Swedish Growth Companies With High Insider Ownership In July 2024

As global markets navigate through fluctuating economic signals, Sweden's market remains a focal point for investors looking for growth opportunities. In particular, Swedish growth companies with high insider ownership are drawing attention as they often signal strong confidence in the company's future among those who know it best.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Sileon (OM:SILEON) | 14.1% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's take a closer look at a couple of our picks from the screened companies.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

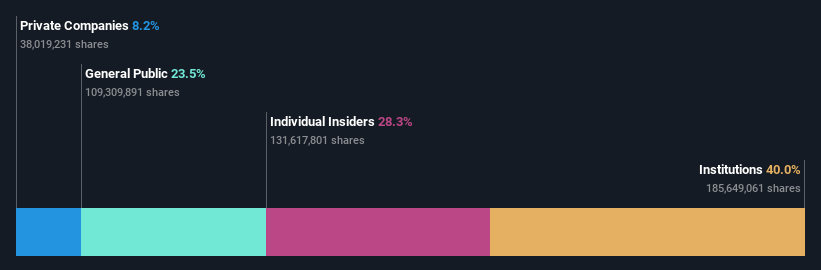

Overview: AB Sagax (publ) is a property company active in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market capitalization of approximately SEK 105.39 billion.

Operations: The company generates its revenue primarily from real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

Earnings Growth Forecast: 33.5% p.a.

AB Sagax, a Swedish property investment company, demonstrates robust growth with its recent revenue and earnings expansion. In the first quarter of 2024, Sagax reported a significant turnaround with sales increasing to SEK 1.19 billion from SEK 1.01 billion year-over-year and net income surging to SEK 1.08 billion from a loss previously. This financial uplift is supported by strategic fixed-income offerings totaling nearly €500 million aimed at enhancing green initiatives under its Green Finance Framework. However, the company's debt levels are not comfortably covered by operating cash flow, indicating potential financial stress despite high insider ownership which usually suggests confidence in long-term prospects.

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

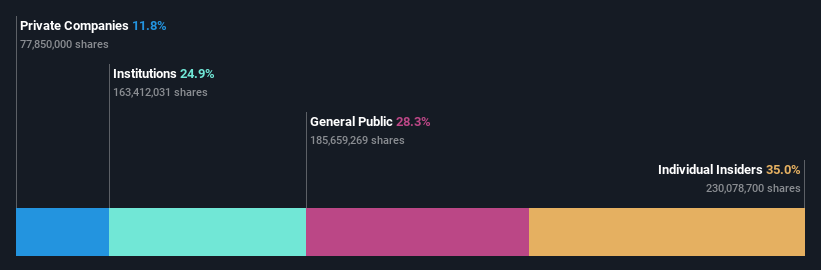

Overview: Wallenstam AB (publ) is a property company based in Sweden, with a market capitalization of approximately SEK 37.12 billion.

Operations: The company generates its revenue primarily from two key regions in Sweden: Gothenburg, which contributes SEK 1.94 billion, and Stockholm, adding SEK 0.94 billion.

Insider Ownership: 35%

Earnings Growth Forecast: 55.3% p.a.

Wallenstam AB has shown a notable recovery this year, transitioning from a net loss to generating SEK 408 million in net income over six months. Recent developments include the environmentally focused redevelopment of Kaserntorget 6, enhancing its appeal and utility. Despite high insider transactions not being substantial, the firm's projected annual earnings growth is significant at 55.3% per year, outpacing the Swedish market forecast of 14.7%. However, concerns remain about interest coverage and low forecasted return on equity in three years.

Click here to discover the nuances of Wallenstam with our detailed analytical future growth report.

The valuation report we've compiled suggests that Wallenstam's current price could be inflated.

Yubico

Simply Wall St Growth Rating: ★★★★★★

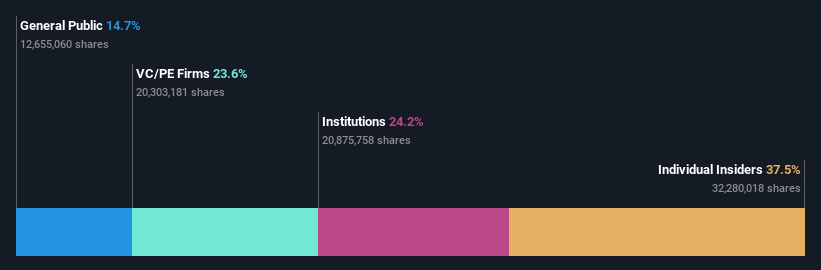

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.75 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Earnings Growth Forecast: 43.8% p.a.

Yubico AB, a Swedish growth company with high insider ownership, is experiencing robust earnings and revenue growth, with forecasts indicating significant annual increases. Despite this positive outlook, the past year has seen considerable shareholder dilution and notable insider selling. Recent product updates emphasize enhanced security features, potentially boosting market competitiveness. However, financial data availability is limited to under three years, posing challenges for long-term assessment.

Turning Ideas Into Actions

Get an in-depth perspective on all 84 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:SAGA A OM:WALL B and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance