm Leigh Day, the act stipulates that the rate paid by former students should be “lower or no higher” than the commercial market rate. Current benchmarks suggest this is 3.81pc.

In her letter Ms Kirton points out that the current rate is double that of car finance and says the system impacts the poorest students the most.

A spokesman for the Department for Education insisted that any rate rise would have no impact on monthly repayments and that the rate of 6.1pc does comply with the law.

She said: “We regularly monitor the interest rates set on student loans against the interest rates prevailing on the market, which continue to be above the maximum interest rate charged on student loans.

“However, as we have already made clear our review of post-18 education and funding will look at how students and taxpayers are getting value for money, including the role of interest rates.”

How is the rate calculated?

There are two separate systems for calculating interest on student loans. Those with “plan one” loans (those taken out before 2012) have less debt and pay a much lower rate, currently 1.25pc.

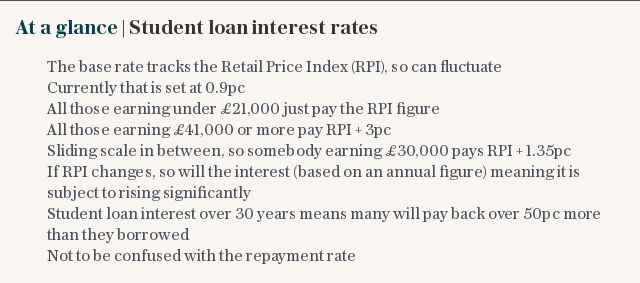

Those with “plan two” loans now leave university with average loan debt of more than £50,000. Their interest rate is set somewhere between RPI and RPI plus 3 percentage points.

Those earning £25,000 or under (previously £21,000) pay a rate equivalent to RPI and those earning more than £45,000 pay RPI plus 3 percentage points, currently 6.1pc. There is a sliding scale between.

Critics argue the Government is “cooking the books” by using RPI as opposed to another measure of inflation known as the consumer prices index (CPI). Both measure the rising cost of a basket of goods but they differ as they take into account a different range of goods. CPI is currently lower.

Last summer, the Office for National Statistics (ONS) branded RPI “flawed”.

However, students' monthly repayments are set at 9pc of their eligible salary regardless of interest rate or the size of their debt. The outstanding loan is also wiped after 30 years.

This means that an increase, or decrease, in interest rate would have no impact on graduates’ monthly repayments, but it may change the amount repaid overall.

How would a legal challenge work?

Mr Beagent said Ms Kirton had taken a first step by writing to the Secretary of State. It could be that the Government takes the view that Ms Kirton is correct and opts to lower the rate.

If this is rejected then Mr Beagent said she could request a judicial review of that decision, which would determine whether the Government was correct in its original assertion.

If the case was won Mr Beagent said he would expect action to be taken swiftly, although he said the need to overturn and introduce new regulations could take up to a year.

An entirely separate review of higher education funding is currently underway. Any changes from this review are unlikely to be seen before 2020.

What are the chances of success?

Mr Beagent said he was confident of success – with some caveats. He said: “On the face of it, it looks to be open and shut. But these things are never as simple as they sometimes appear.

“There could be a question over what the market rate is. The current calculations, RPI plus three means the rates are significantly higher than the market, but there have been times when it has been the other way round.”

The suggested benchmark rate given is the Bank of England’s published rate for an unsecured £10,000 loan, but Mr Beagent pointed out this was given in the preamble to the act, rather than the act itself.

There are also further complications in using this rate. The Government spokesman pointed out that students, most of whom have little-to-no credit history, would be unable to achieve the quoted rate of 3.81pc.

She said a more realistic rate would be between 7.3pc and 7.6pc, making it more than a percentage point higher than the current maximum student loan rate of 6.1pc.

Yahoo Finance

Yahoo Finance