Technical Update For AUD/USD, EUR/AUD & AUD/CAD: 13.07.2018

AUD/USD

With the 0.7425 horizontal-line restricting the AUDUSD’s recent pullback, the pair is expected to re-test the 0.7360 support; though, break of 0.7360 can make the quote vulnerable enough to visit the 0.7330 and the 0.7310 rest-points. In case the pair continue declining after 0.7310, also breaks the 0.7300 round-figure, chances of its drop to 61.8% FE level of 0.7255 can’t be denied. Meanwhile, the 0.7400 may offer immediate resistance to the pair before highlighting the 0.7420 for one more time. Should buyers refrain to respect the 0.7420 barrier, then the 0.7450 and the 0.7575-80 are likely following numbers to appear in their radar to target.

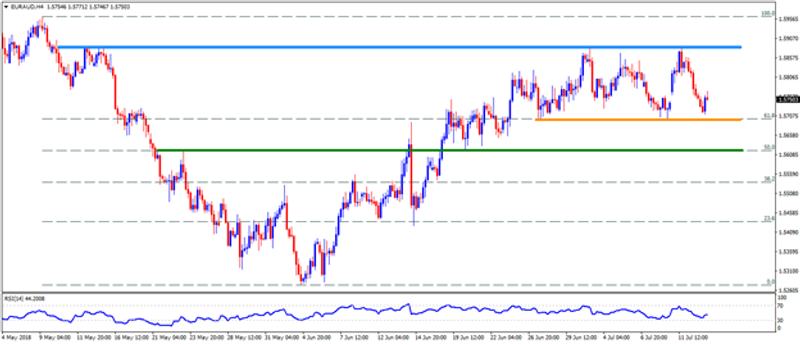

EUR/AUD

EURAUD is also near to the 1.5700-1.5695 support-zone, which if broken might not hesitate dragging the pair to 1.5655 prior to diverting investor attention to 1.5620-15 rest-point. Given the prices keep trading southwards beneath the 1.5615, the 1.5555 and the 1.5510 might please the sellers. Alternatively, the 1.5780 and the 1.5820-25 can restrict the pair’s near-term upside, breaking which the 1.5880-90 must not be missed to observe. It should also be noted that pair’s capacity to conquer the 1.5890 may help the Bulls to look for 1.5910 and the 1.5960 resistances.

AUD/CAD

Following its inability to surpass the 0.9760 resistance, AUDCAD’s pullback to 0.9680 seem acceptable; however, the 0.9665-60 could limit the pair’s further downside. If comparative weakness of the AUD fetch the pair below 0.9660, the 0.9630 and the 0.9600-0.9595 can provide intermediate halts during its plunge to 0.9550. On the upside, pair’s break of 0.9760 still can’t be termed as a sign of its strength unless clearing the short-term descending trend-line, at 0.9780, adjacent to 0.9815 horizontal-line. Assuming that the quote manage to rise beyond 0.9815, then it can target the 0.9845, the 0.9880 and the 0.9910 consecutive resistances.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini Dow Jones Industrial Average (YM) Futures Analysis – July 13, 2018 Forecast

USD/CAD Daily Price Forecast – USD/CAD Back on Track to Breach 1.32 Handle

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – July 13, 2018 Forecast

Natural Gas Price Fundamental Daily Forecast – Weakens Under $2.751, Strengthens Over $2.799

Yahoo Finance

Yahoo Finance