Tapestry (TPR) to Post Q3 Earnings: Key Factors to Note

Tapestry, Inc. TPR is likely to register an increase in the top line when it reports third-quarter fiscal 2022 numbers before the market opens. The Zacks Consensus Estimate for revenues is pegged at $1,418 million, suggesting an improvement of 11.4% from the prior-year reported figure.

The Zacks Consensus Estimate for third-quarter earnings per share has decreased by a penny to 40 cents over the past seven days, indicating a decline of 21.6% from the year-ago period.

The owner of Coach, Kate Spade and Stuart Weitzman brands has a trailing four-quarter earnings surprise of 28.2%, on average. In the last reported quarter, the company’s bottom line outperformed the Zacks Consensus Estimate by a margin of 11.8%.

Factors to Note

Consumer-centric approach, omni-channel capabilities, brand awareness and emphasis on high growth areas are likely to have benefited Tapestry’s third-quarter performance. Its Acceleration Program has been a major contributing factor as well. The program is aimed at transforming the company into a leaner and more responsive organization with a clearly defined path and strategy for each brand.

We believe that strength in North America, as well as sustained growth in digital, might have favorably impacted the company’s top-line performance in the to-be-reported quarter. On its last earnings call, management had projected a low-double-digit increase in the third-quarter revenues.

We note that the Zacks Consensus Estimate for Coach, Kate Spade and Stuart Weitzman brands' revenues is pegged at $1,071 million, $271 million and $68 million, respectively. This indicates a respective year-over-year increase of 11.2%, 7.4% and 18.5%.

While the aforementioned factors instill optimism regarding the outcome of the results, we cannot ignore the impact of ongoing supply chain headwinds and increased freight costs due to the pandemic. Also, any deleverage in SG&A expenses might get reflected in margins. Tapestry had guided third-quarter operating margin to contract largely due to incremental freight expense as well as higher SG&A expenses primarily on account of marketing investments. Management had projected an approximately 20% decline in earnings per share for the third quarter.

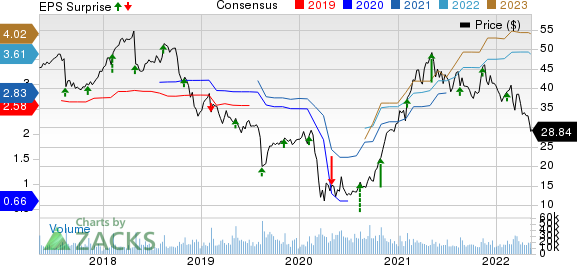

Tapestry, Inc. Price, Consensus and EPS Surprise

Tapestry, Inc. price-consensus-eps-surprise-chart | Tapestry, Inc. Quote

What Our Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Tapestry this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter. You can see the complete list of today's Zacks #1 Rank stocks here.

Tapestry has a Zacks Rank #3 but an Earnings ESP of -5.40%.

Stocks With Favorable Combination

Here are three companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Ross Stores ROST currently has an Earnings ESP of +1.24% and a Zacks Rank #2. The company is likely to register bottom-line decline when it reports first-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 99 cents suggests a decline from $1.34 reported in the year-ago quarter.

Ross Stores’ top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $4.54 billion, which indicates a marginal improvement of 0.5% from the figure reported in the prior-year quarter. ROST has a trailing four-quarter earnings surprise of 33.3%, on average.

Performance Food Group Company PFGC currently has an Earnings ESP of +10.17% and a Zacks Rank #2. The company is expected to register bottom-line growth when it reports third-quarter fiscal 2022 results. The Zacks Consensus Estimate for quarterly earnings per share of 51 cents suggests growth from 19 cents in the year-ago quarter.

Performance Food Group Company's top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $13.11 billion, indicating an increase of 82% from the figure reported in the year-ago quarter. PFGC has a trailing four-quarter earnings surprise of 1.5%, on average.

Boot Barn Holdings BOOT currently has an Earnings ESP of +0.86% and a Zacks Rank #3. The company is expected to register bottom-line growth when it reports fourth-quarter fiscal 2022 results. The Zacks Consensus Estimate for quarterly earnings per share of $1.35 suggests growth from 75 cents reported in the year-ago quarter.

Boot Barn Holdings' top line is anticipated to improve year over year. The consensus mark for revenues is pegged at $352.6 million, indicating an increase of 36.2% from the figure reported in the year-ago quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance