Syndax (SNDX) Gets FDA Priority Tag for Leukemia Drug NDA

Syndax Pharmaceuticals SNDX stock rose 7.6% on Mar 27 after it announced a day before that the FDA had granted a priority review to its new drug application (NDA) for pipeline candidate revumenib. The NDA seeks approval of revumenib, a first-in-class menin inhibitor, for the treatment of patients with relapsed/refractory acute leukemia harboring a KMT2A rearrangement.

The FDA’s targeted action date is Sep 26, 2024. The NDA filing is being reviewed under the FDA's Real-Time Oncology Review Program (RTOR).The RTOR program facilitates efficient engagement between sponsors and the FDA, historically leading to expedited approvals.

The NDA was based on data from the AUGMENT-101 study.At the protocol-defined interim analysis, the study met its primary endpoint with a notable complete remission (CR) or a CR with partial hematological recovery (CRh) rate of 23% among the 57 efficacy evaluable patients in the pooled KMT2Ar acute leukemia population.

Moreover, the data revealed a significant correlation between treatment response and minimal residual disease (MRD) status, with 70% of patients achieving CR/CRh also demonstrating MRD negativity. Furthermore, the study demonstrated an overall response rate of 63% among efficacy-evaluable patients, further solidifying revumenib's efficacy across a broad spectrum of KMT2Ar acute leukemias.

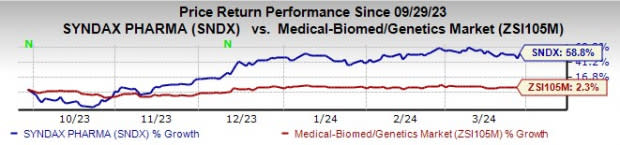

Syndax Pharmaceuticals’ stock has risen 58.8% in the past six months compared with an increase of 2.3% for the industry.

Image Source: Zacks Investment Research

Syndax Pharmaceuticals is on track to get FDA approval for its two best-in-class drugs in 2024.

Syndax's another key candidate, axatilimab, an anti-colony stimulating factor 1 receptor (CSF-1R) antibody, is also under FDA priority review for treating chronic graft-versus-host disease (GVHD) after failure of at least two prior lines of systemic therapy. The FDA has accepted Syndax's biologics license application (BLA) filing for axatilimab and granted priority review to the BLA, with a decision expected on Aug 28, 2024.

Zacks Rank and Stocks to Consider

Syndax Pharmaceuticals currently has a Zacks Rank #3 (Hold).

Syndax Pharmaceuticals, Inc. Price and Consensus

Syndax Pharmaceuticals, Inc. price-consensus-chart | Syndax Pharmaceuticals, Inc. Quote

Some top-ranked stocks in the healthcare sector are Vanda Pharmaceuticals VNDA, ADMA Biologics ADMA and MorphoSys MOR, sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, 2024 estimates for Vanda Pharmaceuticals have improved from a loss of 46 cents to earnings of 1 cent. For 2025, loss estimates have narrowed from 94 cents to 48 cents per share in the past 60 days. In the past year, shares of VNDA have declined 43.3%.

Vanda Pharmaceuticals delivered a three-quarter average earnings surprise of 92.88%.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Estimates for 2025 have increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 106.4%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

In the past 60 days, estimates for MorphoSys’ 2024 loss per share have narrowed from $2.26 to $2.08. Estimates for 2025 have narrowed from a loss of $1.09 per share to a loss of 89 cents per share. In the past year, shares of MOR have risen 341.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

MorphoSys AG Unsponsored ADR (MOR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance