T. Rowe Price (TROW) Q4 Earnings Impressive, Revenues Up

T. Rowe Price Group, Inc. TROW reported a positive earnings surprise of 3.05% in fourth-quarter 2019. Adjusted earnings per share came in at $2.03, outpacing the Zacks Consensus Estimate of $1.97. The reported figure also improved 31.8% from the year-ago figure of $1.54.

Results were driven by higher assets under management (AUM) and revenues. However, escalating expenses were an undermining factor.

Including certain non-recurring items, net income came in at $545.3 million or $2.24 per share compared with the $351.9 million or $1.41 per share recorded in the prior-year quarter.

For full-year 2019, the company reported adjusted net income of $1.98 billion or $8.07 per share as against the year-ago income of $1.81 billion or $7.15 per share. The bottom line beat the Zacks Consensus Estimate of $8.03.

Revenues Improve, Expenses Flare Up

For full-year 2019, net revenues came in at $5.6 billion, up 4.6% year over year. This upside was primarily driven by an increase in investment advisory fees. Moreover, net revenues came almost in line with the Zacks Consensus Estimate.

Net revenues in the fourth quarter increased 12.5% to $1.47 billion from the year-ago quarter. This upswing primarily resulted from higher investment advisory fees, along with elevated administrative, distribution and servicing fees. The net revenue figure also outpaced the Zacks Consensus Estimate of $1.45 billion.

Investment advisory fees climbed 13.6% year over year. Also, administrative, distribution and servicing fees escalated 2.2% year over year to $124 million.

Investment advisory revenues earned from T. Rowe Price mutual funds, distributed in the United States, were up 9.4% year over year to $894.9 million. Investment advisory revenues earned from other investment portfolios, managed by the company, increased 23% from the prior-year quarter to $449.8 million.

Total adjusted operating expenses flared up 8.7% year over year to $863.5 million in the reported quarter. Rise in headcount, continued strategic investments and elevated bonus and stock-based compensation expense mainly resulted in this upsurge. Including certain one-time items, expenses were $888.4 million, up 16.5%.

As of Dec 31, 2019, T. Rowe Price employed 7,365 associates, around 4.9% higher than the last year.

Strong Assets Position

As of Dec 31, 2019, total AUM climbed 25.4% year over year to $1.21 trillion. During the October-December quarter, net market appreciation and income, came in at $79.4 billion, while net cash inflow was $2.8 billion after client transfers.

T. Rowe Price remains debt free with substantial liquidity, including cash and sponsored portfolio investment holdings of about $5.6 billion as of Dec 31, 2019, which enable the company to keep on investing.

Capital-Deployment Activity

During 2019, T. Rowe Price repurchased 7 million shares of its common stock for $708.8 million and at an average cost of $101.65 and invested $204.6 million in capitalized technology and facilities using available cash balances.

During the reported quarter, T. Rowe Price repurchased 1.3 million shares of its common stock for $142 million at an average cost of $110.89.

For 2020, the company projects capital expenditures at approximately $210 million, comprising three-fourth for technology development.

Outlook

T. Rowe Price expects full-year 2020 non-GAAP operating expense growth of 6-9%. This guidance reflects continued investments in the business and technology, cost optimization efforts and concluding part of the phased implementation of making payments to all third-party investment research.

Our Viewpoint

T. Rowe Price witnessed an impressive quarter on stellar revenues. The company’s financial stability has the potential to benefit from growth opportunities in domestic and global AUM. The company’s debt-free position, higher return on earnings and improvement in investor sentiment, as a whole, make us confident of its robust fundamentals. Furthermore, a relatively better mutual fund performance is a positive.

Nonetheless, higher operating expenses are a concern.

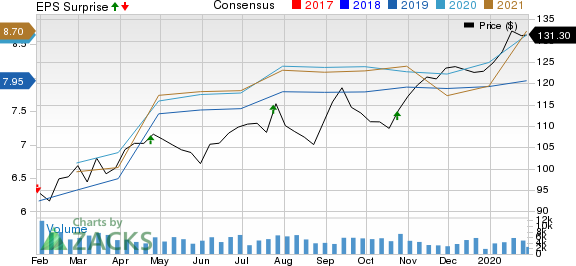

T. Rowe Price Group, Inc. Price, Consensus and EPS Surprise

T. Rowe Price Group, Inc. price-consensus-eps-surprise-chart | T. Rowe Price Group, Inc. Quote

Currently, T. Rowe Price carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other investment managers, BlackRock, Inc.’s BLK fourth-quarter 2019 adjusted earnings of $8.34 per share surpassed the Zacks Consensus Estimate of $7.67. Moreover, the figure was 37.2% higher than the year-ago quarter’s number. Results benefited from an improvement in revenues. Moreover, growth in AUM, driven by net inflows, was a positive. However, higher expenses hurt results to some extent.

Cohen & Steers’ CNS fourth-quarter 2019 adjusted earnings of 74 cents per share surpassed the Zacks Consensus Estimate of 67 cents. Also, the bottom line came in 32.1% higher than the year-ago quarter figure. Results benefited from an improvement in AUM and higher revenues. However, rise in expenses was a headwind.

Franklin Resources, Inc. BEN will release quarterly numbers on Jan 30.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance