Synovus (SNV) to Sell RWA & Reposition Securities Portfolio

Synovus Financial Corp. SNV plans to reduce risk-weighted assets by $2-$2.4 billion in second-quarter 2024 after completing a risk-weighted asset (“RWA”) optimization analysis of its loan portfolio.

The analysis included segments like securitization finance, multifamily mortgage, government lending and residential mortgage. This will result in a marginal increase in its common equity tier 1 (CET1) ratio of 40-50 basis points, offering it higher flexibility for incremental capital deployment.

The bank will also reposition a portion of its $11-billion securities portfolio in May. It anticipates selling available-for-sale securities with a book value of $1.6 billion. This will result in a pretax loss of $275 million. Sale proceeds will be redeployed in other high-quality liquid assets.

This will improve net interest income and the net interest margin (NIM) profile in the upcoming period, with an estimated earn-back period of about five years. The company expects NIM to be relatively stable in second-quarter 2024 and move higher in the second half of 2024, aided by fixed-rate asset repricing and the benefit of hedge maturities. The company estimated NIM to be 3.15-3.20% (excluding the securities repositioning) for 2024.

Moreover, post the securities repositioning, Synovus expects to operate at the upper end of its targeted CET1 ratio of 10-10.5%.

These strategic efforts aside, the company has provided updates on its deposits. It noted that interest-bearing core deposit cost was stable in April. The company expects deposit growth to be weighted in the second half of 2024.

Markedly, Synovus is focused on its organic growth strategy. The company aims to expand its Corporate and Investment Banking, as well as Middle Market Commercial Banking verticals. Its continued loan and deposit growth over the past few years has been supported by its relationship banking model. Net loans witnessed a compound annual growth rate (CAGR) of 4% in the last four years (2019-2023). In addition, total deposits saw a CAGR of 7.2% over the same time frame, backed by continued growth in core transaction deposit accounts. While loans declined in first-quarter 2024, deposits improved.

Synovus’ deposits are well-diversified across industries and geographies in strong Southeast growth markets. Also, the company’s floating-rate loan portfolio is well-positioned in the current high-interest-rate regime.

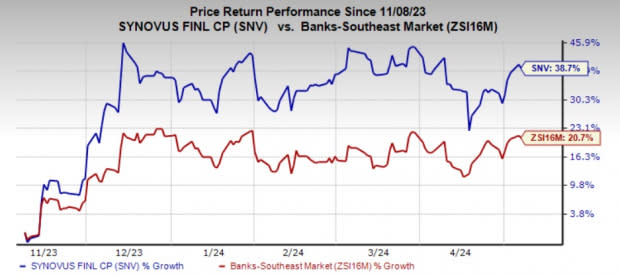

Over the past year, SNV shares have gained 38.7%, outperforming the industry’s rally of 20.7%.

Image Source: Zacks Investment Research

Currently, SNV carries a Zacks Rank #3 (Hold).

Recently, Truist Financial TFC undertook a strategic balance sheet repositioning step for part of its available-for-sale investment securities portfolio. TFC sold $27.7 billion worth of lower-yielding investment securities, which had a book value of $34.4 billion.

Including the tax benefit, the balance sheet repositioning generated $29.3 billion available for reinvestment. Hence, this led to an after-tax loss of $5.1 billion.

A better-ranked bank is Wells Fargo WFC. The company presently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

WFC’s earnings estimates for 2024 have been revised marginally upward in the past week. Shares of Wells Fargo have jumped 49.2% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Synovus Financial Corp. (SNV) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance