Sun Life Financial (SLF) Q1 Earnings Top Estimates, Rise Y/Y

Sun Life Financial Inc. SLF delivered first-quarter 2020 operating earnings per share of 98 cents, which beat the Zacks Consensus Estimate by 24.1%. The bottom line increased 8.9% year over year.

Underlying net income of $574.1 million (C$770 million) was up 7% year over year. This improvement was fueled by higher investing activity in Canada and U.S., business growth, higher available-for-sale gains, higher new business gains and improved credit experience compared with the year-ago quarter. However, lower net investment returns on surplus in Canada and Corporate, unfavorable expense and mortality experience, less favorable morbidity experience and unfavorable other experience were partial offsets.

Insurance sales decreased 0.5% year over year to $578.5 million (C$776 million), attributable to drop in sales in Canada. However, increased sales in the United States and Asia limited the downside.

Wealth sales increased 66.4% year over year to $44.7 billion (C$59.9 billion) in the quarter under review driven by higher sales in Canada, Asia and Asset Management.

Value of new business declined 0.5% to $283.3 million (C$380 million).

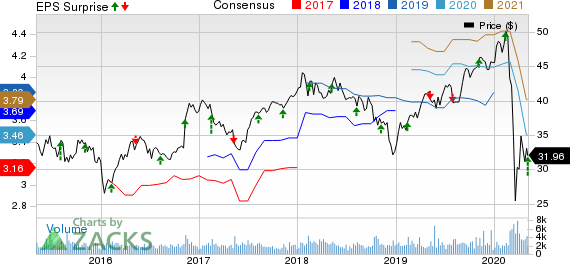

Sun Life Financial Inc. Price, Consensus and EPS Surprise

Sun Life Financial Inc. price-consensus-eps-surprise-chart | Sun Life Financial Inc. Quote

Segment Results

SLF Canada’s underlying net income increased 8% year over year to $190.6 million (C$256 million) owing to business growth and investment-related contributions, partially offset by unfavorable expense and morbidity experience in Group Benefits.

SLF U.S.’ underlying net income was $120 million (C$161 million), up 7% from the prior-year quarter owing to owing to higher investing activity, higher AFS gains and new business gains. However, unfavorable mortality experience and less favorable, but still positive, morbidity experience compared to elevated favorable morbidity experience in the first quarter of 2019 were partial offsets.

SLF Asset Management’s underlying net income of $180 million (C$242 million) increased 7% year over year, driven by higher average net assets in MFS and higher income in SLC, The company benefited from by the BGO acquisition that closed in 2020. However, change in net investment returns of $31 million in MFS due to declines in equity markets and widening of credit spreads was a partial offset.

SLF Asia reported underlying net income of $115.6 million (C$155 million), which rose 27% year over year owing to favorable credit experience, new business gains primarily in International and Hong Kong and improved mortality experience, partially offset by other experience from its joint ventures.

Financial Update

Global assets under management were $724.7 billion (C$1,023 billion), up 15.7% year over year.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio was 130% as Mar 31, 2020, flat year over year.

The LICAT ratio for Sun Life (including cash and other liquid assets) was 143%, flat year over yearl.

Sun Life’s return on equity of 7.2% in the first quarter, down 430 basis points (bps) year over year. Underlying ROE of 14.2% expanded 90 basis points year over year.

Leverage ratio of 207% improved 50 bps year over year.

Dividend Update

On May 5, 2020, the company’s board of directors approved a dividend of 55 cents per share. The amount will be paid out on Jun 30, 2020 to shareholders of record at the close of business on May 27.

Zacks Rank

Sun Life currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Insurance Releases

Among other players from the insurance industry that have reported first-quarter earnings so far, the bottom line of Brown & Brown, Inc. BRO beat the Zacks Consensus Estimate while that of RLI Corp. RLI and Travelers Companies TRV missed the same.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies Inc (TRV) : Free Stock Analysis Report

RLI Corp (RLI) : Free Stock Analysis Report

Sun Life Financial Inc (SLF) : Free Stock Analysis Report

Brown Brown Inc (BRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance