Tech startup Blippar, once worth $1bn, went bust with just $65,000 in the bank

Blippar, the UK augmented reality startup once valued at over $1bn (£770m), went bust with debts of around £2.3m and just over £50,000 in the bank, according to a report into its collapse.

Founded in 2011, Blippar was one of the UK’s most high-profile tech startups. The company raised around $140m (£107.6) from investors and was reportedly once valued at over $1bn, making it a so-called “unicorn” in tech investment parlance.

The company made software that let mobile cameras scan the world around them and identify objects. It could also overlay information about the world around them onto a real-time image from the camera. The business often described itself as a “visual search engine.”

However, despite the huge amounts of money it raised and its lofty valuation, Blippar fell into administration at the end of last year after it failed to secure additional funding from its investors.

A report from administrators David Rubin & Partners, filed with Companies House this week, blamed over-expansion and competition from Google and Apple for the business’ failure.

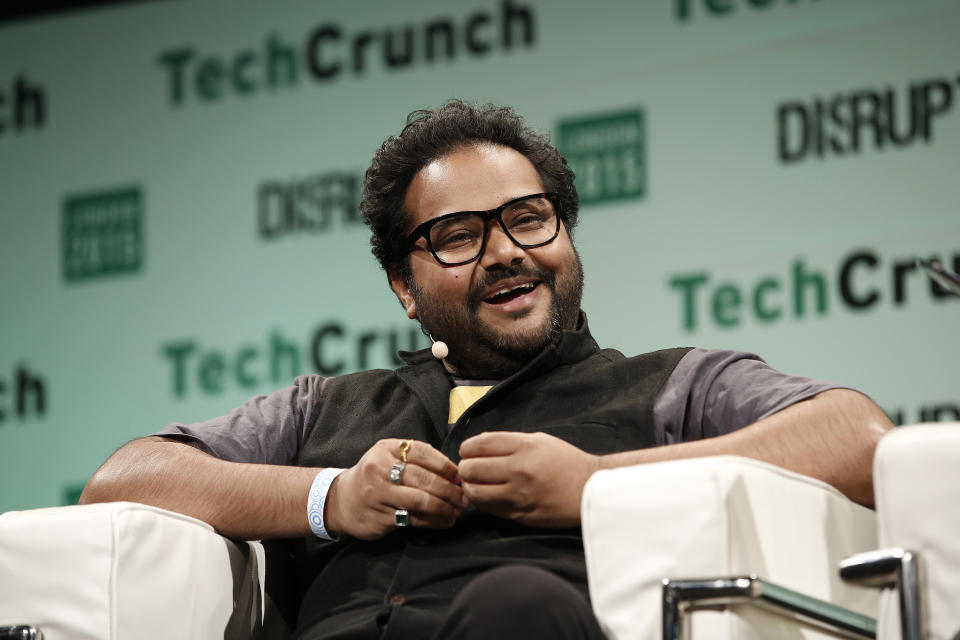

Blippar had offices around the world and employed 200 people at its peak. The business invested heavily in research and development of new technologies, hoping that it could monetise it at a later date. Blippar’s CEO told Business Insider in 2015 he was trying to build something “bigger than the internet itself.”

Revenues did not keep up with costs, however. Blippar had a turnover of £5.6m in 2017 but made an operating loss of £34.4m that year. Revenue was also declining year-on-year. Despite attempts to stem the losses, accounts to September 2018 show a loss of £14.2m on revenues of £2.3m.

This created a cash crunch in November 2018 that forced management to go cap in hand to shareholders and ask for more money.

Efforts to raise $5m (£3.84m) were blocked by one shareholder who feared Blippar would eventually need far more than was being asked for.

The investor was also worried about its ownership stake in the business getting diluted. The investor in question is believed to be Khazanah, the Malaysian state-owned investment firm.

The administrator’s report shows that Blippar went under with estimated debts of £2.3m to unsecured creditors and just £51,525 of cash left in the bank. Employees were owed an estimated £280,000.

The bulk of Blippar’s business was bought out of administration by property entrepreneur Nick Candy, who was a shareholder in the original business. Last month Candy paid just over £500,000 for Blippar’s intellectual property and some of its office equipment, the administrator’s report said.

David Rubin & Partners said that the high-profile nature of Blippar’s collapse led to the business receiving 40 to 50 approaches by parties interested in buying part or all of the company.

The report also revealed that at its peak Blippar’s app had 2m monthly users. The company said in 2016 that it had 65m users.

Blippar is the latest in a series of high-profile tech collapses in the UK in recent years. Other notable administrations include Powa, the payments unicorn company that collapsed in 2016, and Ve Interactive, the adtech business that fell into administration in 2017.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Boss of Google’s new hiring tool says UK ‘very, very attractive market’ despite Brexit

Partners at top law firm Norton Rose Fulbright share £106m profit pot

Goldman exec: UK needs access to EU tech talent post-Brexit

Crisis-era Barclays chairman gives evidence in Qatar court case

Pressure mounts on Barclays as key investor exits ahead of results

Yahoo Finance

Yahoo Finance