Is Taylor Morrison A More Appealing Housing Stock Than Meritage Homes?

The U.S. housing industry has been grappling with slowdown in sales, record-high home prices, labor and material woes and supply chain bottlenecks. Fed’s intention to combat inflation via interest rates hike is eating up builders’ margins and discouraging buyers from indulging in homebuying activities.

Per the Commerce Department’s latest data released on Sep 1, Residential construction spending dropped 1.5% from a month ago but rose 14% from the prior year’s levels.

The latest unemployment data, released by the U.S. Bureau of Labor Statistics on Sep 2, was also discouraging. The unemployment rate rose 0.2 points to 3.7% in August after returning to February 2020 or the pre-pandemic level in July. Apart from these, major homebuilding statistics are also gloomy.

Improving inventory raises hope for the Zacks Building Products - Home Builders industry. Total housing inventory at the end of July was 1,310,000 units, up 4.8% from June and in line with the previous year. Decelerated home price growth in June, which rose at a single-digit annual rate for the first time in the past 23 months. Although the July median sales price of new houses sold was up sequentially, it is expected to slow down soon.

The latest inventory data and decelerating home prices encourage the industry bellwethers like Meritage Homes Corporation MTH, Taylor Morrison Home Corporation TMHC, M/I Homes, Inc. MHO and KB Home KBH, each carrying a Zacks Rank #3 (Hold).

Based on various parameters, let’s check whether Meritage Homes or Taylor Morrison is more appealing to investors. It is to be noted that both companies are almost neck to neck in terms of market cap. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Determinants of the Stocks

Meritage Homes — having a market cap of $2.88 billion — engages in building and selling single-family homes for first-time and move-up buyers in historically high-growth regions of the United States. The company’s successful execution of strategic initiatives to boost profitability and focus on entry-level LiVE.NOW homes — which address the need for lower-priced homes — are expected to yield higher absorptions, backed by increased demand and an improving community count growth trajectory.

For third-quarter 2022, MTH is projecting total closings to be between 3,500 and 3,700 units, home closing revenues of $1.575 billion to $1.675 billion, home closing gross margin between 27.5% and 28.5%, an effective tax rate of approximately 25% and EPS in the range of $6.00-$6.80. In third-quarter 2021, it reported closings of 3,112 units, home closing revenue of $1.25 billion, home closing gross margin of 29.7%, effective tax rate of approximately 23.3% and EPS of $5.25.

Conversely, Taylor Morrison — with a market cap of $2.86 billion — offers a diverse assortment of homes across a wide range of price points for entry-level, move-up, luxury and active adult buyers. The company designs, builds and sells single and multi-family attached and detached homes. It operates under Taylor Morrison, Darling Homes and William Lyon Signature brands. The company has been benefiting from buyouts, strategic initiatives to boost profitability and building homes on a spec basis.

For third-quarter 2022, TMHC projects home closings to be between 3,200 and 3,400 units, home closing gross margin consistent sequentially and an effective tax rate of approximately 25%. Ending active community count is anticipated within 315-325. In third-quarter 2021, it reported home closings of 3,327 units, home closing gross margin of 21.2% and effective tax rate of 23.5%.

In terms of market cap, Meritage Homes is a comparatively bigger company than Taylor Morrison. Yet, TMHC has a large spectrum of customers as it serves luxury and active adults, along with entry-level and move-up buyers. Also, its homebuilding segments operate under three big brand names. In contrast, Meritage Homes offers luxury homes under the Monterey Homes brand in limited cases.

That said, the companies’ customer-centric approach and investment in land acquisition and development are encouraging.

acks Estimates & Stock Performance

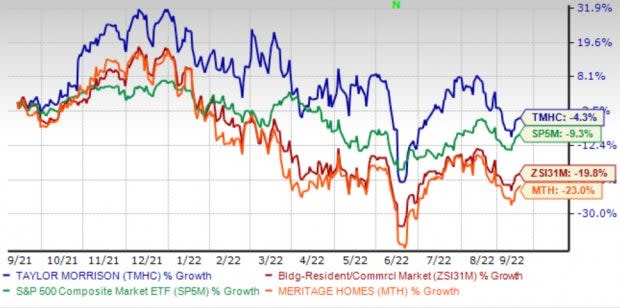

Shares of Meritage Homes have declined 23% in the past year compared with Taylor Morrison’s 4.3% fall. TMHC is definitely more appealing to investors. Notably, it has outpaced the industry and S&P 500 index’s collective decline of 19.8% and 9.3% in the same time frame.

Image Source: Zacks Investment Research

Depending on the ability to yield higher profits amid headwinds, both the companies are expected to generate higher earnings.

For Meritage Homes, the Zacks Consensus Estimates for earnings is expected to rise nearly 37% year over year in 2022. Taylor Morrison’s bottom line for the year is likely to increase 87.8%. Taylor Morrison and Meritage Homes have a VGM Score of A and C, respectively. TMHC certainly has the edge over MTH.

A Look at Stocks’ Profitability & Valuation

Return on Equity in the trailing 12 months for Meritage Homes is 29.1% compared with Taylor Morrison and the industry’s 22.2% and 22.7%, respectively. Markedly, Meritage Homes provides better returns to investors than Taylor Morrison and the industry.

The trailing 12-month price-to-earnings multiple for Meritage Homes and Taylor Morrison is 3.35 and 3.51, respectively, compared with 4.85 for the industry. After having a look at these valuation metrics, we can say that MTH is the cheaper of the two stocks and provides higher returns to investors.

Bottom Line

Taylor Morrison certainly has the edge over Meritage Homes in terms of customer spectrum, price performance, growth potential, and VGM score. But, MTH provides better returns to investors and is relatively cheaper than TMHC and the industry.

A Brief Overview of the Other Two Stocks

M/I Homes: This is one of the nation's leading builders of single-family homes.

M/I Homes’ earnings for 2022 are expected to grow 23.9%.

KB Home: This Los Angeles, CA-based homebuilder is well positioned, given a robust backlog level, a strong lineup of community openings and a solid return-focused growth model.

KBH’s earnings for fiscal 2022 are expected to rise 69.1% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KB Home (KBH) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

MI Homes, Inc. (MHO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance