AT&T (NYSE:T) looks Undervalued but Uncertainty Could lead to Further Downside

This article originally appeared on Simply Wall St News.

Shares of AT&T Inc . ( NYSE:T ) have been under pressure for the last few days, along with other telecom stocks. The sector has been under pressure since Barclays cut price targets for AT&T and Verizon ( NYSE:VZ ). In AT&T’s case, the stock is also trading ex-dividend (as of last Friday), with a dividend cut on the horizon. Once shareholders were due the latest dividend, there was less reason to hold onto their shares. The results of the latest selloff is that the stock trading is at levels last seen in July 2010.

AT&T has been a long time underperformer, but investors have stuck by the stock for its very generous dividends. But the dividend is set to be cut when the spin-off of Warner Media and Discovery is completed next year. In June, AT&T’s CFO Pascal Desroches said that once the deal was completed, the remaining entity will have a dividend payout ratio of 40 to 43% , compared to the current ratio of 64.5%.

So, does the lower stock price make up for the prospect of a lower yield?

Check out our latest analysis for AT&T

What's the opportunity in AT&T?

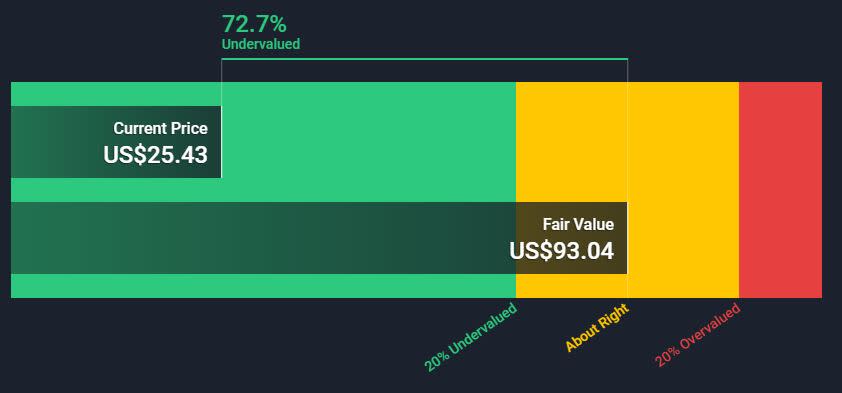

The above graphic illustrates our estimate of AT&T’s fair value based on expected future cash flows. This estimate is calculated using the 2-stage free cash flow to equity model (you can view the calculation here ) so it’s sensitive to changes in analyst forecasts. On the face of it, it appears the stock is trading at a considerable discount.

What kind of growth will AT&T generate?

As you can see, analysts are expecting a full rebound in earnings per share by the end of this year, and for EPS to then increase gradually over the next few years. If this happens, the current share price would probably look cheap in hindsight.

But there are a few issues that could affect both the valuation and sentiment in the next 12 months:

AT&T plans to merge WarnerMedia and Discovery ( Nasdaq:DISCA ) and spin off the combined entity to its shareholders. There is uncertainty about exactly what shareholders will receive in this deal, and Discovery’s share price has already fallen 30% since the deal was announced.

The company has a very high level of debt (the debt to equity ratio is 100%), and it’s not entirely certain where all the debts will end up after the assets are spun off.

The idea is for AT&T to focus on 5G and broadband going forward. But there isn’t a compelling growth strategy and the execution over the last 10 years has been poor.

The prospect of rising interest rates would make the lower dividend yield less attractive than other assets.

AT&T will still generate a lot of cash in the next few years and the reduced dividend yield will still be more attractive than most other shares. But the growth prospects don’t look exciting, and there’s a reasonable chance current shareholders will continue selling their stock, or sell as soon as they receive their WarnerMedia/Discovery shares. Of course, in time this may create an even better opportunity for value investors.

To stay up to date with AT&T’s financials (along with at least one risk not covered here) check out our latest analysis for AT&T ..

If you are no longer interested in AT&T, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance