Tactics and Analysis, July 20, 2017 – Pound Support Being Tested

The Pound will experience a fast and volatile trading day as it stands in the shadow of the European Central Bank’s monetary policy outlook. The Pound has seen early downside pressure against the U.S Dollar and traders may look for upside potential. Risk management is crucial today.

Pound Will Face Volatility Today

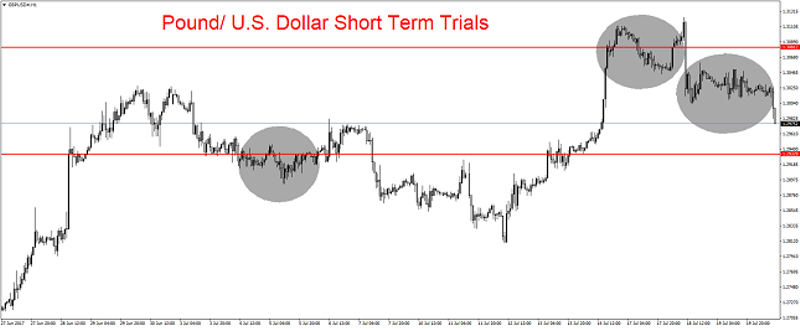

The Pound has come under pressure early today and has traded below the important 1.30 juncture against the U.S Dollar short-term.

Because of volatile sentiment in forex as the European Central Bank’s rhetoric is absorbed, traders should expect speculation for the Pound and U.S Dollar to be quite strong today.

Traders will need to be ready for volatile conditions over the next few hours as support and resistance levels are bound to see a wild ride. The 1.29 to 1.31 range for the Pound and U.S Dollar could see a whirlwind of results. Risk management is essential short term.

More Tests to Come for Pound

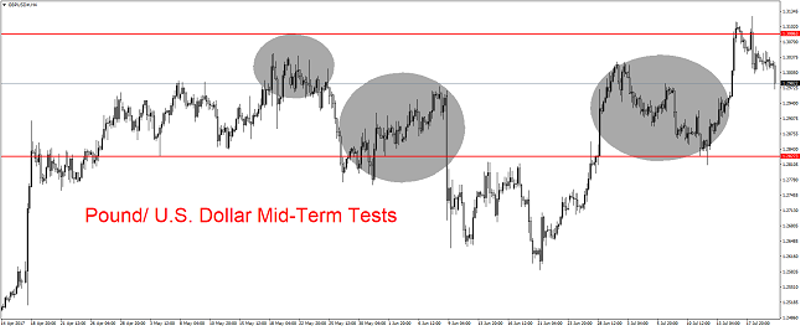

Investors in the Pound should be used to tests of value by now. The British currency has provided an avalanche of volatility the past year and this is not going to go away anytime soon.

Brexit negotiations continue between the U.K and the European Union, and while cooler heads are expected to prevail, there are no guarantees about the outcome regarding the mechanics for the U.K to leave the E.U economically. And the Pound will be affected by the ramifications.

Upside Reversals Offer Opportunity

Trading today in the Pound is only for those who have a strong stomach and the patience to watch fast market conditions which can provide turbulence.

Traders may want to test what are perceived to be low water marks for the Pound. If the British currency get pushed to around 1.2950 it might be time to consider a buying position.

The Pound will be fast and traders need to consider their positions carefully before entering the market. While dips may occur for the British currency against the U.S Dollar today, this could present interesting buying opportunities.

In the short term, we believe The Pound may be positive. Mid-term and Long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance