Taking a Closer Look at Sysco

Income investors love Dividend Aristocrats, which have a long history of increasing dividends consistently every single year. Those companies tend to be less volatile than non-dividend-paying companies, as their reliable and consistent payouts could provide a decent cushion during market downturns, reducing overall portfolio volatility. By investing in these stocks, investors receive both regular dividend income streams and the potential for capital appreciation when the business keeps growing.

In this discussion, we will analyze Sysco Corp. (NYSE:SYY), which has been growing dividends for 56 years. Let's delve deeper to see whether the stock will fit well in long-term portfolios.

Business snapshot

Sysco is one of the largest worldwide distributors serving 725,000 customer locations. The company has three primary segments: U.S. Foodservice, International Foodservice and SYGMA. Its product offering include fresh and frozen foods, dairy, specialty imports and non-food items to restaurants (accounting for 62% of annual sales), health care facilities, educational institutions and hospitality venues. This diversification in products and customers hedges risks and secures revenue streams. Further, Sysco has over thousands of suppliers supporting its supply chain efficiency and local demand fulfillment. Centralized procurement programs and quality assurance ensure product consistency and optimize the supply chain.

In addition, Sysco's management is prudent and disciplined with capital investment. The capital expenditure as a proportion of revenue has stayed in the range of 0.92% to 1.36% over the past 10 years. It invested around $793.30 million in facilities, technology and fleet enhancements in 2023, continuing its capital expenditure rate of around 1% of sales.

Operational excellence also demonstrates that Sysco is able to fulfill most sales orders within 24 hours with proper inventory management. The Global Support Center (GSC) provides centralized support for finance, IT, HR and supply chain management, enabling operational efficiencies and cost savings.

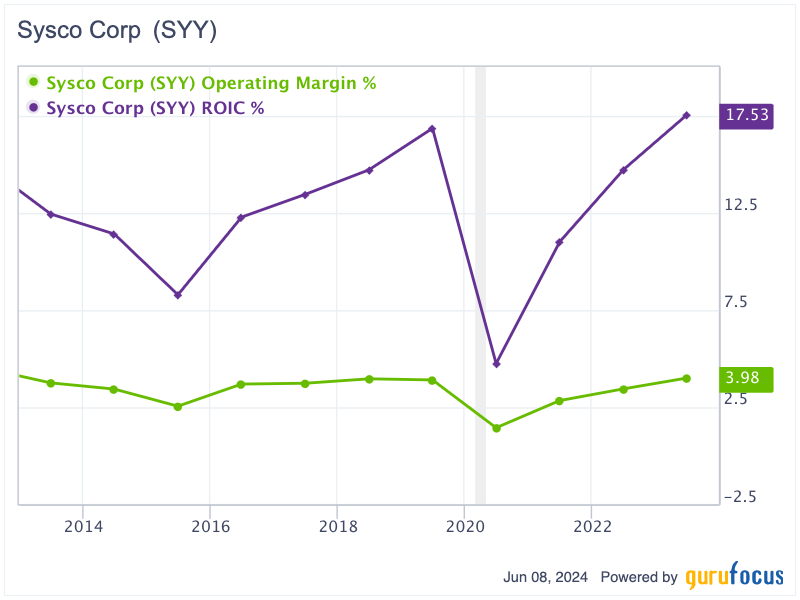

Growing operating performance with good cash flow generation

Over the past decade, though significantly affected by the Covid-19 pandemic, when most restaurants closed their doors, Sysco has bounced back strongly in operating performance. Its revenue and operating income for 2023 are at $76.32 billion and $3.04 billion, while its operating margin has recovered from its pandemic low of 1.42% to its current high of 3.98%. What makes me excited about Sysco's business is that it typically returns double digits on invested capital. Including the pandemic period, Sysco's return on invested capital has spanned between 8.26% and 17.53% over the past decade.

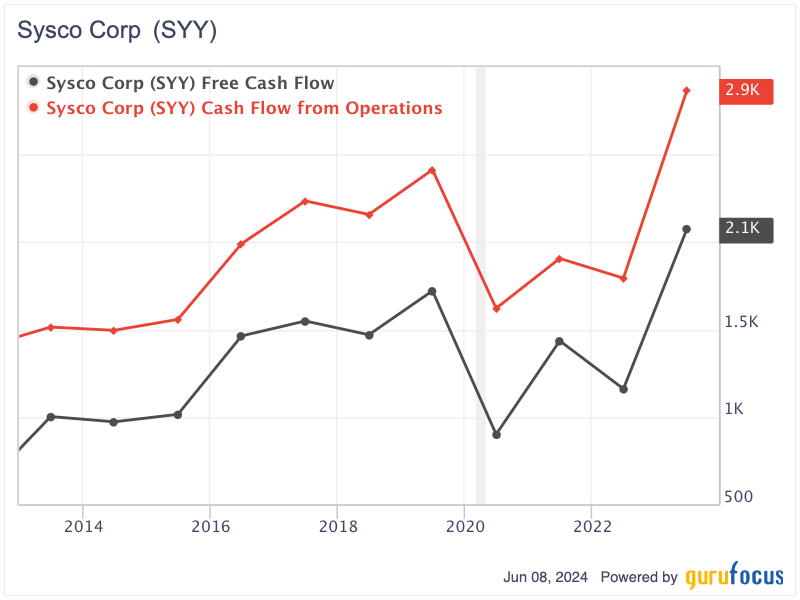

Along with the growing operating income, Sysco has been generating fluctuating but growing cash flow. Its operating cash flow has grown from $1.51 billion in 2013 to $2.87 billion in 2023, while free cash flow has risen from nearly $1 billion to $2.07 billion over the same period. The annual compounded gain in free cash flow in the past 10 years has been quite decent at 7.50%.

Highly leveraged but comfortable balance sheet

At first glance, Sysco appears to be extremely leveraged. As of March, the company reported $2.10 billion in shareholders' equity and nearly $600 million in cash, but the long-term and short-term debt as well as the operating lease liabilities amounted to a whopping $13.10 billion. The debt-equity stood at very high ratio of 6.10. The low shareholders' equity was attributed to huge accumulated share repurchases over time, which was booked as treasury stock, at nearly $11.18 billion. This treasury stock was recorded as a negative figure from the total shareholders' equity number.

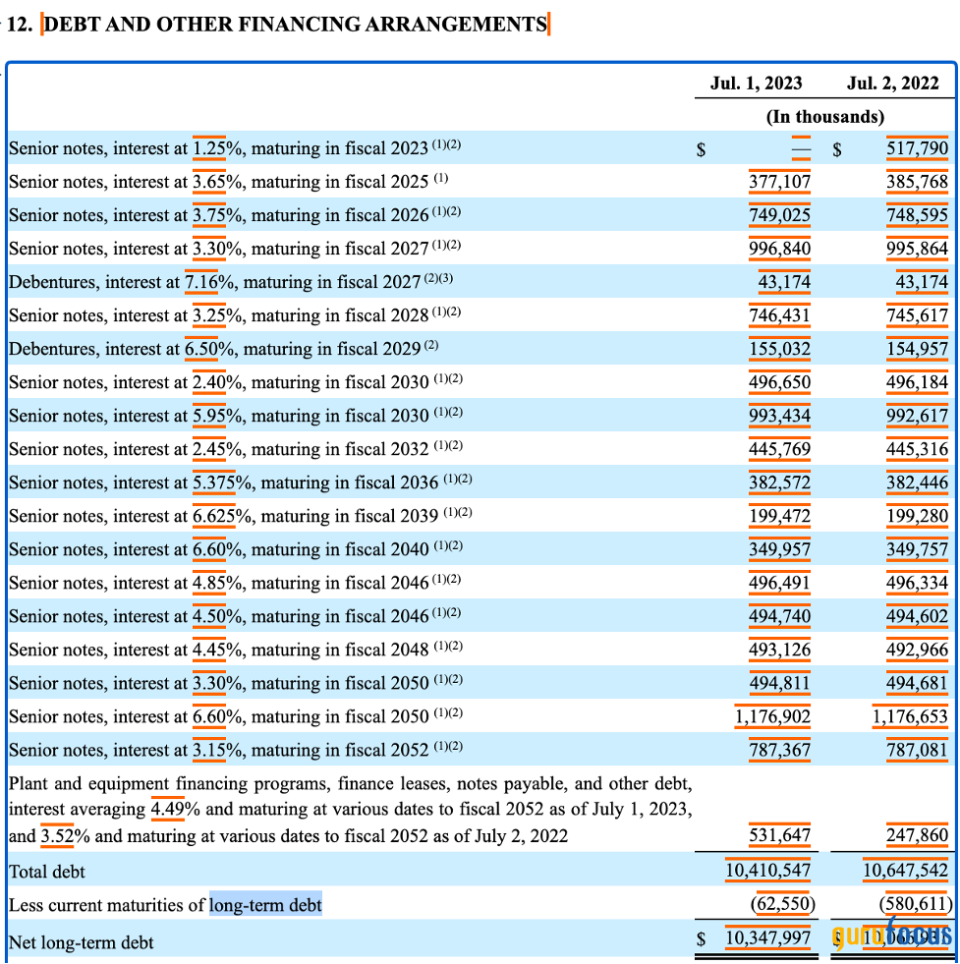

Moreover, the long-term debt is spread out over many years until 2052, with the annual principal payment ranging from $377 million to $1.5 billion and interest rates fluctuating between 1.25% and 7.16%. The two biggest payments are nearly $1.05 billion due in 2027 and $1.50 billion due in 2030. As Sysco is currently generating $2.87 billion and growing, it is quite comfortable in settling interest and debt obligations.

Source: Sysco's 10-K filing

On the asset side, there is a large amount of goodwill and intangibles at $6.36 billion. Thus, we understand that Sysco has made many acquisitions in the past as the goodwill and intangibles were often recorded when it acquired other companies above their book values. A large amount of goodwill and intangibles could pose a potential risk of impairment if the acquired businesses do not perform as expected or if there are significant changes in the market conditions. This would lead to a substantial decline in reported earnings, potentially reducing the share prices in the short term.

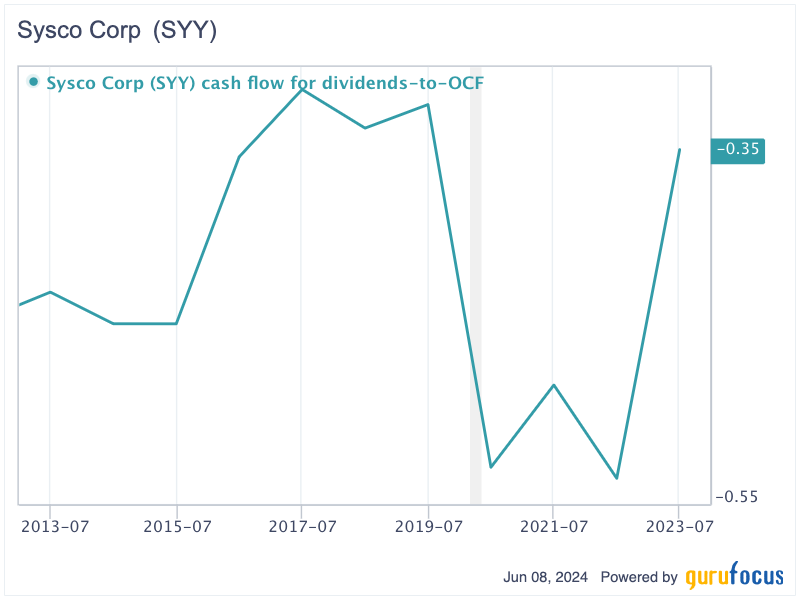

Uninterrupted dividend increases

Sysco has paid increasing dividends every year for 56 years. The company has raised its dividend payments from $1.11 to $1.97 per share since 2013 (5.90% compounded annually). We can determine the sustainability of its dividend payments by looking at the ratio of dividend payments to the operating cash flow over time. Over the past decade, dividend payments have only accounted for 31% to 54% of operating cash flow, suggesting fairly sustainable dividend payments.

Potential upside

Because Sysco is a consistent dividend payer, the Gordon Growth Model is quite suitable valuation method. I will assume the company will keep growing its dividend at 5.90% per year in perpetuity. Applying an 8% discount rate, the estimated intrinsic value of Sysco can be determined as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= $1.97 *(1+5.9%) / (8%5.9%)

= $99

The calculated intrinsic value of Sysco using the Gordon Growth Model is $99 per share, 41% higher than the current trading price. As a result, Sysco is quite undervalued at the moment.

Key takeaway

Sysco is a great option for investors looking for income, as the company has an impressive track record of raising dividends for 56 consecutive years. The company's history not only shows its commitment to delivering value to shareholders, but also showcases its ability to withstand challenges and perform exceptionally well in its operations. It has been able to consistently produce robust cash flows as well as sustain a reasonable dividend payout ratio due to its varied customer base, effective supply chain and careful capital investments. Even though the company has a significant amount of debt, its effective management of that debt and increasing operating income provide reassurance about its financial stability.

Additionally, according to the Gordon Growth Model, there is a substantial opportunity for potential upside of 41%, indicating the stock is currently valued much lower than its intrinsic value. Investors looking for a stable source of income along with potential growth in their investment will be attracted to this appealing opportunity. Sysco provides investors with reliable dividend streams and significant opportunity for growth over the long term, making it an attractive choice for those seeking income from their investments.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance