SunCoke Energy Inc (SXC) Surpasses Analyst Earnings Projections in Q1 2024

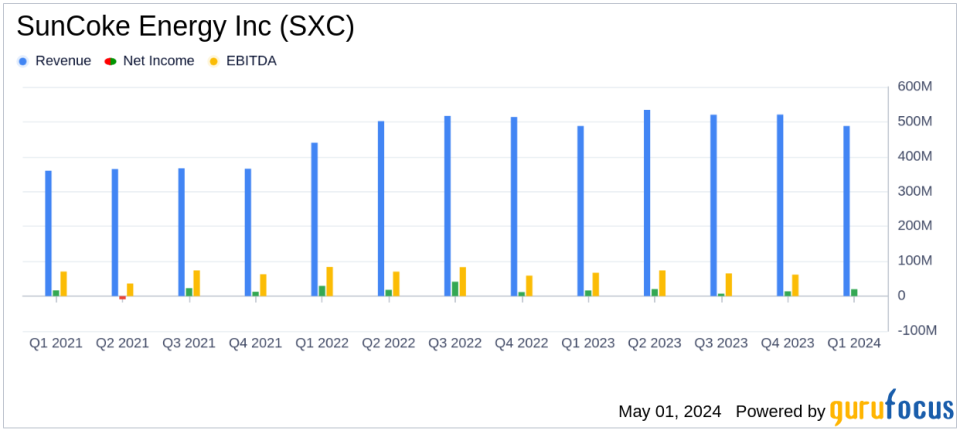

Net Income: Reported at $21.1 million for Q1 2024, up from $17.7 million in Q1 2023, exceeding estimates of $18.05 million.

Earnings Per Share (EPS): Achieved $0.23 per diluted share, surpassing the estimated $0.22.

Revenue: Totalled $488.4 million, slightly above the prior year's $487.8 million and exceeding estimates of $457.85 million.

Adjusted EBITDA: Increased modestly to $67.9 million from $67.1 million year-over-year.

Domestic Coke Segment: Revenue slightly increased to $459.5 million, with sales volumes growing to 996 thousand tons from 950 thousand tons.

Logistics Segment: Experienced a slight decrease in revenue and Adjusted EBITDA, with revenue falling to $20.6 million from $21.1 million.

2024 Full-Year Guidance: Reaffirmed, with expected Consolidated Adjusted EBITDA between $240 million and $255 million.

On May 1, 2024, SunCoke Energy Inc (NYSE:SXC), a leading independent producer of coke in the Americas, disclosed its first-quarter financial results for 2024 through an 8-K filing. The company reported a net income of $21.1 million, with earnings per diluted share of $0.23, surpassing the analyst estimates of $0.22 per share and net income of $18.05 million. Revenue for the quarter stood at $488.4 million, also exceeding the estimated $457.85 million.

SunCoke Energy operates through three segments: Domestic Coke, Brazil Coke, and Logistics, providing metallurgical and thermal coal alongside handling and mixing services. The company's strategic focus on maintaining full operational capacity at its domestic coke plants and delivering robust logistics solutions has significantly contributed to its current financial upturn.

Financial Performance Highlights

The company's revenue saw a slight increase from $487.8 million in Q1 2023 to $488.4 million in Q1 2024, driven by higher blast coke sales volumes and activity at domestic logistics terminals. This was slightly offset by the impact of lower coal prices on long-term contracts and reduced volumes at the CMT terminal. Adjusted EBITDA for the quarter was reported at $67.9 million, a marginal rise from $67.1 million in the prior year, reflecting efficient operational management and cost control.

Net income attributable to SXC rose by $3.7 million year-over-year, primarily due to reduced depreciation, amortization, and interest expenses. The earnings per share increase from $0.19 to $0.23 reflects not only improved operational performance but also effective financial stewardship.

Operational Insights and Segment Performance

In the Domestic Coke segment, revenues edged up to $459.5 million from $458.8 million in the previous year, with adjusted EBITDA increasing to $61.4 million. This segment benefited from an increase in coke sales volumes, though it faced challenges from lower coal prices affecting long-term contracts. The Logistics segment, however, experienced a slight decline in both revenues and adjusted EBITDA, primarily due to lower transloading volumes at CMT, despite higher volumes at other domestic terminals.

The Brazil Coke segment maintained stable performance, aligning with previous year results, demonstrating resilience in its operations. Corporate and other activities also reflected consistent performance with slight fluctuations in financial metrics.

Looking Ahead

For 2024, SunCoke Energy anticipates domestic coke production to be around 4.1 million tons, with net income projected between $67 million and $84 million. The company expects adjusted EBITDA to range from $240 million to $255 million, with capital expenditures estimated between $75 million and $80 million. These projections underline the company's confidence in maintaining operational efficiency and financial stability.

SunCoke Energy's robust quarterly performance, coupled with a positive outlook for 2024, positions it well within the competitive coke production industry. The company's strategic operations and financial management not only provide a solid foundation for sustained growth but also enhance shareholder value in a challenging market environment.

Conclusion

As SunCoke Energy continues to execute its operational strategies and financial management, it remains a significant player in the coke production industry, poised for further growth and profitability. Investors and stakeholders can look forward to the company's continued success based on its strong Q1 performance and optimistic projections for the rest of the year.

Explore the complete 8-K earnings release (here) from SunCoke Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance