Swedish Stocks Possibly Trading Below Fair Value In September 2024

As global markets react to the recent Federal Reserve rate cut, European indices have shown mixed performance, reflecting investor caution and varied economic outlooks. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst broader market fluctuations. When evaluating potential investments in the current climate, it is essential to consider companies with strong fundamentals that may be trading below their intrinsic value due to temporary market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sleep Cycle (OM:SLEEP) | SEK42.80 | SEK79.83 | 46.4% |

Husqvarna (OM:HUSQ B) | SEK67.10 | SEK125.14 | 46.4% |

QleanAir (OM:QAIR) | SEK25.50 | SEK50.73 | 49.7% |

Biotage (OM:BIOT) | SEK185.20 | SEK363.59 | 49.1% |

Lindab International (OM:LIAB) | SEK279.20 | SEK523.68 | 46.7% |

Securitas (OM:SECU B) | SEK130.90 | SEK258.89 | 49.4% |

Tourn International (OM:TOURN) | SEK8.56 | SEK16.47 | 48% |

MilDef Group (OM:MILDEF) | SEK84.70 | SEK160.36 | 47.2% |

Sinch (OM:SINCH) | SEK32.60 | SEK64.43 | 49.4% |

Lyko Group (OM:LYKO A) | SEK115.00 | SEK215.63 | 46.7% |

We're going to check out a few of the best picks from our screener tool.

BHG Group

Overview: BHG Group AB (publ) is a consumer e-commerce company operating in Sweden, Finland, Denmark, Norway, the rest of Europe, and internationally with a market cap of SEK2.57 billion.

Operations: The company's revenue segments are comprised of Value Home (SEK2.90 billion), Premium Living (SEK2.25 billion), and Home Improvement (SEK5.32 billion).

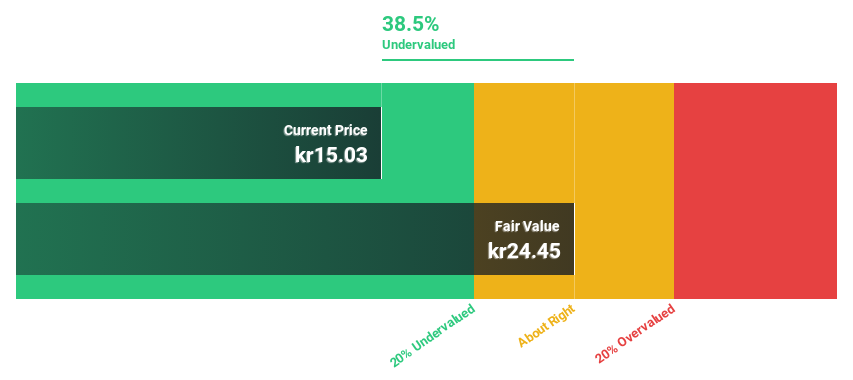

Estimated Discount To Fair Value: 46.1%

BHG Group is trading at SEK14.33, significantly below its fair value estimate of SEK26.61, indicating it may be undervalued based on cash flows. Despite recent financial challenges, including a net loss of SEK102.3 million in Q2 2024 and reduced revenue compared to the previous year, BHG is forecast to become profitable within three years with earnings expected to grow 132.75% annually. The stock's current price represents good relative value compared to peers and the industry.

CTT Systems

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.48 billion.

Operations: The company's revenue from Aerospace & Defense amounts to SEK317.70 million.

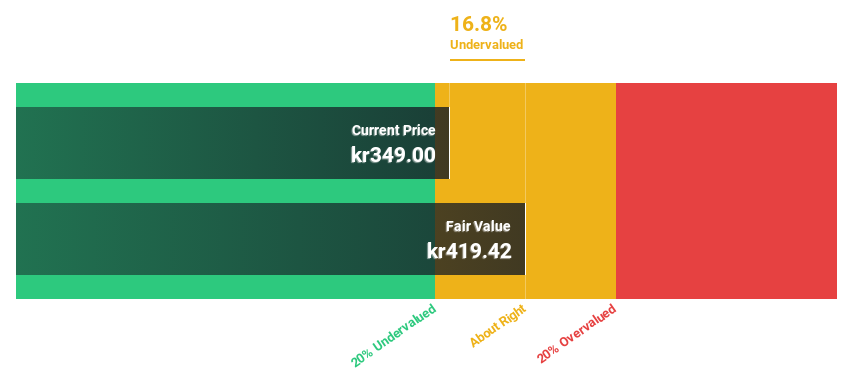

Estimated Discount To Fair Value: 43.5%

CTT Systems is trading at SEK278, significantly below its fair value estimate of SEK491.86. The company reported Q2 2024 sales of SEK83.1 million and net income of SEK24.6 million, with a positive sales guidance for the second half of 2024 (SEK160-180 million). Forecasts indicate robust annual earnings growth of 24.81% and revenue growth of 21.9%, both outpacing the Swedish market averages. Despite an unstable dividend track record, CTT’s return on equity is projected to be very high at 44.4% in three years.

Yubico

Overview: Yubico AB provides authentication solutions for computers, networks, and online services, with a market cap of SEK20.19 billion.

Operations: Yubico AB generates revenue primarily from its Security Software & Services segment, amounting to SEK2.09 billion.

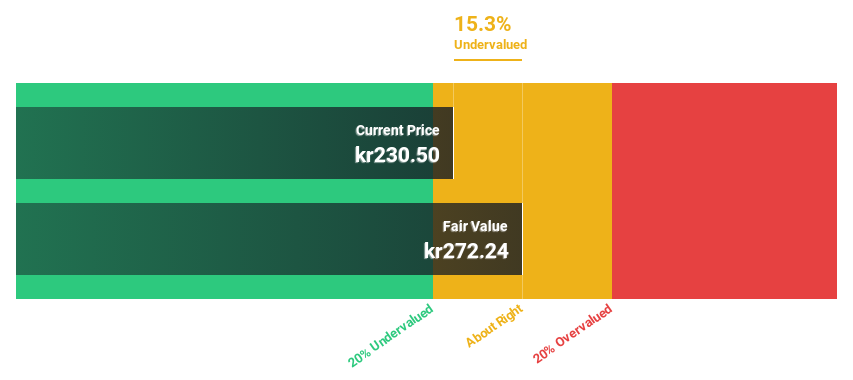

Estimated Discount To Fair Value: 16.1%

Yubico reported Q2 2024 sales of SEK614.4 million and net income of SEK103.6 million, reflecting solid growth from the previous year. The stock is trading at SEK234.5, below its estimated fair value of SEK279.59, indicating potential undervaluation based on cash flows despite recent volatility in share price. Forecasts suggest robust earnings growth of 42.35% annually over the next three years, significantly outpacing the Swedish market average and highlighting strong future revenue prospects driven by innovative product developments like MilSecure Mobile with Straxis for secure web browsing applications in defense sectors.

The growth report we've compiled suggests that Yubico's future prospects could be on the up.

Navigate through the intricacies of Yubico with our comprehensive financial health report here.

Turning Ideas Into Actions

Unlock our comprehensive list of 46 Undervalued Swedish Stocks Based On Cash Flows by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BHG OM:CTT and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com