T. Rowe Price (TROW) to Post Q4 Earnings: Is a Beat in Store?

T. Rowe Price Group, Inc. TROW is anticipated to report fourth-quarter and 2021 results, before the opening bell on Jan 27. TROW’s revenues and earnings are projected to indicate increases from the respective year-ago reported figures.

In the last reported quarter, T. Rowe Price’s earnings outpaced the Zacks Consensus Estimate on higher assets under management (AUM) and investment advisory fees. However, escalating expenses were an undermining factor.

T. Rowe Price has an impressive surprise history. Earnings outpaced estimates in three of the trailing four quarters, missing the mark in one, the average surprise being 3.21%.

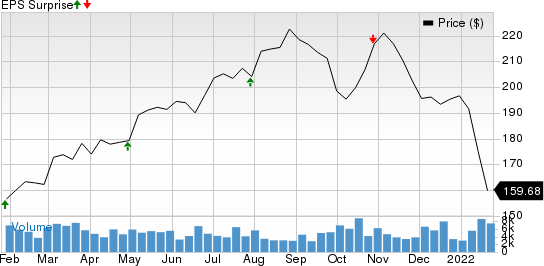

T. Rowe Price Group, Inc. Price and EPS Surprise

T. Rowe Price Group, Inc. price-eps-surprise | T. Rowe Price Group, Inc. Quote

TROW’s activities during the quarter were adequate to gain analysts’ confidence. The Zacks Consensus Estimate of $3.08 for fourth-quarter earnings has moved north marginally over the past 30 days. It indicates a rise of 6.6% from the year-ago quarter’s reported figure. Also, the Zacks Consensus Estimate of $1.94 billion for revenues suggests an 11.8% rise from the prior-year quarter’s reported number.

Key Development During The Quarter

To expand its ambit into the alternative investment markets, T. Rowe Price acquired a domineering alternative credit manager OHA in December 2021. The move complemented TROW’s current global platform and the ongoing strategic investments in its distribution competencies as well as its core investments. The cash-and-stock transaction, valued at $4.2 billion, was announced in October 2021.

Factors at Play

Overall Outflows Likely: T. Rowe Price reported a preliminary month-end AUM of $1.69 trillion as of Dec 31, 2021. The same is likely to have witnessed net outflows on a combined basis, having recorded modest inflows in fixed income products, partly offset by outflows in equities during the to-be-reported quarter. TROW’s results are likely to reflect a decrease in AUM due to overall outflows and modest client activities.

Revenue Growth: T. Rowe Price’s efforts to improve its operating efficiency have resulted in year-over-year top-line growth over the past few years. We believe, TROW is well poised to sustain this encouraging uptrend in the fourth quarter as well.

This comes on the back of several planned initiatives, largely tied with launching investment strategies and vehicles, enhancing client-engagement capabilities in each distribution channel, strengthening distribution channel in the United States, EMEA and the Asia Pacific, and boosting T. Rowe Price’s

technology platform.

Rising Expenses: The bank incurs significant expenditures to attract new investment advisory clients and additional investments from its existing clients.

Management projects 2021 non-GAAP operating expense growth of 13-15% from the previously envisioned 12-15%. This excludes the impact of expenses related to the OHA buyout but includes the impact of TROW's expanded partnership with Fidelity. Therefore, the quarterly results might reflect the impact of such projections. Such a rise in expenses might have affected the bottom-line expansion in the December quarter.

Here is what our quantitative model predicts:

T. Rowe Price has the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: T. Rowe Price has an Earnings ESP of +0.54%.

Zacks Rank: T. Rowe Price currently carries a Zacks Rank of 3.

Other Stocks That Warrant a Look

A few other finance stocks worth considering with the right combination of elements to beat on earnings in their upcoming releases per our model, are Franklin Resources BEN, Ameriprise Financial AMP and Prosperity Bancshares PB.

Franklin has an Earnings ESP of +0.11% and a Zacks Rank of 3 at present. BEN is scheduled to report quarterly numbers on Feb 1.

Ameriprise Financial is slated to report quarterly results on Jan 26. AMP currently has an Earnings ESP of +0.69% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Prosperity Bancshares is slated to report quarterly earnings on Jan 26. PB, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +0.55%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance