Tap into Bitcoin's Bull Market with these 3 Crypto Stocks

Bitcoin is the best performing asset over the past decade, and its performance has shown little signs of letting up -- and some top crypto stocks are on a tear, too.

Year-to-date, the world’s first and largest cryptocurrency is up nearly 60%, gaining almost 150% over the past twelve months. Despite regulatory hurdles, crypto exchange closures, and a brutal bear market, Bitcoin has climbed the proverbial “Wall of Worry” and is only a few thousand off its all-time high of $73,798.

Looking ahead to the second-half of 2024, Bitcoin and Bitcoin proxies should benefit from two major bullish catalysts, including:

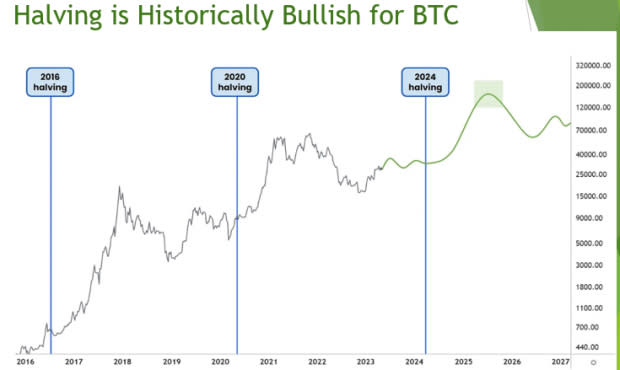

The Bitcoin Halving Fuels Record Gains

The Bitcoin “Halving” event occurs every four years and cuts the number of newly “minted” Bitcoin in half. Bitcoin’s unique monetary policy separates it from central bank-issued currencies and makes it an attractive investment for so many. While central banks have no limit on how much they can inflate their currency, Bitcoin’s supply is limited. Historical price moves est illustrate the benefits of the halving. The first three halvings produced gains of 9,133%, 281%, and 562% one year later!

Image Source: Zacks Investment Research

Institutional Adoption Grows with Bitcoin ETFs

A 13F is a disclosure required by the U.S. Securities and Exchange Commission (SEC) that companies with assets under management north of $100 million must present. This quarter, more than 600 institutions disclosed positions in spot Bitcoin ETFs, including a who’s who of top-tier firms like JP Morgan (JPM), Wells Fargo (WFC), and Millenium (disclosed a $2 billion position), to name a few.

Image Source: Glassnode

3 Crypto-Related Stocks to Buy Now

Coinbase (COIN)

Coinbase is the most prominent crypto exchange in the U.S., earning a best-possible Zacks Rank #1 (Strong Buy) score.

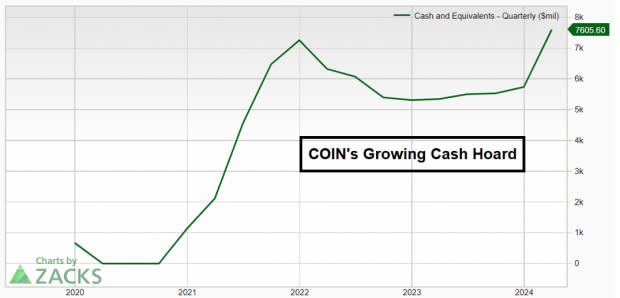

Cash Cow

Seth Klarman is a legendary value investor, billionaire, and one of the highest-earning money managers in the world. In an interview last year, Klarman stated that he avoids crypto but sees value in Coinbase, saying, “Coinbase is sitting on $5 billion in cash, has less than that in debt, and is doing some smart things.” Well, now that number has grown to more than 7 billion. I bring this to your attention because not many people trading a stock like COIN probably understand how sound the company is fundamentally.

Image Source: Zacks Investment Research

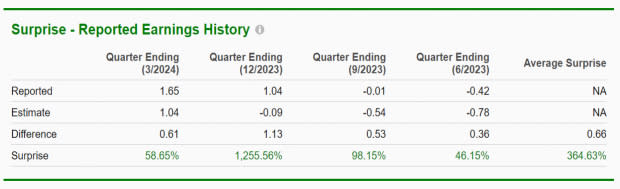

Coinbase Smashing the Street’s Expectations

On May 3rd, the leading crypto exchange announced EPS of $4.4, smashing the Street’s estimate of $1.07.Here is a snippet of the EPS transcript that stuck out to me:“Our financial performance in Q1 reflects our focused execution on product expansion, ongoing operational discipline, and strong crypto market conditions. We generated $1.6 billion of total revenue and $1.2 billion of net income*. Adjusted EBITDA was $1.0 billion – more than we generated in all of 2023.” Lastly, we continue to drive regulatory clarity for crypto through grassroots advocacy, pushing for legislation, and ongoing efforts to seek clarity through the courts.”

COIN has beaten expectations for five straight quarters, and not only are they beating them, they are smashing them. Over the past five quarters the average EPS surprise is 364.63%!

Image Source: Zacks Investment Research

Robinhood Markets (HOOD)

Zacks Rank #2 (Buy) stock Robinhood (HOOD) is one of the most popular brokerages in the United States. Robinhood was the first major broker to “democratize” trading by offering a commission-free investing app. The app rose to prominence during the meme stock craze that was spurred on by retail investing groups on the social media platform Reddit (RDDT) and included meteoric moves in stocks like GameStop (GME).

Bull Catalyst: Crypto

HOOD recently added crypto-enabled trading. Though HOOD is late to the crypto game, the company has the perfect client base to take advantage of a Bitcoin bull market.

Consistent Positive EPS Surprises

HOOD reported first-quarter earnings that trounced Zacks Consensus Estimates by 260%. Over the past four quarters, positive earnings beats have become the norm, with an average EPS beat of 230%!

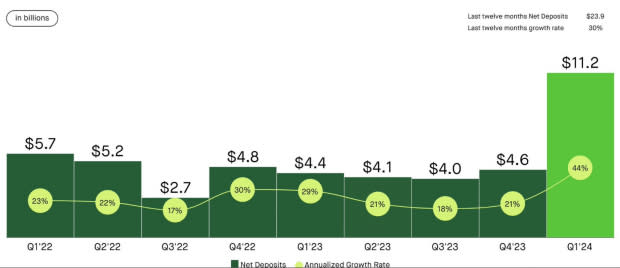

Record Net Deposits

Net deposits are one of the most important metrics to monitor for brokers. HOOD net deposits reached a record $11.2 billion in Q1, translating to a 44% annualized growth rate and contributing to a 30% growth rate over the last twelve months. Meanwhile, CEO Vlad Tenev announced on May 14th that Robinhood hit $5B in equities trading volume.

Image Source: Robinhood

Robinhood Gold is Growing

Robinhood recently announced a new “Gold” credit card. HOOD has already gained a healthy 260,000 new subscribers.

MicroStrategy (MSTR)

MicroStrategy has been around for years and is a leading provider of business intelligence software.

Adopting the Bitcoin Standard

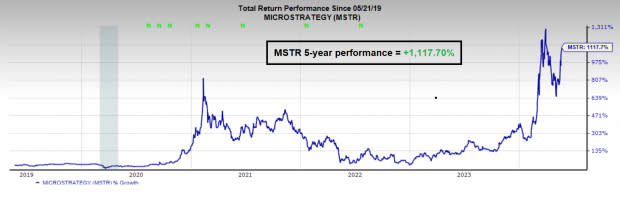

Former CEO and billionaire Michael Saylor made waves on Wall Street a few years ago when he got MSTR on the “Bitcoin Standard.” Instead of sitting in inflationary assets like U.S. dollars, Saylor realized MSTR would be better off on a “Bitcoin sail.” Essentially, MSTR is a leveraged Bitcoin bet. The results speak for themselves – over the past five years, MicroStrategy is up more than 1,000%!

Image Source: Zacks Investment Research

Conversely, a good option for investors who do not want a leveraged bet but want to tap into Bitcoin’s potential upside is the iShares Bitcoin Trust (IBIT) ETF. IBIT has some of the lowest fees and the most liquidity out of all the Bitcoin ETFs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

iShares Bitcoin Trust (IBIT): ETF Research Reports

Reddit Inc. (RDDT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance