Swiss Dividend Stocks To Consider In July 2024

Despite a generally positive trading day, the Swiss market closed slightly lower last Friday, reflecting investor caution as they processed regional inflation data and U.S. economic reports. The benchmark SMI index experienced modest fluctuations but ultimately recorded a slight decline amid mixed performances across major stocks. In such an environment, dividend stocks can be particularly appealing for their potential to offer steady returns amidst market volatility.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.58% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.22% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.24% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.39% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.35% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.85% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.18% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.19% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

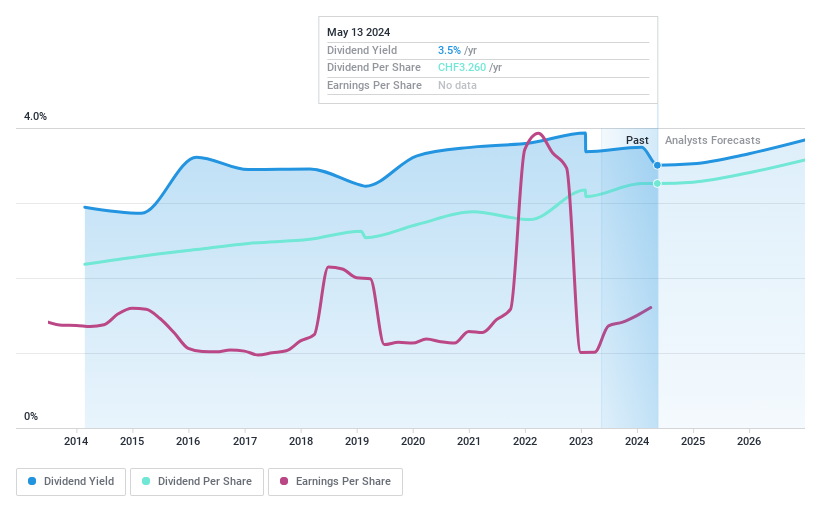

Novartis

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Novartis AG is a global healthcare company based in Switzerland, specializing in the research, development, manufacturing, and marketing of a wide range of healthcare products, with a market capitalization of approximately CHF 196.23 billion.

Operations: Novartis AG generates $47.73 billion in revenue from its Innovative Medicines segment.

Dividend Yield: 3.4%

Novartis, a notable player in the Swiss dividend stock arena, offers a stable dividend yield of 3.35%, supported by a payout ratio of 88.7% and cash flow coverage at 60.7%. While its dividend yield is below the top quartile for Swiss stocks, its consistent payments over the past decade underscore reliability. Recent announcements include promising trial results for Fabhalta in treating rare kidney disease, potentially boosting future earnings stability and supporting ongoing dividends despite trading at 56.2% below estimated fair value as of Q1 2024.

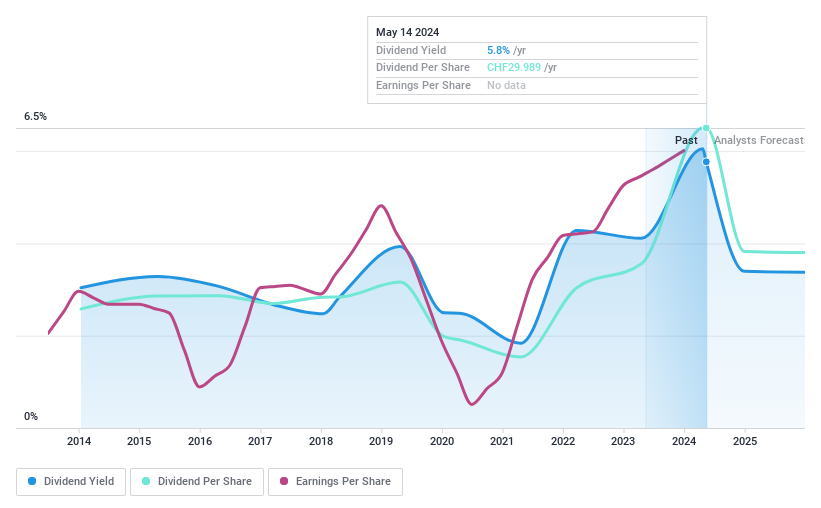

Phoenix Mecano

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Phoenix Mecano AG is a global manufacturer and seller of components for industrial customers, with a market capitalization of approximately CHF 455.56 million.

