Swiss chemicals giant Clariant plans to cut 1,000 jobs

Clariant (CLN.SW) said it was planning to cut around 1,000 jobs as it looks to “adapt and refocus” the company after two major divestments.

This includes the divestments of two of its businesses, Healthcare Packaging in October 2019 and Masterbatches in July 2020, plus the expected divestment of a third business, Pigments.

The company said “it plans to rightsize regional organisations and service units in order to avoid remnant cost, thereby reducing complexity and increasing agility post the expiration of transitory service agreements following the closing of the divestitures.”

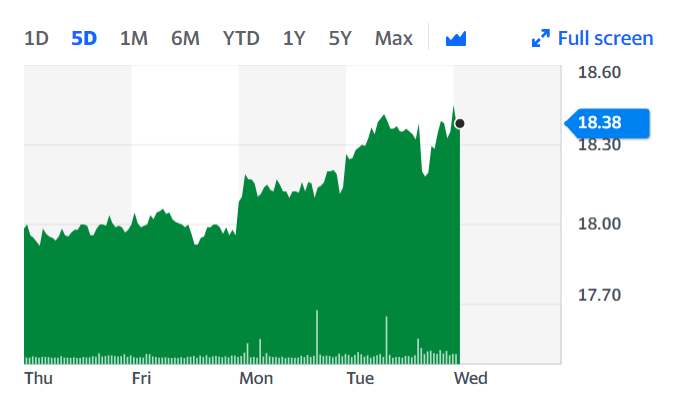

Shares moved slightly into positive territory in the early hours of trading on Wednesday on the news:

It added that “the rightsizing program foresees a reduction of approximately 1,000 positions in service and regional structures. Approximately one third of the reductions will be included in the divestment transfers.”

It explained that it has “decided to make a provision in the magnitude of CHF 70 million ($76.7m, £57.5m) in discontinued operations in Q4 of 2020 for the rightsizing program.”

The timeline for these measures will extend over a maximum of two years.

A previously announced efficiency program is already being implemented to cut around 600 positions and realize CHF 50 million cost base savings. It will be completed by the end of next year.

“By avoiding remnant cost and consequently reducing complexity, putting an even stronger focus on innovation, sustainability and operational excellence, we put our company’s high value specialty businesses in a position to operate in an even more focused and agile manner,” said Hariolf Kottmann, executive chairman ad interim of Clariant.

“This will help us deliver above-market growth, higher profitability and stronger cash generation,” he added.

WATCH: Why job losses are rising despite the economy reopening

Yahoo Finance

Yahoo Finance