Taylor Wimpey to step up house building as demand soars

Taylor Wimpey has promised to increase production and use more of its short-term land bank as the market for housebuilding improves.

The company wants to reduce the amount of time it holds land to between four and four and a half years, a year less than currently, as a result of a stronger land market that means it does not need to stockpile sites.

The better market conditions have been driven by improved planning policy, chief executive Pete Redfern said.

“Whilst it has been a slow process, which is not yet complete, the planning system today is more balanced and effective than at any point over the last 30 years,” he said.

Developers have been under pressure from the Government to avoid ‘landbanking’ and develop unused sites rather than holding on to them. But developers argue that holding sites allows them to plan their pipeline more easily, especially when the land market is particularly competitive.

Building out its land bank at a quicker rate should boost the return on capital and lead to volumes increasing faster than originally expected over the next few years, Charlie Campbell, an analyst at Liberum said.

Mr Redfern said that he planned to “work our existing land assets harder and smarter” to increase the number of homes it builds at different price points.

The FTSE 100 company is trialling a new 15-home scheme called ‘rent to buy’, which functions like a shared ownership scheme allowing people to rent a home until they can afford to purchase it, he said.

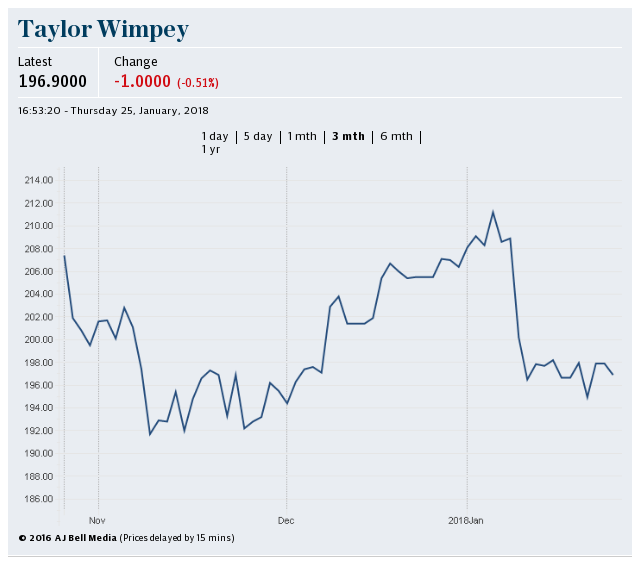

Taylor Wimpey said ahead of an investor day on Tuesday that market conditions remained stable. It will boost its ordinary dividend to at least £250m a year from 2019, or roughly 7.5pc of its assets. This is an increase from at least £150m, or 5pc, at present. It also said it would pay a special dividend of £350m in 2019.

The company has worked to shake off the leasehold scandal that engulfed it last year. In March it revealed it had slashed 23pc from its directors’ bonuses in response to the public outcry after it emerged that it had been selling leasehold homes with punitive terms, and it took a £130m hit to profits last year to rectify the problems.

Yahoo Finance

Yahoo Finance