Sun Life Financial (SLF) Q1 Earnings Decrease Year Over Year

Sun Life Financial Inc. SLF delivered first-quarter 2022 net income of $858 million, which decreased 8.4% year over year.

The underlying net income of $665.4 million (C$843 million) was down 0.8% year over year. The downside was due to unfavorable mortality and disability, which included impacts from COVID-19 and lower available-for-sale (AFS) gains. It was offset by broad-based business growth, higher investment gains and lower corporate expenses.

Insurance sales increased 9.4% year over year to $630.7 million (C$799 million), attributable to increased sales in Canada, driven by large case group benefits sales in Sun Life Health.

Wealth sales and asset management gross flow decreased 12.1% year over year to $45.7 billion (C$57.9 billion) in the quarter under review due to lower sales in asset management. It was offset by higher sales in Asia and Canada.

The value of new business declined 7.2% to $203.6 million (C$258 million).

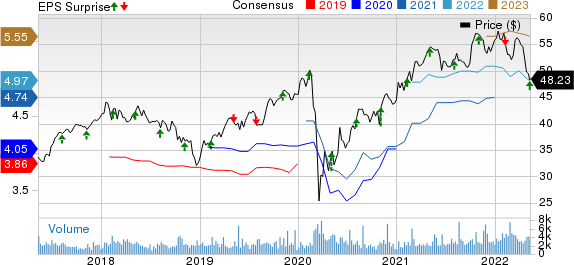

Sun Life Financial Inc. Price, Consensus and EPS Surprise

Sun Life Financial Inc. price-consensus-eps-surprise-chart | Sun Life Financial Inc. Quote

Segment Results

SLF Canada’s underlying net income increased 4.5% year over year to $235.2 million (C$298 million), driven by business growth and new business gains.

SLF U.S.’ underlying net income was $93.1 million (C$118 million), down 31% from the prior-year quarter due to mortality and morbidity. It was partially offset by business growth.

SLF Asset Management’s underlying net income of $257.3 million (C$326 million) increased 12% year over year, driven by higher results in MFS and SLC Management.

SLF Asia reported an underlying net income of $120 million (C$152 million), which decreased 4.4% year over year due to a new business strain in Hong Kong, largely due to lower sales as a result of COVID-19 restrictions. It was partially offset by experience-related items.

Financial Update

Global assets under management were $1083.2 billion (C$1,352 billion), up 4.7% year over year.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio was 123% as of Mar 31, 2022, down 100 basis points year over year.

The LICAT ratio for Sun Life (including cash and other liquid assets) was 143%, up 200 basis points (bps) year over year.

Sun Life’s return on equity was 14.3% in the first quarter, contracting 260 bps year over year. Underlying ROE of 14% contracted 130 basis points year over year.

The leverage ratio of 25.9% deteriorated 320 bps year over year.

Dividend Update

On May 11, Sun Life’s board of directors approved a 4.5% increase in the quarterly dividend to 69 cents per share.

Zacks Rank

Sun Life currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Life Insurers

Voya Financial, Inc. VOYA reported first-quarter 2022 adjusted operating earnings of $1.47 per share, which surpassed the Zacks Consensus Estimate by 8.1%. The bottom line increased 42.7% year over year. Total revenues amounted to $1.5 billion against ($2 billion) in the year-ago quarter.

Voya Financial's net investment income declined 11.7% year over year to $630 million. Meanwhile, fee income of $433 million decreased 5.4% year over year. Premiums totaled $613 million versus ($5 billion) in the year-ago quarter. Total expenses were $1.4 billion versus a benefit of $3 million in the year-ago quarter.

Lincoln National Corporation LNC reported first-quarter 2022 adjusted earnings of $1.66 per share, which missed the Zacks Consensus Estimate of $1.97. Also, the bottom line declined from the prior-year figure of $1.82 per share.

Lincoln National's adjusted operating revenues decreased to $4,718 million in the first quarter from $4,762 million a year ago. Also, it missed the consensus mark of $4,768 million.

Reinsurance Group of America, Incorporated RGA reported first-quarter 2022 adjusted operating earnings of 47 cents per share against the Zacks Consensus Estimate of a loss of 61 cents. In the year-ago quarter, RGA had reported a loss of $1.24 per share. Net premiums of $3.1 billion rose 8.3% year over year.

Investment income, net of related expenses, decreased 0.2% from the prior-year quarter to $810 million. The average investment yield was down 38 basis points to 5.29%. Total benefits and expenses at Reinsurance Group increased 1.4% year over year to $3.9 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

Voya Financial, Inc. (VOYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance