Suncor Energy Completes Growth Phase and Plans to Reward Shareholders

The fourth quarter was a major milestone for Suncor Energy (NYSE: SU) as it completed an ambitious growth phase that started a few years back. Construction is now complete at both Fort Hills and Hebron, which means the company's capital spending plans are going to change in a big way over the next couple of years.

Let's dig into the company's results from this past quarter and get a feel for what investors can expect from this Canadian oil giant over the next couple of years.

By the numbers

Metric | Q4 2017 | Q3 2017 | Q4 2016 |

|---|---|---|---|

Revenue | CA$9.04 billion | CA$8.03 billion | CA$8.14 billion |

Net earnings | CA$1.38 billion | CA$1.29 billion | CA$531 million |

EPS | CA$0.84 | CA$0.78 | CA$0.32 |

Operating cash flow | CA$2.76 billion | CA$2.91 billion | CA$2.79 billion |

DATA SOURCE: SUNCOR ENERGY EARNINGS RELEASE. EPS = EARNINGS PER SHARE.

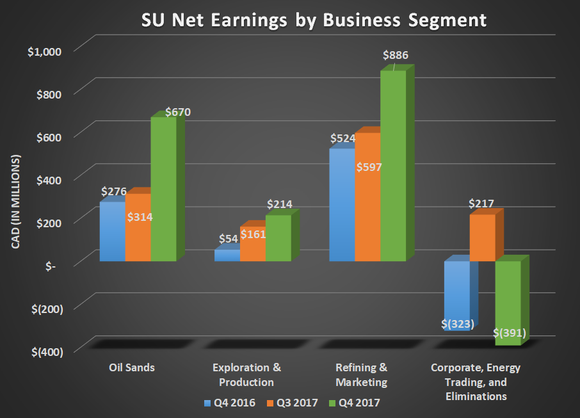

It is hard to find fault with anything that happened at Suncor this past quarter, because everything went its way, really. The company was able to maintain high production rates for oil and gas, and higher oil prices significantly improved earnings. What's more surprising was that the company's refining and marketing segment didn't suffer as a result of higher prices. Typically, when crude prices rise quickly, refined product prices don't respond quick enough, and refining margins get very small. However, Suncor's facilities are designed to use a lot of heavy Canadian crude oil, which comes at a much lower cost than lighter crudes that are produced from shale.

Data source: Suncor Energy earnings release. Chart by author.

The highlights

Suncor's total production for the fourth quarter was 736,000 barrels per day, which is more or less flat compared to both the prior quarter and this time last year. That is still a good result because it represents high utilization rates for all of its oil sands facilities.

First oil was announced at both its Fort Hills oil sands facility and the Hebron offshore platform. While neither contributed significant production in the quarter, they should ramp to near full capacity by the end of 2018. Once both facilities are running at full nameplate capacity, they should add about 137,000 barrels per day of production.

After a few operational hiccups this past year at Syncrude, Suncor got the facility back on track with a 94% utilization rate and a cash operating cost per barrel of 32.80 Canadian dollars. Combined with the rest of Suncor's oil sands operations, the company achieved its lowest cash cost per barrel in over a decade (CA$23.80) over the full year.

Thanks to better than expected cash flow and a favorable debt market, the company used proceeds from a previously announced sale of its crude oil tank farm and newly issued debt to repay CA$1.5 billion in notes due in 2018.

Also, that additional cash flow enabled the board to accelerate its share repurchase program and bought back CA$835 million worth of shares in the quarter and increased its dividend by 12.5%.

Image source: Suncor Energy.

What management had to say

Here's CEO Steven Williams press release statement on Suncor's performance and management's intentions for the coming year:

Strong performance in both our upstream and downstream operations combined to generate record quarterly funds from operations of more than $3 billion. This was significantly higher than our capital and dividend commitments, allowing us to reduce long-term debt and return additional value to shareholders through more than $800 million in share repurchases.

With Fort Hills and Hebron both successfully commissioned and now producing oil, the safe and steady ramp up of production is proceeding as planned. We believe the addition of these high-quality assets to our portfolio will return long-term value to shareholders and could not have been achieved without the hard work and dedication of our employees and business partners.

What a Fool believes

These next couple of years have a chance to be incredibly lucrative for Suncor investors. Now that Hebron and Fort Hills are operational, the company doesn't have any greenlighted projects. That means management expects to spend about CA$4.5 billion to CA$5.0 billion next year, which is a significant reduction from the past few years. Chances are that a large chunk of that cash will be given back to shareholders until it gets ready to sanction any new projects. The only things that might give investors pause are the operational hiccups it had over the past couple of years.

With low capital obligations for the foreseeable future, production increases from Fort Hills and Hebron throughout 2018, and a more favorable crude oil environment; shares of Suncor are looking very attractive.

More From The Motley Fool

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance