SunPower (SPWR) Declares Marginal Investment in Solar Dealers

SunPower Corporation SPWR recently announced marginal investment in leading solar dealers, EmPower Solar and Renova Energy, as part of its Dealer Accelerator Program. Through the platform, SPWR aims to bolster the growth prospects of solar dealers amid the rising demand.

Significance of Dealer Accelerator Program

In March 2022, SunPower launched the Dealer Accelerator Program to boost the growth of the local solar dealer platform, thus assisting in the faster adoption of renewable energy across the United States.

As part of the program, SPWR invests in solar dealer businesses that boast strong prospects while supporting their development through enhanced lead generation and strategic business plans.

Meanwhile, dealers involved in the program sell SunPower solar systems and SunVault battery storage to customers. They also offer perks to customers included in the SunPower Financial via higher credit limits, lower interest rates and a faster application process.

Before Renova and EmPower, SunPower invested in Freedom Solar Power and Sea Bright Solar. This highlights the company’s continuous focus on tapping the increased demand for solar products in the United States through a strong channel of distributors.

Such programs will assist the company in the increased penetration of its products and provide extensive network advantages, thereby boosting revenues.

Looking Ahead

As the federal incentivizes the clean energy sector to promote and accelerate the pace of green energy adoption, solar companies have become attractive. Buoyed by the probable increase in demand in the days ahead, solar companies are increasingly focusing on augmenting their business strength either by capacity expansion and new collaborations with installers or product introduction.

In this context, apart from SunPower, solar companies that have adopted measures for production ramp-up or launched new products in the solar energy landscape to reap the benefits of the intensified demand are as follows:

In September 2022, Canadian Solar CSIQ announced the launch of the battery storage solution EP Cube for homeowners and SolBank for utility-scale operations at the RE+ trade show. Also, the company intends to scale up its battery manufacturing capacity to 10 gigawatt-hours by the end of 2023.

The Zacks Consensus Estimate for Canadian Solar’s 2022 earnings suggests a growth rate of a solid 135.4% from the prior-year reported figure. CSIQ shares have returned 10.6% in the past year.

In August 2022, First Solar FSLR announced that it plans to invest up to $1.2 billion in scaling the production of photovoltaic solar modules and boost its production capacity to more than 10 gigawatts by 2025.

First Solar’s long-term earnings growth rate is pegged at 49.3%. FSLR shares have risen 27.5% in the past year.

Price Movement

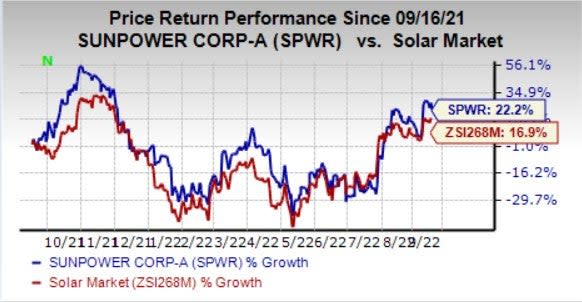

In the past year, shares of SunPower have risen 22.2% compared with the industry’s 16.9% growth.

Image Source: Zacks Investment Research

Zacks Rank

SunPower currently carries a Zacks Rank #3 (Hold). A better-ranked stock from the same industry is Enphase Energy ENPH, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Enphase Energy boasts a long-term earnings growth rate of 47.2%. The Zacks Consensus Estimate for Enphase Energy’s 2022 earnings indicates a growth rate of 69.1% from the prior-year reported figure.

The Zacks Consensus Estimate for Enphase Energy’s 2022 sales suggests a growth rate of 63% from the prior-year reported figure. Shares of ENPH have surged 98.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance