AT&T Is Rising From Missteps

AT&T Inc. (NYSE:T) is striving for a recovery following a period of underperformance, a situation brought on by challenges and missteps in executing its core business strategy.

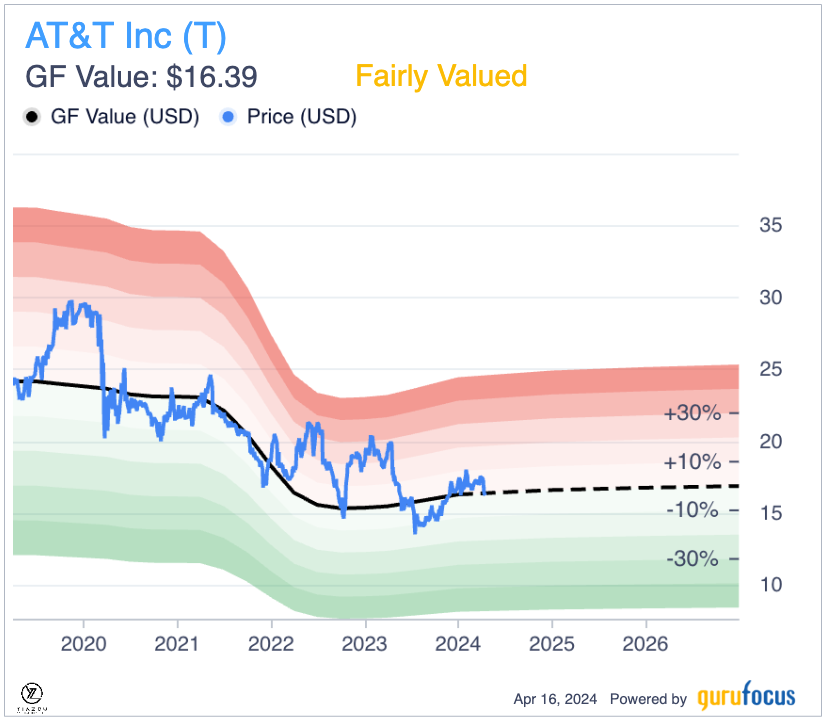

Since the pandemic started, the stock has been stuck in a downtrend, shedding nearly 50% in market value before it bottomed in 2023.

Investors shunned the stock, and short sellers continued to push it lower as the wireless company struggled to integrate some of its most expensive media acquisitions, including the $85 billion Time Warner and DirecTV businesses.

While the company did receive a reprieve as it abandoned its media ambitions, struggles in the core wireless business amid stiff competition left the stock susceptible to soaring selling pressure.

Nevertheless, amid global challenges, this telecom leader has soared in subscriber growth and financial strength thanks to its focus on innovation and strategic investments.

Explore how AT&T is not just recovering but excelling, setting the stage for a future where connectivity and customer satisfaction are paramount.

Wireless win: Surging ahead with subscriber growth and 5G expansion

The upward momentum has been supported by growing optimism that AT&T's wireless business is doing much better than initially feared. The bounceback in its market comes from significant gains in the company's wireless business.

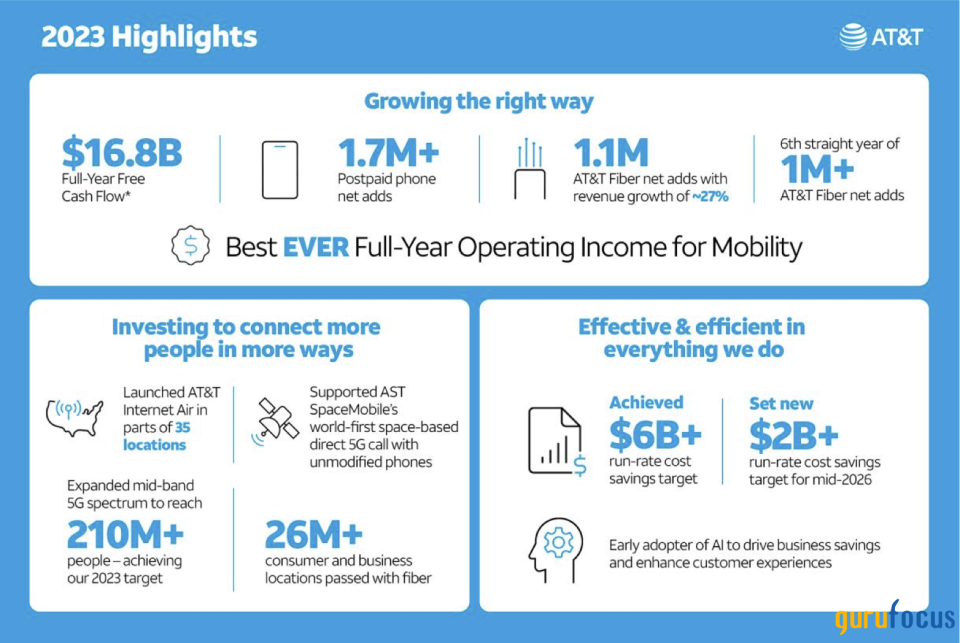

The company has been posting gains in subscribers signed up for its wireless plans. Specifically, AT&T recorded 526,000 postpaid net subscriber ads in the fourth quarter and 1.70 million for the entire year, much better than the 499,000 phone contract subscribers at Verizon (NYSE:VZ) for the same period.

Subscriber growth was primarily driven by attractive promotions and phone upgrades, affirming AT&T's ability to attract and retain customers. Thus, the growth in postpaid phone net subscribers underlies the company's commitment to offering cutting-edge technology and connectivity.

Source: AT&T

In addition, the company recorded 273,000 AT&T fiber net ads in the fourth quarter and 1.1 million net ads for the year, marking a sixth consecutive year of 1 million or more fiber net ads. AT&T has succeeded in fending off the competition and attracting more subscribers by enhancing its wireless network in North America.

Expanding its 5G network and mid-band 5G spectrum, which covers over 250 million people, has also helped strengthen its competitive edge in the sector. The fiber network buildup is also progressing as planned, reaching 26 million by the end of last year. Hence, the telecommunications giant remains on track to reach 30 million by 2025, strengthening its revenue base further.

Consequently, AT&T ended 2023 with 71.30 million net postpaid phone subscribers in its 5G and fiber network, an improvement from 69.60 million as of the end of 2022. Similarly, fiber subscribers also increased to 8.30 million from 7.20 million.

Finally, it turned out to be one of the best years for the company as it recorded one of the lowest churn levels that helped support a string of average revenue per user growth. The postpaid churn level fell by 1.010%, consistent with the year-ago quarter. Therefore, the revenue the company generates from postpaid phones only increased by 1.40% to $56.23 per user due to higher-priced unlimited plans and decisive pricing actions.

Quarterly earnings soar with substantial subscriber gains and revenue surge

Based on the solid subscriber gains, AT&T delivered better-than-expected fourth-quarter results that indicate it is firing on all cylinders in its wireless business. The telecommunication giant delivered impressive results, characterized by solid revenue growth and remarkable subscriber gain numbers.

For the quarter, revenue increased 2.20% year over year to $32 billion, well above consensus estimates of $31.50 billion and above $31.3 billion delivered the same quarter a year ago. The increase was driven mainly by strong growth in mobility revenues, up 4.10% to $22.4 billion, as wireless services revenue increased by 3.90% to $16 billion.

Revenue for the full year grew 1.40% to $122.40 billion, driven by higher sales from mobility, which was above guidance. Additionally, the company's consumer broadband revenue increased 8.10%, which was above the guidance driven by solid growth in AT&T fiber revenue growth of 26.60%.

Amid the robust revenue growth, AT&T achieved what it set out to accomplish: delivering sustainable growth and consistent business performance. Operating expenses shrank by nearly half to $26.80 billion versus $52.40 billion delivered a year ago. The decrease can be attributed to, among other things, continued transformation efforts, including lower personnel costs. As a result, the telecom giant achieved $6 billion in run-rate cost savings and will reach $2 billion in cost savings by mid-2026.

In the end, AT&T delivered income from continuing operations of $2.60 billion versus a loss of $23.10 billion delivered a year ago. Earnings per share stood at 30 cents versus $3.20 delivered a year ago. Consequently, the company achieved $16.8 billion in free cash flow for the year, exceeding the previous guidance and up $2.6 billion from the prior year.

Looking forward, the 2024 outlook further indicates AT&T is in a robust growth phase after years of underperformance. The company expects wireless service revenue to increase by 3%, while broadband revenue is projected to grow by 7%. It is also planning a capital investment of between $21 billion and $22 billion to bolster the growth metrics, which should lead to free cash flow of between $17 billion and $18 billion with adjusted earnings of between $2.15 and $2.25 per share.

Innovations and investments drive 5G and fiber Growth

AT&T's solid fourth-quarter and full-year financial results come from it actively expanding its business with innovations and investments.

The telecommunications giant continuously expands its wireless and 5G networks, consequently helping fuel substantial subscriber growth. Investments in 5G and fiber connectivity have led to solid and profitable customer relationships while increasing efficiency and robust business performance.

The company also increases its fiber network capabilities and supports initiatives in the broadband and technology sectors. The enhanced financial outlook underlines a sustainable long-term growth and value creation strategy.

According to the tech expert and security analyst Kelly Indah, the company has strengthened its market position in telecommunications through strategic network expansions and innovative offerings like AT&T Internet Air, leading to a 3.3% increase in postpaid subscribers and significant growth in reseller and connected devices segments.

Therefore, these efforts, along with a robust addition of fiber and 5G subscribers, have not only catered to the high demand for advanced services, but also solidified its competitive edge.

From market lows to soaring highs

AT&T plunged from highs of $29 a share as the pandemic started in 2020 to record lows of about $13 a share in 2022. While the stock did bounce back in early 2023, recouping a significant chunk of the losses, it plunged further as the Federal Reserve embarked on aggressive monetary policy tightening to tame runaway inflation, consequently affecting consumer purchasing power on its wireless plans.

The company's valuation has improved significantly as solid wireless subscriber gains and growth in the fiber internet business continue to boost free cash flow. Since the stock bottomed out in July last year, it has rallied by about 21% and there is still room for growth to the upside as the shares are trading below the $20 level.

If the stock were to rally to about $21 a share, considering the updated guidance of free cash flow between $17 billion and $18 billion, the stock would have a price-to-free cash flow ratio of 8.60. That is still on the low end of its historical level of 14, affirming the stock is trading at discounted levels.

Additionally, the company's $1.11 per share annual payout on dividends and a dividend yield of 6.80% further strengthen its sentiments regarding generating passive income. Hence, AT&T is a solid dividend-paying play, given that its payout is 5 times more than that of the S&P 500 average.

Bottom line

AT&T is enjoying the benefits of innovation and investments, allowing it to expand its subscriber base and deliver strong financial results. The company's bounce back to profitability underlines improved operational efficiency, especially in cost management. Likewise, increased free cash flow growth and forecasts highlight its commitment to long-term growth and value creation.

Finally, the strategic positioning in 5G fiber connectivity services should support AT&T's subscription base growth. Hence, the pessimism weighing on the stock is slowly dissipating, signaling it should continue soaring as long as it maintains solid growth rates in its wireless and fiber internet businesses.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance