Takeover attempt opens boardroom rift at Tory ad agency

The future of an advertising agency founded by admen who helped Margaret Thatcher win power will be decided by independent directors after they opposed a potential merger deal driven by its deputy chairman.

M&C Saatchi's independent directors said a deal with the vehicle led by the software entrepreneur Vin Murria was not backed by a new strategy that would benefit investors.

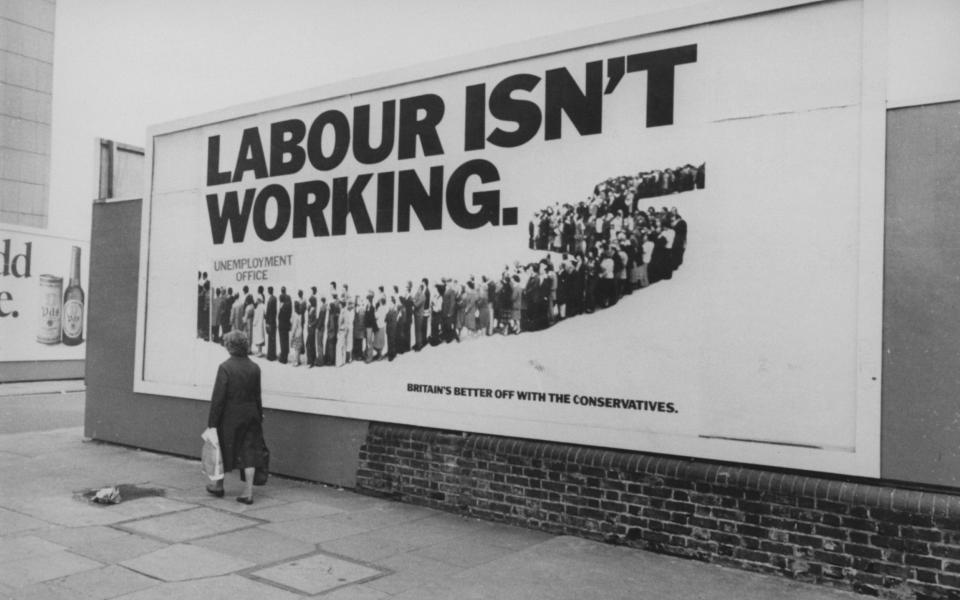

The proposed merger would hand investors 1.86 new AdvancedAdvT shares for each share in the agency founded in 1995 by brothers Maurice and Charles Saatchi. Their first agency, Saatchi & Saatchi, created the “Labour Isn't Working” advert that helped the Conservatives win the 1979 election.

The directors said the offer would fail to reflect M&C's value and its prospects by "disproportionately" transferring equity value from M&C investors to those backing the takeover vehicle.

"It is not clear to the independent directors how shareholders and other stakeholders would benefit from ownership dilution and a change in board leadership of the company," they added.

Shares fell more than 12pc to 184p, valuing the company at £225m.

The opposition comes after AdvancedAdvT said a "share exchange merger" would provide M&C with the financial firepower to pursue takeovers that would bolster its data and analytics business.

AdvancedAdvT said on Friday that a combined business would be "well-positioned to take advantage of the structural changes" from the digital age that are changing the way businesses operate and sell to customers.

A merger “would defend M&C's traditional creative base against disruptive competitors and enable the enlarged group to grow market share against its peers”, it added.

M&C, whose recent campaigns include Barclays and Hello Fresh, is trying to keep pace with its rivals by refashioning itself as a technology-led business.

WPP, the world's biggest advertising agency, announced a deal in November for Cloud Commerce Group, the e-commerce services firm that helps companies brand, sell and market their products across Amazon and eBay.

Sir Martin Sorrell's S4 Capital burnished its digital credentials in September when it merged with Zemoga, the tech group that provides design and engineering services to companies.

A merger between M&C and AdvancedAdvT looked a possibility when the latter seized a 9.8pc stake worth £24m on Wednesday. The move emboldened Ms Murria, who is already M&C Saatchi's biggest shareholder with a 12.5pc personal stake.

She became deputy chairman last year when the ad agency, with long-standing links to the Conservative Party, launched a top-level shake-up following an accounting scandal that caused the founders to quit.

Ms Murria has a 13pc stake in AdvancedAdvT. Another 15.4pc is controlled by investment company Marwyn, a serial acquirer of public companies which previously owned Peppa Pig owner Entertainment One and BCA Marketplace, the owner of WeBuyAnyCar.com.

The chief executive, Moray MacLennan, has been overhauling the business after it took a hit at the height of the pandemic due to a steep advertising downturn.

The group remains the subject of an investigation by the Financial Conduct Authority over its historic accounting problems.

M&C was revealed to have overstated its accounts by £14m three years ago when forensic accountants from PwC discovered irregularities from 2014.

Yahoo Finance

Yahoo Finance