Swedish Exchange Highlights: 3 Growth Companies With High Insider Ownership

As global markets exhibit mixed signals with technological sectors reaching new heights while others face downturns, the Swedish market remains a point of interest for investors looking for stability and growth potential. High insider ownership in growth companies often signals strong confidence in the company's future, making such stocks particularly noteworthy in the current economic landscape.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

BioArctic (OM:BIOA B) | 35.1% | 50.5% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

Dignitana (OM:DIGN) | 34.6% | 139% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 42.5% |

SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

We're going to check out a few of the best picks from our screener tool.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) specializes in developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of SEK 20.54 billion.

Operations: The company generates revenue through the development of biological drugs targeting central nervous system disorders.

Insider Ownership: 35.1%

BioArctic, a Swedish biopharma company, is anticipated to become profitable within three years, with expected revenue growth of 40.7% per year, significantly outpacing the market. Despite trading at 64.9% below its estimated fair value and analysts predicting a substantial price increase, insider transactions have been minimal recently. The firm's strategic collaboration with Eisai on Alzheimer's treatments like Leqembi®, which recently gained approval in South Korea, underscores its potential in pioneering significant medical advancements.

Click here to discover the nuances of BioArctic with our detailed analytical future growth report.

Upon reviewing our latest valuation report, BioArctic's share price might be too pessimistic.

Calliditas Therapeutics

Simply Wall St Growth Rating: ★★★★★★

Overview: Calliditas Therapeutics is a commercial-stage biopharmaceutical company specializing in novel treatments for orphan renal and hepatic diseases, primarily serving the U.S., Europe, and Asia, with a market cap of approximately SEK 10.86 billion.

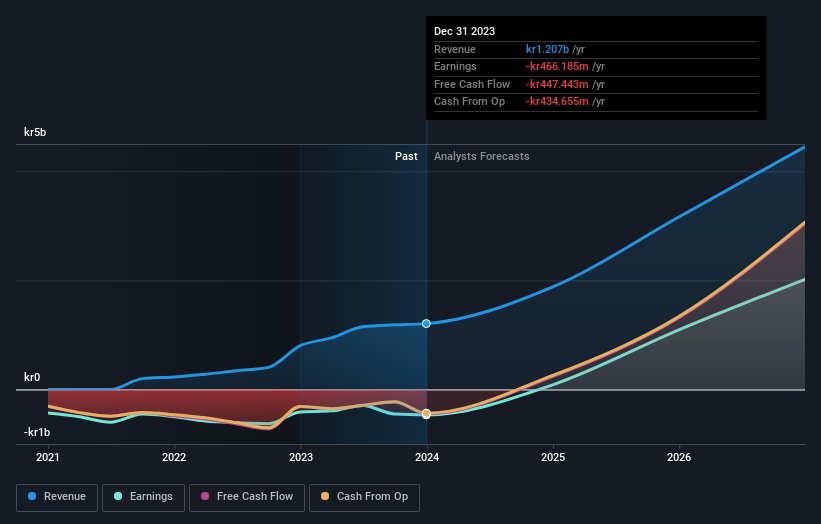

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling SEK 1.21 billion.

Insider Ownership: 11.6%

Calliditas Therapeutics, a Swedish biopharma company, is forecasted to become profitable within the next three years with expected revenue growth of 29% per year. Despite its share price volatility, the company trades at 95.9% below its estimated fair value, indicating potential undervaluation. However, there's no recent insider buying activity which could suggest caution among those closest to the company. Recently, Asahi Kasei proposed a SEK 11.2 billion acquisition of Calliditas, reflecting significant market interest and potential for future growth under new ownership.

Yubico

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.88 billion.

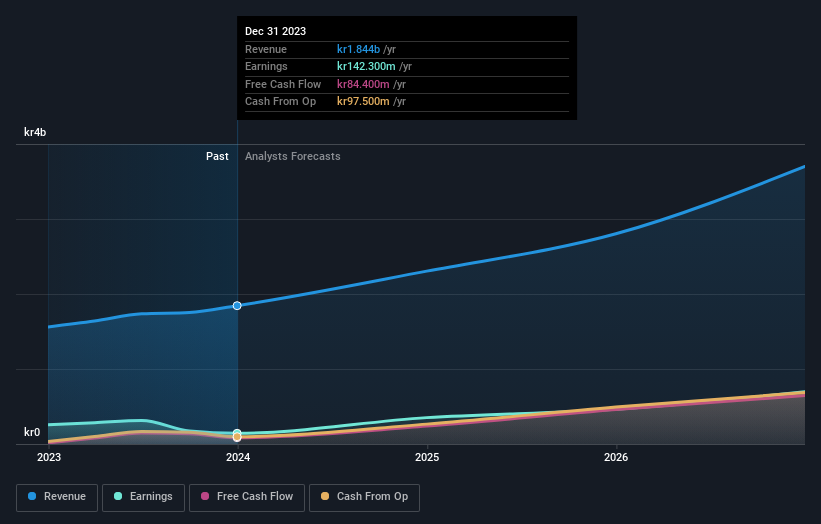

Operations: The company generates revenue primarily from its security software and services, totaling SEK 1.93 billion.

Insider Ownership: 37.5%

Yubico AB, a Swedish growth company with high insider ownership, reported a 20.4% increase in Q1 sales year-over-year, reaching SEK 504.4 million. Despite this revenue growth, net income margins declined from last year due to lower earnings per share. Recently, Yubico announced significant product updates aimed at enhancing enterprise security solutions, potentially boosting future market competitiveness. However, the company has experienced substantial shareholder dilution over the past year and has seen significant insider selling in the last quarter.

Turning Ideas Into Actions

Navigate through the entire inventory of 87 Fast Growing Swedish Companies With High Insider Ownership here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA B OM:CALTX and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com