SVB collapse — latest news: Silicon Valley Bank ‘open for business’ says new CEO as Moody’s US bank view dims

Wall Street rebounded on Tuesday as inflation data met expectations and regional bank shares bounced back after Monday’s sharp falls following the collapse of Silicon Valley Bank (SVB).

Six regional financial institutions remain under tight scrutiny but the response from regulators to protect depositors appears to have addressed market concerns.

Nevertheless, credit ratings firm Moody’s has cut its outlook for the whole of the US banking system to negative from stable “to reflect the rapid deterioration in the operating environment”.

Meanwhile, the US Securities and Exchange Commission and Department of Justice have reportedly opened probes into the failure of SVB and any share trades undertaken by management in the run-up to its shuttering on Friday. A class-action lawsuit has also been filed by investors against the parent company, CEO and CFO.

Tim Mayopoulos, the newly appointed CEO of SVB, has declared the bank is back open for business, opening new accounts and making new loans. He served as CEO of Fannie Mae bringing it back to profitability after the 2008 financial crisis.

Elsewhere, Wall Street expert Robert Kiyosaki, famed for predicting the Lehman Brothers’ failure, has pegged Credit Suisse as the next major bank most likely to collapse.

Key Points

Dow Jones closes up 330 points as bank shares bounce back

DOJ and SEC to probe stock sales ahead of Silicon Valley Bank collapse, report says

‘Rapid deterioration’ of operating environment sees Moody’s cut US banking outlook

Credit Suisse shares fall after Kiyosaki prediction

New York State Department of Financial Services takes over Signature Bank

Biden to ask Congress ‘to strengthen the rules for banks'

BUT New York regulator says Signature Bank closure ‘nothing to do with crypto’

03:15 , Oliver O'Connell

New York’s financial regulator has pushed back on former Rep Barney Frank’s comments, saying its decision to close Signature Bank had “nothing to do with crypto,” citing what it called “a significant crisis of confidence in the bank’s leadership” that occurred over the weekend after regulators shuttered Silicon Valley Bank.

Mr Frank is a board member of Signature Bank and was one of the pioneers of the landmark Dodd-Frank Act, which was enacted after the 2008 financial crisis to better insulate the banking system from shocks.

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message,” Mr Frank told CNBC on Monday. “We became the poster boy because there was no insolvency based on the fundamentals.”

But NYDFS denied his claims in a statement on Tuesday, saying that its decision to close Signature Bank on Sunday and appoint the Federal Deposit Insurance Corp as receiver “was based on the current status of the bank and its ability to do business in a safe and sound manner on Monday.”

“The decisions made over the weekend had nothing to do with crypto. Signature was a traditional commercial bank with a wide range of activities and customers,” an NYDFS spokesperson said.

“DFS has been facilitating well-regulated crypto activities for several years, and is a national model for regulating the space,” they said.

The spokesperson added that as withdrawal requests ballooned over the weekend, Signature Bank failed to provide reliable and consistent data.

Mr Frank said he was surprised the regulator said the decision to close the bank was not related to cryptocurrency.

“I think that was a factor,” he said in an interview. “I’m puzzled as to why it was closed.”

He added that to his knowledge, bank executives were working to provide data to regulators.

“What we heard from our executives is that the deposit situation had stabilised and they would be getting the capital from the discount window and I continue to be convinced that if we had opened on Monday given the announcements of those two policies, we would have been in a reasonably good shape and certainly functional,” he said.

Signature was a commercial bank with private client offices with nine national business lines including commercial real estate and digital asset banking.

With reporting from Reuters

Barney Frank claims Signature Bank seized to send banks a message

02:45 , Oliver O'Connell

A regulatory takeover of a New York-based bank was intended to send a message to U.S. banks to stay away from the cryptocurrency business, a former member of Congress who was on the bank’s board says.

Former US Rep. Barney Frank said Monday that he believes the state officials behind the action were trying to make an example of Signature Bank.

“This was just a way to tell people, ‘We don’t want you dealing with crypto,’” Frank told The Associated Press in a telephone interview.

Signature Bank seized to send banks a message, director says

Voices: Ghosts of the 2008 financial crisis loom over Biden’s response

01:15 , Oliver O'Connell

Eric Garcia writes:

When President Joe Biden announced on Monday that people who had deposited their money in the now-unraveled Silicon Valley Bank would have their money available, he emphasised that American taxpayers would not be left on the hook.

Similarly, he added that the people responsible at the bank would need to be fired and that investors in Silicon Valley Bank would not be made whole, arguing that they took a risk and now have to suffer the losses.

Ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

DOJ and SEC to probe stock sales ahead of Silicon Valley Bank collapse, report says

00:15 , Oliver O'Connell

The US Department of Justice and the Securities and Exchange Commission are investigating the collapse of Silicon Valley Bank, The Wall Street Journal reports, citing people familiar with the matter.

The tech and start-up-focused lender based in Santa Clara, California, was taken over by regulators on Friday during a run on its deposits, making it the second-largest bank failure in US history.

It is not unusual for there to be such investigations when large financial institutions or public companies collapse or suffer unexpected losses, but the separate probes will also look at stock sales that company bosses made days before the bank failed.

SVB: Justice Department and SEC to probe stock sales ahead of collapse

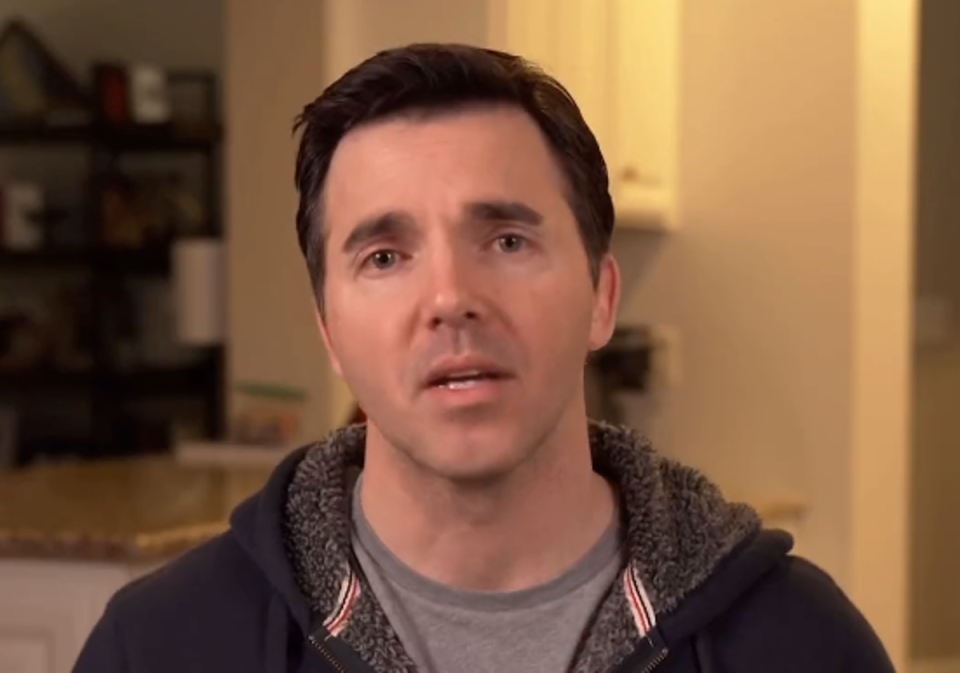

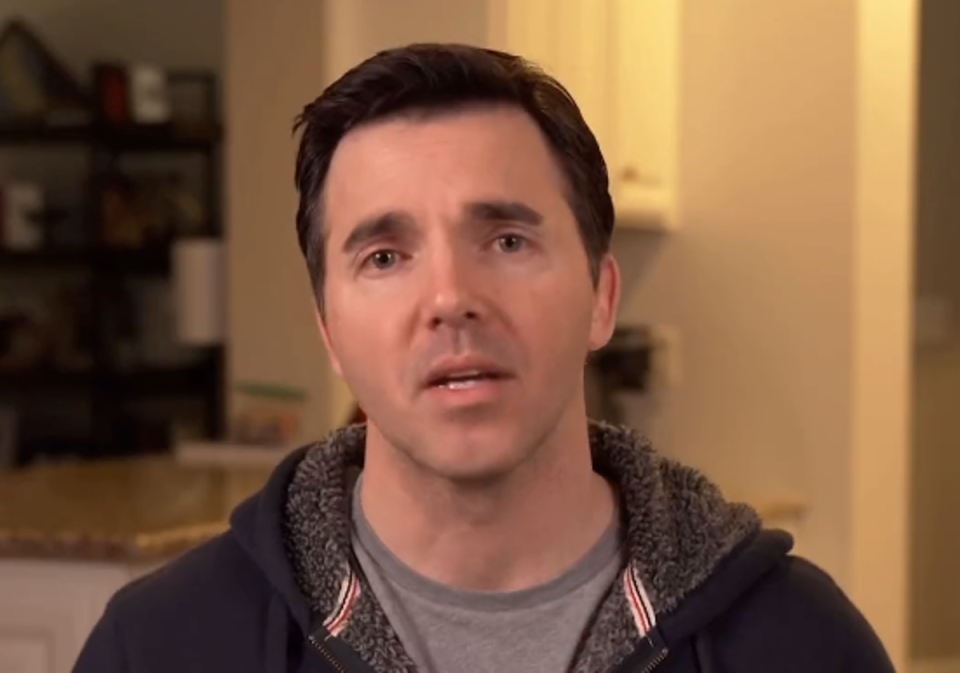

Lawmaker’s explanation of Silicon Valley Bank’s collapse goes viral

23:45 , Oliver O'Connell

A congressman has been widely praised for posting a two-and-a-half-minute video to Twitter and TikTok clearly laying out the Silicon Valley Bank situation.

North Carolina Democrat Jeff Jackson, originally from Chapel Hill, was elected to the US House of Representatives for the state’s 14th District in 2022.

At 2am on Monday morning, he filmed a video for social media explaining how the Silicon Valley Bank crisis began, what was being done about it, and to discourage panic.

Read more:

North Carolina lawmaker’s video explanation of the SVB collapse earns praise online

Voices: The Silicon Valley Bank collapse has made three things horrifically clear

23:15 , Oliver O'Connell

It was no Lehman Brothers moment, but there are three hard lessons to be learned from the past few days, writes David Callaway.

The Silicon Valley Bank collapse has made three things horrifically clear

Biden says banking system is ‘safe’ and vows accountability for executives

22:45 , Oliver O'Connell

President Joe Biden reassured Americans that the nation’s banking system is safe after Silicon Valley Bank collapsed last week and said there would be accountability for financial executives.

The president’s actions come after the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corporation announced on Sunday evening that depositors for Silicon Valley Bank would have access to their money.

Eric Garcia filed this report from Washington, DC, on Monday.

Biden says banking system is ‘safe’ after Silicon Valley Bank collapse

22:15 , Oliver O'Connell

Jeremy Hunt hails ‘great resilience’ as HSBC rescues Silicon Valley Bank UK branch

Recap: Why did Silicon Valley Bank collapse?

21:45 , Oliver O'Connell

The collapse of the 16th largest bank in the US sent ripples through global markets on Monday as governments and businesses scrambled to figure out what the impact would be and how it could be contained.

Silicon Valley Bank collapsed on Friday after failing to raise new capital last week.

On Monday, the UK government said that HSBC would take over the UK wing of the bank.

But what was SVB, why did it collapse, and are other banks at risk? We examine these questions here.

Why did Silicon Valley Bank collapse and are other lenders at risk?

Top GOP Senate Finance member: No new banking rules needed

21:25 , Oliver O'Connell

Senator Mike Crapo, the top Republican on the Senate Finance Committee told CNN’s Manu Raju that no new banking rules were needed following the collapse of Silicon Valley Bank, arguing the system is in place, but better supervision is needed.

Mr Crapo was the author of the 2018 bill that led to the rollback of the Dodd-Frank regulations put in place after the 2008 global financial crisis.

“The regulatory system is in place. The regulatory authorities that Congress has given to the Fed and the FDIC are completely adequate for the system to work,” he said.

“We simply need to have better supervision, and probably, like I said, a little tuning up of how the regulatory stress testing works with regard to liquidity issues in the banks right now.”

Crapo added: “We simply need to have better supervision, and probably, like I said, a little tuning up of how the regulatory stress testing works with regard to liquidity issues in the banks right now.”

— Manu Raju (@mkraju) March 14, 2023

Watering down financial regulations sees Trump blamed for Silicon Valley Bank collapse

21:15 , Oliver O'Connell

Critics looking to assign blame for the collapse of Silicon Valley Bank have found possible culprits in Donald Trump and Republican senators.

Though little known outside of Silicon Valley, the SVB was the leading lender to tech firms and startups before it crumbled on Friday.

Graig Graziosi reports.

Trump blamed over Silicon Valley Bank collapse for cutting down financial regulations

Watch: UK arm of Silicon Valley Bank sold to HSBC for £1

20:45 , Oliver O'Connell

UK arm of Silicon Valley Bank sold to HSBC for £1

Tough decisions ahead as Fed criticised for missing red flags before bank failure

20:32 , Oliver O'Connell

The Federal Reserve is facing stinging criticism for missing what observers say were clear signs that Silicon Valley Bank was at high risk of collapsing into the second-largest bank failure in U.S. history.

The Fed was the primary federal supervisor of the bank based in Santa Clara, California, that failed last week. The bank was also overseen by the California Department of Financial Protection and Innovation.

Critics point to many red flags surrounding Silicon Valley Bank, including its rapid growth since the pandemic, its unusually high level of uninsured deposits and its many investments in long-term government bonds and mortgage-backed securities, which tumbled in value as interest rates rose.

Read more:

Fed, under criticism for bank failure, faces tough decisions

Dow Jones closes up 330 points as bank shares bounce back

20:12 , Oliver O'Connell

The Dow Jones Industrial Average closed up 330 points on Tuesday as investors signaled that they believe the risk of contagion to the wider banking network has been contained by regulators following the failure of Silicon Valley Bank and Signature Bank over the weekend.

The Dow Jones Industrial Average ended up 329.28 points, or 1%, at 32,153.89, ending a five-day losing streak. The S&P 500 added 64.54 points, or 1.67%, to close at 3,920.30. The Nasdaq Composite climbed 239.31 points, or 2.1%, to end at 11,428.15.

In addition to an improved perception of the banking system, the Labor Department's CPI report showed consumer prices cooled in February, largely in line with market expectations, with headline and core measures notching welcome annual declines.

Even so, inflation has a considerable way to go before approaching the central bank's average annual 2% target.

But signs of economic softness, combined with the regional banking scare, have increased the odds that the Federal Reserve will implement a modest, 25 basis-point hike to its key interest rate at the conclusion of its two-day policy meeting on 22 March.

With reporting from Reuters

Private equity firms interested in SVB loan book, reports say

20:00 , Oliver O'Connell

CNBC reports that private equity firms Apollo Global Management and KKR are among the institutions reviewing a book of loans held by Silicon Valley Bank. The network cites people familiar with the discussions who requested anonymity.

Two of the sources said Apollo may be interested in acquiring a piece of the business but it is unclear if the FDIC would prefer a single buyer for the whole bank.

Bloomberg earlier reported a number of private equity firms were interested in the bank’s loan portfolio, including Ares Management, Blackstone, and Carlyle Group, in addition to Apollo and KKR.

New Silicon Valley Bank CEO brings experience and ‘humility'

19:40 , Oliver O'Connell

In a message to clients, newly appointed Silicon Valley Bank CEO Tim Mayopoulos says: “I look forward to getting to know the clients of Silicon Valley Bank. I come to this role with humility. I also come to this role with experience in these kinds of situations.”

He explains: “I was part of the new leadership team that joined Fannie Mae in the wake of the financial crisis in 2008-09, and I served as the CEO of Fannie Mae from 2012-18. I am very proud of work we did there to restore the company to profitability and to stabilize the housing finance system in a period of unprecedented challenge.”

Mr Mayopoulos adds: “I also come with experience in and an appreciation for the innovation economy. Until recently, I was the president of a Silicon Valley-based software company that provides technology to financial institutions to serve their consumer banking customers. I know how important Silicon Valley Bank has been and continues to be to the success of its clients and the innovation ecosystem.”

Premium: Has enough been done to calm Wall Street over the banking crisis?

19:20 , Oliver O'Connell

James Moore, The Independent’s chief business commentator, writes:

Just what we needed right now: another banking crisis. But after the bloodbath at the beginning of the week, a rally quickly got underway. Regional banks in the United States – in real danger of experiencing a run on their deposits while larger rivals benefit from inflows – found some support.

Has enough been done to calm Wall Street over the banking crisis?

New Silicon Valley Bank CEO: ‘We are open for business'

19:05 , Oliver O'Connell

Tim Mayopoulos, the new CEO of Silicon Valley Bank — now technically known as Silicon Valley Bridge Bank — has declared the bank is open for business.

In a message posted to the company’s website and emailed to customers, Mr Mayopoulos said: “We are doing everything we can to rebuild, win back your confidence, and continue supporting the innovation economy. We recognise the past few days have been an extremely challenging time, and we are grateful for your patience.”

He continued: “We are open for business and are hard at work bringing all systems and solutions back online to support you. We are making new loans and fully honoring existing credit facilities.

“The number one thing you can do to support the future of this institution is to help us rebuild our deposit base, both by leaving deposits with Silicon Valley Bridge Bank and transferring back deposits that left over the last several days.”

Underlining the announcement yesterday that depositors have full access to their money, and that both new and existing deposits are fully protected by the FDIC, he characterised the bank as now among the safest in the country thanks to the actions of regulators.

The bank is actively opening new accounts of all sizes and making new loans, Mr Mayopoulos added.

The first ‘Twitter fueled bank run’

18:52 , Oliver O'Connell

House Financial Services Committee Chairman Patrick McHenry (R-NC) labelled the Silicon Valley Bank collapse the “first Twitter-fueled bank run” on Friday.

In a statement, he said: “This was the first Twitter-fueled bank run. At this time, it is important to remain levelheaded and look at the facts — not speculation — when assessing the right path forward, I have confidence in our financial regulators and the protections already in place to ensure the safety and soundness of our financial system.”

This morning he joined CNBC’s Squawkbox to underline his statement saying: “I want to convey confidence to the American people that these agencies are doing the right thing.”

You can watch the whole interview segment here:

#NEW: Chairman @PatrickMcHenry joins @SquawkCNBC to discuss the failure of #SVB and Signature Bank:

"I want to convey confidence to the American people that these agencies are doing the right thing."

📺 WATCH 👇 pic.twitter.com/KdY8bGKFlJ— Financial Services GOP (@FinancialCmte) March 14, 2023

Demise of Silicon Valley Bank disrupts the tech disruptors

18:32 , Oliver O'Connell

Silicon Valley Bank’s collapse rattled the technology industry that had been the bank’s backbone, leaving shell-shocked entrepreneurs thankful for the government reprieve that saved their money while they mourned the loss of a place that served as a chummy club of innovation.

Read more:

Silicon Valley Bank's demise disrupts the disruptors in tech

Lawmaker’s explanation of Silicon Valley Bank’s collapse goes viral

18:12 , Oliver O'Connell

A congressman has been widely praised for posting a two-and-a-half-minute video to Twitter and TikTok clearly laying out the Silicon Valley Bank situation.

North Carolina Democrat Jeff Jackson, originally from Chapel Hill, was elected to the US House of Representatives for the state’s 14th District in 2022.

At 2am on Monday morning, he filmed a video for social media explaining how the Silicon Valley Bank crisis began, what was being done about it, and to discourage panic.

Read more:

North Carolina lawmaker’s video explanation of the SVB collapse earns praise online

Six regional US banks under scrutiny

17:52 , Oliver O'Connell

Moody’s Investors Service placed six other US banks on review for potential downgrades late on Monday, following the collapse of Silicon Valley Bank. The credit ratings firm also downgraded Signature Bank deep into junk territory.

On the firm’s watchlist are First Republic Bank, Zions, Western Alliance, Comerica, UMB Financial, and Intrust Financial. Moody’s cited the “extremely volatile funding conditions for some US banks exposed to the risk of uninsured deposit outflows.”

Shares of regional banks plummeted on Monday despite the federal government stepping in to prevent further bank runs.

When markets opened on Tuesday, regional bank shares rebounded strongly.

Watch: UrbanStems CEO talks about having 100% of cash with SVB

17:32 , Oliver O'Connell

"We have a tough decision with whether we stay with them. We are not sure if there are any risks to leaving. We are not supposed to take our money out."

CEO of UrbanStems— which banks 100% of its cash assets with Silicon Valley Bank— joins to discuss SVB collapse: pic.twitter.com/o30rpVBMIr— CNN This Morning (@CNNThisMorning) March 14, 2023

BUT New York regulator says Signature Bank closure ‘nothing to do with crypto’

17:22 , Oliver O'Connell

New York’s financial regulator has pushed back on former Rep Barney Frank’s comments, saying its decision to close Signature Bank had “nothing to do with crypto,” citing what it called “a significant crisis of confidence in the bank’s leadership” that occurred over the weekend after regulators shuttered Silicon Valley Bank.

Mr Frank is a board member of Signature Bank and was one of the pioneers of the landmark Dodd-Frank Act, which was enacted after the 2008 financial crisis to better insulate the banking system from shocks.

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message,” Mr Frank told CNBC on Monday. “We became the poster boy because there was no insolvency based on the fundamentals.”

But NYDFS denied his claims in a statement on Tuesday, saying that its decision to close Signature Bank on Sunday and appoint the Federal Deposit Insurance Corp as receiver “was based on the current status of the bank and its ability to do business in a safe and sound manner on Monday.”

“The decisions made over the weekend had nothing to do with crypto. Signature was a traditional commercial bank with a wide range of activities and customers,” an NYDFS spokesperson said.

“DFS has been facilitating well-regulated crypto activities for several years, and is a national model for regulating the space,” they said.

The spokesperson added that as withdrawal requests ballooned over the weekend, Signature Bank failed to provide reliable and consistent data.

Mr Frank said he was surprised the regulator said the decision to close the bank was not related to cryptocurrency.

“I think that was a factor,” he said in an interview. “I’m puzzled as to why it was closed.”

He added that to his knowledge, bank executives were working to provide data to regulators.

“What we heard from our executives is that the deposit situation had stabilised and they would be getting the capital from the discount window and I continue to be convinced that if we had opened on Monday given the announcements of those two policies, we would have been in a reasonably good shape and certainly functional,” he said.

Signature was a commercial bank with private client offices with nine national business lines including commercial real estate and digital asset banking.

With reporting from Reuters

ICYMI: Barney Frank claims Signature Bank seized as warning to stay away from crypto

17:12 , Oliver O'Connell

A regulatory takeover of a New York-based bank was intended to send a message to U.S. banks to stay away from the cryptocurrency business, a former member of Congress who was on the bank’s board says.

Former U.S. Rep. Barney Frank said Monday that he believes the state officials behind the action were trying to make an example of Signature Bank.

“This was just a way to tell people, ‘We don’t want you dealing with crypto,’” Frank told The Associated Press in a telephone interview.

Signature Bank seized to send banks a message, director says

Watch: No losses will be borne by taxpayers, Biden says

17:00 , Oliver O'Connell

‘No losses’ will be borne by taxpayers after Silicon Valley Bank collapse, Biden says

‘Rapid deterioration’ of operating environment sees Moody’s cut US banking outlook

16:56 , Oliver O'Connell

Credit ratings agency Moody’s cut its outlook for the whole of the US banking system to negative from stable “to reflect the rapid deterioration in the operating environment”.

The move follows the failure of Silicon Valley Bank and Signature Bank in quick succession over the weekend.

The Tuesday morning report came as US regional banks — that saw dramatic plunges in value on Monday — bounced back from steep selloff after fears of a contagion effect eased following the intervention of the federal government and regulators to protect depositors.

Nevertheless, the Moody's report cited “the rapid and substantial decline in bank depositor and investor confidence” in recent days, which it claimed highlights “risks in US banks' asset-liability management”.

There have been no further bank runs since SVB failed, though there were concerns for other similar-sized institutions that often have a less diverse, more focused client base, either geographically or by sector, when compared to larger banks such as Citi, Bank of America, Wells Fargo, or JP Morgan Chase.

On Moody’s watchlist are First Republic Bank, Zions, Western Alliance, Comerica, UMB Financial, and Intrust Financial.

The firm cited the “extremely volatile funding conditions for some US banks exposed to the risk of uninsured deposit outflows”.

Class action suit filed against Silicon Valley Bank parent and chiefs

16:32 , Oliver O'Connell

A class action lawsuit is being filed against the parent company of Silicon Valley Bank, its CEO and its chief financial officer, saying that company didn’t disclose the risks that future interest rate increases would have on its business.

Read on:

Class action suit filed against Silicon Valley Bank parent

Warren: Powell should recuse himself from SVB probe

16:12 , Oliver O'Connell

Democratic Senator Elizabeth Warren on Tuesday called on Federal Reserve Chair Jerome Powell to recuse himself from an internal review of recent bank failures, saying his actions “directly contributed” to them.

In a separate letter, Senator Warren pressed ex-Silicon Valley Bank CEO Greg Becker for details on the bank’s lobbying in favor of a 2018 law that eased regulations for large regional banks, which she and others have pointed to as contributing to the bank’s Friday collapse. She also asked for information regarding any stock sales by executives or bonuses paid out in the months leading up to its failure.

The Federal Reserve said on Monday it is reviewing its oversight of the bank in the wake of its abrupt failure Friday. Senator Warren argued that Mr Powell’s prior support for easing bank rules indicates he should not participate in the review. Fed Vice Chairman Michael Barr, who President Joe Biden nominated, is leading that review.

Fed Chair Powell’s actions directly contributed to these bank failures. For the Fed’s inquiry to have credibility, Powell must recuse himself from this internal review. It’s appropriate for Vice Chair for Supervision Barr to have the independence necessary to do his job.

— Elizabeth Warren (@SenWarren) March 14, 2023

“Fed Chair Powell’s actions directly contributed to these bank failures. For the Fed’s inquiry to have credibility, Powell must recuse himself from this internal review,” she said in a Twitter post.

“It’s appropriate for Vice Chair for Supervision Barr to have the independence necessary to do his job,” said Ms Warren, a Democrat, who has been a sharp critic of Mr Powell.

Reuters

Banks shake off immediate SVB contagion fears

15:50 , Oliver O'Connell

US bank stocks made sharp gains on Tuesday, recovering ground from lows triggered by the collapses of Silicon Valley Bank and Signature Bank which had prompted assurances from President Joe Biden and other global policymakers.

Worries about contagion risks from the collapse of the two US banks had compounded investor concerns about the impact on lenders of rising interest rates, hitting bank shares in Asia and Europe as investors re-examined their risks.

An indicator of credit risk in the eurozone banking system hit its highest since mid-July, while ratings agency Moody’s cut its US banking system outlook to negative from stable “to reflect the rapid deterioration in the operating environment”.

Although the VIX volatility index, Wall Street’s “fear gauge”, neared six-month highs overnight, US regional bank shares bounced, with First Republic Bank up 52.7 per cent, a day after hitting an intraday record low of $17.53.

“If we do not see any high-profile failures in the near future, then the fears would subside,” said Jack Ablin, chief investment officer at Cresset Capital.

Banking giants Citi, Wells Fargo, and JP Morgan were also higher in the pre-market.

However, Moody’s said it was reviewing six lenders for a downgrade, including First Republic, Zions Bancorp, Western Alliance Bancorp and Comerica.

Reuters

Watch: Democrat congressman gives clearest explanation of SVB bank run

15:35 , Oliver O'Connell

North Carolina Democrat Congressman Jeff Jackson has been widely praised for posting this two and half minute video to Twitter and TikTok clearly laying out the Silicon Valley Bank situation.

Watch below:

Last night we had an emergency Zoom call with most of Congress to stop a bank run.

Here’s the situation: pic.twitter.com/wiplqp9PsS— Rep. Jeff Jackson (@JeffJacksonNC) March 13, 2023

Ah, yes, being ‘woke’ brought down Silicon Valley Bank... of course!

15:25 , Oliver O'Connell

The historic failure of Silicon Valley Bank is likely the result of a host of compounded factors that have nothing to do with so-called “wokeness,” from Donald Trump-era cuts to regulations that were put in place during the last financial crisis to the bank’s untenable concentration in an explosion of venture capital firms and tech startups as it careened into reality, rising interest rates and panic.

Alex Woodward reports.

Republicans blame ‘wokeness’ for Silicon Valley Bank’s collapse

After fierce blowback against Trump administration, Pence blames Biden for SVB failure

15:05 , Oliver O'Connell

Former Vice President Mike Pence has joined the choir of conservative voices trying to pin the Silicon Valley Bank collapse on Democrats while Democrats try to do the same to them.

In an editorial for The Daily Mail, Mr Pence takes aim at Joe Biden and the Democrats, claiming that “just like 2008,” the party has “increased spending by over $10 trillion” that “fueled record inflation, inevitably requiring the FED to raise interest rates.”

He laid some of the blame on the bank, which collapsed on Friday, and laced his criticisms with conservative media buzzwords.

Graig Graziosi reports on the former vice president’s commentary.

Pence: Biden to blame for SVB collapse

DOJ and SEC to probe stock sales ahead of Silicon Valley Bank collapse, report says

14:50 , Oliver O'Connell

The US Department of Justice and the Securities and Exchange Commission are investigating the collapse of Silicon Valley Bank, The Wall Street Journal reports, citing people familiar with the matter.

Read more:

SVB: Justice Department and SEC to probe stock sales ahead of collapse

Market rally continues

14:47 , Oliver O'Connell

The market rally continues in New York with the Dow Jones Industrial average up 419 points (1.32 per cent) as of 10.45am ET.

The S&P 500 is up 1.9 per cent and the Nasdaq Composite has climbed 2.2 per cent.

After yesterday’s brutal pummeling of the share price of a number of regional banks, many have shown signs of recovery today with no signs of further bank runs since the federal government said it would effectively guarantee customer deposits.

White House statement on February inflation figures

14:30 , Oliver O'Connell

Statement from President Joe Biden on February CPI Report

Today’s report shows annual inflation is down by a third from this summer at a time when the unemployment rate remains near a 50-year low. That is the slowest annual increase since September 2021. I will continue working to lower costs for hard-working Americans so they have a little more breathing room at the end of the month.

On that front, I am pleased at today’s announcement that, in line with my call, Novo Nordisk will be lowering their insulin prices by 75 percent, following Eli Lilley’s action. This builds on the important progress we made last year when I signed a law to cap insulin at $35 for seniors. I urge all other manufacturers to follow suit and Republicans in Congress to join us and cap insulin at $35 for all Americans.

As I’ve long said, and as challenges in the banking sector remind us, there will be setbacks along the way in our transition to steady and stable growth. But we face these challenges from a position of strength. More than 12 million jobs have been created since I took office and the share of working age adults in jobs or looking for work is the highest it has been in 15 years. We will continue to make progress in our fight to build an economy from the bottom up and middle out, not top down.

At the same time, I will do everything in my power to prevent us from going backwards on the progress we’ve made – including by standing up to Congressional Republicans who threaten economic catastrophe over the debt limit in order to secure tax cuts for the wealthy and large corporations and reckless cuts to critical programs that American seniors and families count on.

More problems for tech as Meta slashes another 10,000 jobs

14:15 , Oliver O'Connell

Facebook parent Meta is slashing another 10,000 jobs and will not fill 5,000 open positions as the social media pioneer cuts costs.

The company said on Tuesday it will reduce the size of its recruiting team and make further cuts in its tech groups in late April, and then its business groups in late May.

“This will be tough and there’s no way around that,” said CEO Mark Zuckerberg. “It will mean saying goodbye to talented and passionate colleagues who have been part of our success.”

Andrew Griffin has the full details.

Meta to fire 10,000 more people, Mark Zuckerberg says

Full Story: Wall Street expert predicts next major bank to fold

14:00 , Oliver O'Connell

A Wall Street expert has revealed which bank he believes will fail next, following the Silicon Valley Bank (SVB) collapse.

SVB folded on Friday after failing to raise new capital after it sold government bonds at heavy losses to reimburse customers withdrawing their cash.

Now Robert Kiyosaki, who accurately predicted the 2008 Lehman Brothers’ collapse, warned that Credit Suisse could be at risk as the volatile bond market crashes, with rising interest causing bonds to fall in price.

Kate Plummer reports.

Wall Street expert predicts next major bank to fold

Regulator response should address market concerns for now

13:45 , Oliver O'Connell

Several experts said the tools already announced, including a deposit guarantee at the two failed banks and a new Federal Reserve facility that can provide banks with liquidity on attractive terms, should address market concerns for now.

Silicon Valley Bank failed days after announcing it had to raise capital to offset losses brought on by rapid interest rate increases, and its extremely high level of uninsured deposits were quick to flee.

The experts said the measures announced Sunday are squarely aimed at both issues, giving banks easy access to emergency funds and sending a message that bank deposits, even uninsured ones, are safe.

Some dramatic steps, such as raising the $250,000 ceiling for FDIC deposit insurance, would require new laws from Congress, an uncertain prospect in a divided government where policymakers are already feuding over next steps.

“The Fed and Treasury have kind of shot their bazooka for now,” said Mark Sobel, a former senior US Treasury official who is US chairman of the London-based OMFIF financial think tank. “I think it’s a question of the market steadying out.”

Reuters

US regional bank shares rebound after sell-off

13:38 , Oliver O'Connell

Shares in US regional banks are rebounding after Monday’s sell-off, with First Republic up sharply in early Tuesday trading indicating concerns over the bank’s future may be easing.

The stock traded 52 per cent higher in premarket trading. Shares of other regional banks also surged before the opening bell, with PacWest jumping 44 per cent, KeyCorp up 16 per cent, and Zions Bancorp up 21 per cent.

After the opening bell in New York, the Dow Jones Industrial Average jumped more than 250 points and by 9.40am was up 328 points of more than 1.03 per cent.

US market holds steady as inflation eases slightly

13:32 , Oliver O'Connell

US futures held steady following a report that inflation eased slightly last month but remains elevated, posing a challenge for the Federal Reserve at a delicate moment for the financial system.

Even though prices are rising faster than the Fed wants, some economists expect the central bank to suspend its yearlong streak of interest rate hikes when it meets next week. With the collapse of two large banks since Friday fueling anxiety about other regional banks, the Fed may, at least in the short term, focus more on boosting confidence in the financial system than on its long-term drive to tame inflation.

Futures for the Dow were up 0.8% before the bell Tuesday, while futures for the S&P rose 1%.

The government said Tuesday that prices increased 0.4% last month, less than January’s 0.5% rise. But excluding volatile food and energy costs, core prices rose 0.5% last month, slightly higher than January’s 0.4% gain. The Fed is particularly focused on the core measure as a gauge of underlying inflation pressures.

AP

Six regional US banks under scrutiny

13:29 , Oliver O'Connell

Moody’s Investors Service placed six other US banks on review for potential downgrades late on Monday, following the collapse of Silicon Valley Bank. The credit ratings firm also downgraded Signature Bank deep into junk territory.

On the firm’s watchlist are First Republic Bank, Zions, Western Alliance, Comerica, UMB Financial, and Intrust Financial. Moody’s cited the “extremely volatile funding conditions for some US banks exposed to the risk of uninsured deposit outflows.”

Shares of regional banks plummeted on Monday despite the federal government stepping in to prevent further bank runs.

As markets open on Tuesday, regional bank shares are rebounding strongly.

Watch: UrbanStems CEO talks about having 100% of cash with SVB

13:23 , Oliver O'Connell

"We have a tough decision with whether we stay with them. We are not sure if there are any risks to leaving. We are not supposed to take our money out."

CEO of UrbanStems— which banks 100% of its cash assets with Silicon Valley Bank— joins to discuss SVB collapse: pic.twitter.com/o30rpVBMIr— CNN This Morning (@CNNThisMorning) March 14, 2023

US regulators may take wait-and-see approach before further intervention

13:15 , Oliver O'Connell

US regulators are likely to let emergency measures announced Sunday to shore up investor confidence in the banking sector sink in and increase scrutiny of the industry before intervening with any further steps, regulatory experts said.

Fears remained on Wall Street on Monday despite the measures announced over the weekend following the collapse of California-based Silicon Valley Bank and New York-based Signature Bank. Regional bank shares tumbled, and the S&P 500 Banking Index ended the day down 7%, its largest one-day fall since 11 June 2020.

Some investors have called for further action by banking regulators to reassure markets. But banking experts said regulators would likely want to see the extent of any further contagion before deciding on fresh measures.

“It all depends on what the situation will look like,” said Saule Omarova, a law professor at Cornell Law School who President Joe Biden once nominated to lead the Office of the Comptroller of the Currency, a top banking regulator. “Whatever else they can do will depend on how creative they are.”

Some experts also argued there were some signs for optimism that the intervention was helping.

“It’s noteworthy that we haven’t seen any bank failures yet throughout the day,” said Young Kim, a banking lawyer with Clifford Chance. “At least some of their objectives were achieved as it concerns calming fears.”

Reuters

Wall Street Journal under fire for column blaming SVB collapse on diversity

13:15 , Megan Sheets

The Wall Street Journal is facing fierce backlash for publishing a column that appeared to blame the Silicon Valley Bank collapse on diversity efforts.

Opinion writer Andy Kessler, whose column focuses on technology and markets, reacted to the stunning bank failure in a piece entitled “Who Killed Silicon Valley Bank?”

“In its proxy statement, [Silicon Valley Bank] notes that besides 91 percent of their board being independent and 45 percent women, they also have ‘1 Black,’ ‘1 LGBTQ+,’ and ‘2 Veterans,’” he wrote.

“I’m not saying 12 white men would have avoided this mess, but the company may have been distracted by diversity demands.”

The comments drew immense criticism on social media.

For @wsj to say flat out that SVB could have failed because they added non-white men to their board shows how far behind the times (and certifiably stupid) this publication really is. It makes me so angry and very sad. WSJ readers and staff deserve better. pic.twitter.com/ppbcugJNhW

— Jessica Lessin (@Jessicalessin) March 13, 2023

Credit Suisse shares fall after Kiyosaki prediction

12:46 , Megan Sheets

Shares in Credit Suisse shares fell by 5 per cent to an all-time low in early trading on Tuesday as Wall Street continues to reel from the Silicon Valley Bank (SVB) collapse.

The share drop came just after Credit Suisse - the world’s eighth largest investment bank - published an annual report revealing an $8bn loss for 2022.

The bank blamed “weaknesses” in the report on “failure to design and maintain an effective risk assessment process to identify and analyze the risk of material misstatements”.

The report was especially alarming given a prediction the night before from Robert Kiyosaki, an expert who foresaw the collapse of Lehman Brothers in 2008.

Speaking to Fox Business, Mr Kiyosaki said Credit Suisse was “most vulnerable” to following SVB into failure due to a struggling bond market.

“My prediction, I called Lehman Brothers years ago, and I think the next bank to go is Credit Suisse because the bond market is crashing,” he said.

“The bond market is much bigger than the stock market. The Fed is up and they’re the firemen and the arson.”

Republicans have a scapegoat for Silicon Valley Bank’s collapse: ‘Woke banks’

12:15 , Alex Woodward

For months, right-wing media figures and Republican elected officials have blamed a “woke” agenda for what they perceive is the collapse of American institutions, from its schools and workplaces to the banks that facilitate their businesses.

The historic failure of Silicon Valley Bank is likely the result of a host of compounded factors that have nothing to do with so-called “wokeness,” from Donald Trump-era cuts to regulations that were put in place during the last financial crisis to the bank’s untenable concentration in an explosion of venture capital firms and tech startups as it careened into reality, rising interest rates and panic.

Yet Republican lawmakers have continued to return to their catch-all scapegoat – using “woke” as an umbrella term for anything related to diversity, progressive political platforms, LGBT+ inclusivity, antiracism initiatives or environmental activism – while advancing a nationwide legislative agenda singularly devoted to its destruction.

The Independent’s Alex Woodward has more:

Republican blame ‘wokeness’ for Silicon Valley Bank’s collapse

Voices: The ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

11:45 , Megan Sheets

Eric Garcia writes:

When President Joe Biden announced on Monday that people who had deposited their money in the now-unraveled Silicon Valley Bank would have their money available, he emphasised that American taxpayers would not be left on the hook.

Similarly, he added that the people responsible at the bank would need to be fired and that investors in Silicon Valley Bank would not be made whole, arguing that they took a risk and now have to suffer the losses.

On the surface, the Silicon Valley Bank collapse, as well as the closing of Signature Bank in New York, appears quite similar to the 2008 financial crisis that took banks like AIG to the brink and led to the collapse of Lehman Brothers. At the time, Mr Biden was a sitting senator running for vice president alongside Barack Obama. Both of them, as well as their White House opponent at the time, voted for the Troubled Assets Relief Program, or TARP, which became known as the “bailout” in the popular imagination.

But there are important distinctions between 2008 and today.

Read on:

Ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

ICYMI: Biden speaks on US financial system

11:15 , Emily Atkinson

Watch: Biden speaks on US financial system following collapse of Silicon Valley Bank

Wall Street expert ‘predicts’ next bank failure after Silicon Valley

10:46 , Emily Atkinson

A Wall Street expert famed for predicting the 2008 Lehman Brothers’ failure has pegged Credit Suisse as the next major bank set for collapse.

Robert Kiyosaki divined his latest forecast just hours before the Switzerland-based bank confessed to having a “material weakness” in its internal controls over financial reporting and said it had not yet stemmed customer outflows.

Speaking on Cavuto: Coast to Coast, Mr Kiyosaki said: “The problem is the bond market, and my prediction, I called Lehman Brothers years ago, and I think the next bank to go is Credit Suisse, because the bond market is crashing.”

He explained, while holding up a bank note: “The US dollar is losing its hegemony in the world right now. So they’re going to print more and more and more of this...trying to keep this thing from sinking.”

Voices: The ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

10:30 , Emily Atkinson

Eric Garcia writes:

When President Joe Biden announced on Monday that people who had deposited their money in the now-unraveled Silicon Valley Bank would have their money available, he emphasised that American taxpayers would not be left on the hook.

Similarly, he added that the people responsible at the bank would need to be fired and that investors in Silicon Valley Bank would not be made whole, arguing that they took a risk and now have to suffer the losses.

On the surface, the Silicon Valley Bank collapse, as well as the closing of Signature Bank in New York, appears quite similar to the 2008 financial crisis that took banks like AIG to the brink and led to the collapse of Lehman Brothers. At the time, Mr Biden was a sitting senator running for vice president alongside Barack Obama. Both of them, as well as their White House opponent at the time, voted for the Troubled Assets Relief Program, or TARP, which became known as the “bailout” in the popular imagination.

But there are important distinctions between 2008 and today.

Read on:

Ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

Watch: Hunt hails ‘resilience’ as HSBC rescues Silicon Valley Bank’s UK branch

09:45 , Emily Atkinson

Jeremy Hunt hails ‘great resilience’ as HSBC rescues Silicon Valley Bank UK branch

Trump blamed for bank collapse over watering down regulations

09:00 , Oliver O'Connell

Critics looking to assign blame for the collapse of Silicon Valley Bank have found possible culprits in Donald Trump and Republican senators.

Graig Graziosi filed this report.

Trump blamed over Silicon Valley Bank collapse for cutting down financial regulations

Global bank shares slump after Silicon Valley Bank goes bust

08:15 , Emily Atkinson

Global bank shares have slumped following the collapse of Silicon Valley Bank.

On Tuesday, Japan’s Topix Banks saw its shares fall by more than 7 per cent, while Mitsubishi UFJ Financial Group’s index was down by 8.1 per cent in mid-day Asian trading.

In the UK, banks were heavily lower after steep falls on Friday, with international bank Standard Chartered sinking to the bottom of the FTSE 100 with a 6.9 per cent drop, and Barclays down by 6.3 per cent.

Other UK banks were also caught up in the rout, with Lloyds Banking Group closing 5.1 per cent lower, while NatWest was down 4.8 per cent and HSBC down 4.1 per cent.

Top European markets finished the day even more scathed than in Britain, with the German Dax tumbling more than 3 per cent and the French Cac 40 declining 2.9 per cent at close.

Why did Silicon Valley Bank collapse?

07:30 , Oliver O'Connell

The collapse of the 16th largest bank in the US sent ripples through global markets on Monday as governments and businesses scrambled to figure out what the impact would be and how it could be contained.

Silicon Valley Bank collapsed on Friday after failing to raise new capital last week.

On Monday, the UK government said that HSBC would take over the UK wing of the bank.

But what was SVB, why did it collapse, and are other banks at risk? We examine these questions here.

Read on:

Why did Silicon Valley Bank collapse and are other lenders at risk?

Central banks could ‘ease up on rate hikes’

05:45 , Oliver O'Connell

The collapse of Silicon Valley Bank could fuel pressure on central banks to ease up on interest-rate hikes, according to some finance experts.

Alice Haine, a personal finance analyst at Bestinvest, said: “The collapse of two US banks in recent days, Silicon Valley Bank and Signature Bank, is a reminder of the risks that come when central banks, like the US Federal Reserve, raise interest rates aggressively.”

Read on:

Central banks could ‘ease up on rate hikes’ after Silicon Valley Bank collapse

Biden says banking system is ‘safe’ and vows accountability for Silicon Valley Bank executives

03:45 , Oliver O'Connell

President Joe Biden reassured Americans that the nation’s banking system is safe after Silicon Valley Bank collapsed last week and said there would be accountability for financial executives.

The president’s actions come after the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corporation announced on Sunday evening that depositors for Silicon Valley Bank would have access to their money on Monday.

“No losses — and this is an important point — no losses will be borne by the taxpayers,” the president said. “Instead the money will come from the fees that banks pay into the deposit insurance fund.”

Eric Garcia reports from Washington, DC.

Biden says banking system is ‘safe’ after Silicon Valley Bank collapse

Voices: The Silicon Valley Bank collapse has made three things horrifically clear

01:45 , Oliver O'Connell

David Callaway writes:

Silicon Valley Bank is no Lehman Brothers moment.

Of that we were assured by regulators, banking executives and any number of media pundits over the weekend, who took pains to draw SVB’s collapse as an outlier. But as the shock waves spread around the world Sunday, from Wall Street and here in London to Asia, it became horrifically clear that an entire new and important asset class would now need to be protected – climate tech.

Read more:

The Silicon Valley Bank collapse has made three things horrifically clear

What you need to know about the Silicon Valley Bank collapse

00:45 , Oliver O'Connell

Two large banks that cater to the tech industry have collapsed after a bank run, government agencies are taking emergency measures to backstop the financial system, and President Joe Biden is reassuring Americans that the money they have in banks is safe.

It’s all eerily reminiscent of the financial meltdown that began with the bursting of the housing bubble 15 years ago. Yet the initial pace this time around seems even faster.

Over the last three days, the U.S. seized the two financial institutions after a bank run on Silicon Valley Bank, based in Santa Clara, California. It was the largest bank failure since Washington Mutual went under in 2008.

How did we get here? And will the steps the government unveiled over the weekend be enough?

Here are some questions and answers about what has happened and why it matters:

Silicon Valley Bank collapse: What you need to know

Over £50bn wiped off FTSE 100 amid banking stock sell-off

Monday 13 March 2023 23:45 , Oliver O'Connell

More than £50 billion has been wiped off the UK’s biggest stock market on Monday after the second and third biggest bank failures in US history spooked investors across the globe.

The collapse of tech-focused Silicon Valley Bank sparked fears across Wall Street that the banking system was being crippled by a relentless cycle of interest rate rises.

Read more:

More than £50bn wiped off FTSE 100 amid banking stock sell-off

Premium: Silicon Valley rescue saves UK tech industry – but shares in other banks plummet

Monday 13 March 2023 23:00 , Oliver O'Connell

Britain’s tech industry was saved from a crisis on Monday after HSBC rescued the UK arm of Silicon Valley Bank in a deal brokered by the government and the Bank of England.

Read more:

Silicon Valley rescue saves UK tech industry – but shares in other banks plummet

Start-ups, small businesses and online sellers despair at frozen funds

Monday 13 March 2023 22:15 , Oliver O'Connell

It’s not just large tech firms and venture capital funds caught up in the collapse of Silicon Valley Bank. There are numerous small businesses, kitchen table start-ups and side-hustle online retailers impacted by the sudden bank failure.

They range from business owners unable to pay employees to Etsy sellers worried about paying bills as online payments stalled.

Many have taken to social media to vent their frustrations.

Online retailers despair in wake of Silicon Valley Bank collapse

Voices: The ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

Monday 13 March 2023 21:45 , Oliver O'Connell

Eric Garcia writes:

When President Joe Biden announced on Monday that people who had deposited their money in the now-unraveled Silicon Valley Bank would have their money available, he emphasised that American taxpayers would not be left on the hook.

Similarly, he added that the people responsible at the bank would need to be fired and that investors in Silicon Valley Bank would not be made whole, arguing that they took a risk and now have to suffer the losses.

On the surface, the Silicon Valley Bank collapse, as well as the closing of Signature Bank in New York, appears quite similar to the 2008 financial crisis that took banks like AIG to the brink and led to the collapse of Lehman Brothers. At the time, Mr Biden was a sitting senator running for vice president alongside Barack Obama. Both of them, as well as their White House opponent at the time, voted for the Troubled Assets Relief Program, or TARP, which became known as the “bailout” in the popular imagination.

But there are important distinctions between 2008 and today.

Read on:

Ghosts of the 2008 financial crisis loom over Biden’s response to Silicon Valley Bank

Shopify CEO: ‘Very minor impact for us'

Monday 13 March 2023 21:30 , Oliver O'Connell

Tobi Lutke, CEO of e-commerce platform Shopify, shared an email sent out to merchants offering to help if their funds were frozen at Silicon Valley Bank and confirmed that the collapse of the bank had only had “very minor impact for us”.

Email we just sent to affected Shopify merchants pic.twitter.com/77MzG8F0bh

— tobi lutke (@tobi) March 12, 2023

Yahoo Finance

Yahoo Finance