Operations: Phoenix Mecano's revenue is primarily derived from three segments: Enclosure Systems (€231.16 million), Industrial Components (€223.58 million), and Dewertokin Technology Group (€335.80 million).

Dividend Yield: 6.1%

Phoenix Mecano AG recently increased its ordinary dividend to CHF 18.00 and announced a special dividend of CHF 12.00, totaling a gross payout of CHF 30.00 per share effective from May 30, 2024. Despite these increases, the company's dividends have shown volatility and unreliability over the past decade with significant annual fluctuations exceeding 20%. However, both earnings and cash flows currently support these dividends, with a payout ratio of 68.4% and cash payout ratio at 58.1%. The firm's financial performance improved in the past year with earnings up by 14.1%, yet future growth is projected modestly at around 1.71% annually.

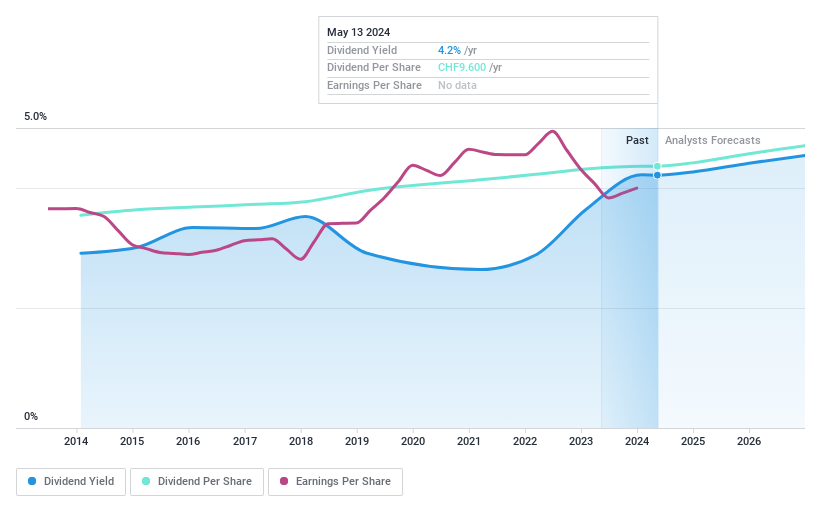

Roche Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Roche Holding AG operates in the pharmaceuticals and diagnostics sectors across multiple global regions, with a market capitalization of approximately CHF 201.50 billion.

Operations: Roche Holding AG generates CHF 44.43 billion from its Roche Pharmaceuticals segment and CHF 7.20 billion from its Chugai Pharmaceuticals segment, alongside CHF 14.16 billion in revenue from its Diagnostics division.

Dividend Yield: 3.8%

Roche Holding's dividend attractiveness is moderate with a yield of 3.85%, slightly below the top quartile in the Swiss market. Over the past decade, dividends have shown stability and growth, supported by a payout ratio of 66.7% from earnings and cash flows alike. Despite trading at 64.1% below its estimated fair value and aligning well against industry peers, Roche carries a high debt level which could influence future dividend sustainability. Recent approvals for OCREVUS in new formats highlight ongoing innovation but are not directly tied to immediate financial metrics influencing dividends.

Get an in-depth perspective on Roche Holding's performance by reading our dividend report here.

Our valuation report unveils the possibility Roche Holding's shares may be trading at a discount.

Turning Ideas Into Actions

Take a closer look at our Top Dividend Stocks list of 26 companies by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:NOVNSWX:PMN and SWX:ROG

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance