Taiwan Semi's AI Boom and US Expansion Set to Drive Q1 Earnings Growth

Key Taiwanese contract chipmaker Taiwan Semiconductor Manufacturing Co (NYSE:TSM) expects to report a 5% rise in first-quarter profit on Thursday backed by robust demand.

The artificial intelligence boom helped the Apple Inc (NASDAQ:AAPL) and Nvidia Corp (NASDAQ:NVDA) supplier to battle the correction of pandemic-induced electronics demand and reach a record high.

According to an LSEG SmartEstimate, TSMC will likely report a net profit of T$217.2 billion ($6.71 billion) for the quarter ended March 31, compared to T$206.9 billion last year, Reuters reports.

Also Read: Micron’s DRAM Supply Temporarily Hit by Taiwan Earthquake, But Long-Term Outlook Remains Strong

TSMC recently reported 16.5% revenue growth, surpassing Wall Street estimates and at the high end of the company’s guidance. The company boosted its total investment in the U.S. to over 60% to $65 billion, backed by a $6.6 billion federal grant and $5 billion in loans to produce 2-nanometer chips.

Taiwan’s Eastspring Investments VP Eric Yao credited the $6.6 billion in U.S. subsidies for TSMC’s new Arizona plants with helping it maintain its moat, dismissing the prospects of Intel Corp (NASDAQ:INTC) and Samsung catching up.

Recently, Intel disclosed aggravating operating losses for its foundry business. Meanwhile, TSMC shared its plans to build a third fab in Arizona.

Fubon Securities analysts expect TSMC to revise its outlook for AI demand in future years. They expect the chipmaker to account for the high teens of its revenue by 2025.

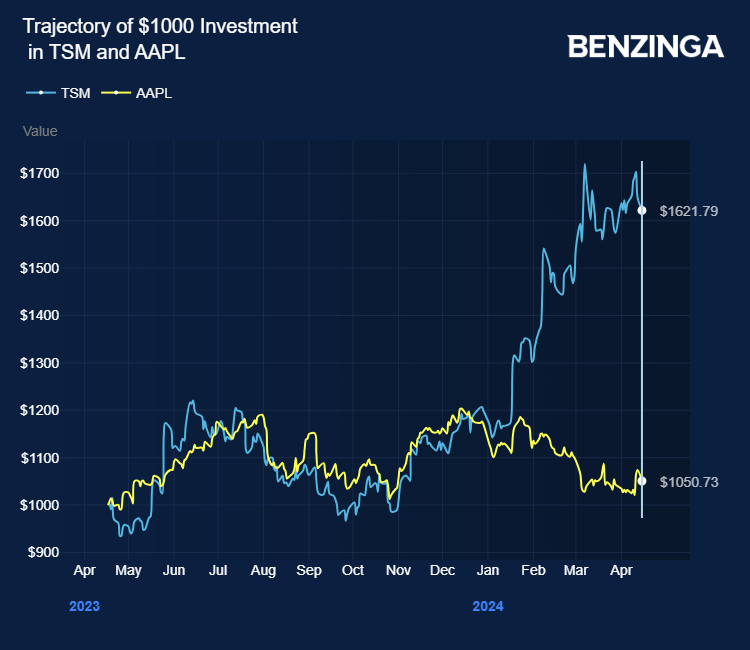

TSMC stock gained over 59% in the last 12 months. Investors can gain exposure to the stock via VanEck Semiconductor ETF (NASDAQ:SMH) and iIShares Semiconductor ETF (NASDAQ:SOXX).

Price Action: TSM shares closed lower by 1.67% at $140.14 on Monday.

Photo by Jack Hong via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Taiwan Semi's AI Boom and US Expansion Set to Drive Q1 Earnings Growth originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance