Technical Update For GBP/USD, GBP/JPY, GBP/NZD & GBP/CAD: 09.11.2017

GBP/USD

While last week’s bounce of the GBPUSD failed to surpass 1.3180, the pair currently re-tests the eight-month-old ascending trend-line support around 1.3075, break of which can quickly drag it to 1.3030, the 1.3000 and then the 1.2960 adjacent rest-points. During the pair’s additional downside beneath 1.2960, the 1.2910 and the 200-day SMA level of 1.2865 become important, which if conquered may fetch prices to 1.2770. If at all the TL support again plays its role, the quote needs to clear the 1.3180-85 region in order to extend its pullback and aim for the 1.3230 and then to the 1.3290 resistances. However, the 1.3330-40 horizontal-line might restrict the pair’s following advances beyond 1.3290, failure to do so can open the door for a northward trajectory in the direction to 1.3400 and the 1.3445-50 resistance levels.

GBP/JPY

Unlike GBPUSD, the GBPJPY already broke short-term TL support and its sustained trading below the same signals the pair’s downturn to 147.80 and 147.40 levels. Should the pair declines below 147.40, the 147.00 round-figure might offer an intermediate halt prior to highlighting the 146.55-60 horizontal-line. Given the sellers’ dominance remain intact after 146.55, it becomes wise to expect 145.70 & 145.35 to appear on the chart. Meanwhile, the 149.00 and the 149.60 are likely nearby resistances that the pair might find in case of a bounce, breaking which the 150.00 and the 150.30 could entertain the buyers before pushing them to challenge the 150.90 and the 151.50-55 resistances.

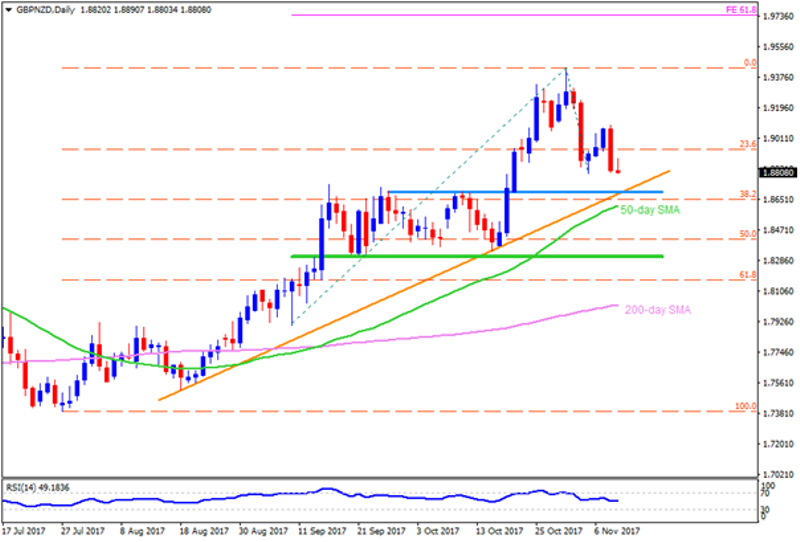

GBP/NZD

Even if the 1.9075 triggered the GBPNZD’s recent drop, the 1.8700–1.8680 support-confluence, followed by 50-day SMA level of 1.8610, can restrict the pair’s near-term declines. Though break of 1.8610 can swiftly fetch the quote to 1.8515 and then to the 1.8400 ahead of helping Bears to aim for 1.8320–1.8300 support-area. On the upside, the 1.8940, the 1.9075 and the 1.9100 seem immediate resistances for the pair, break of which can escalate its recovery to 1.9280 and to the October high near 1.9430. Moreover, pair’s successful trading above 1.9430 enables it to claim the 61.8% FE level of 1.9740 with 1.9570 likely acting as a buffer.

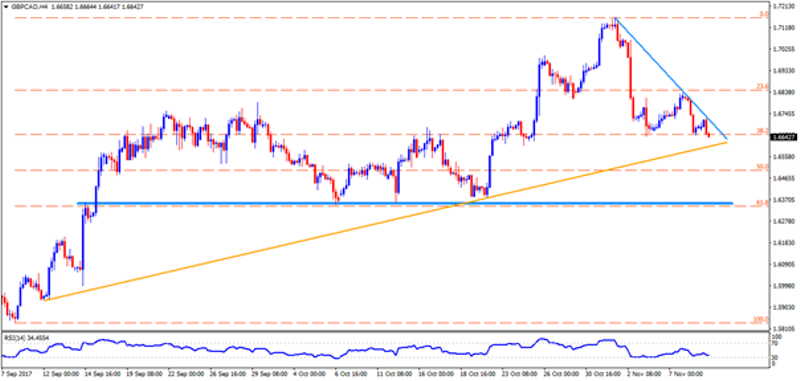

GBP/CAD

With immediate downward slanting trend-line limiting the GBPCAD’s upside, chances of the pair’s drop to eight-week-old ascending trend-line, at 1.6600 now, can’t be denied. Given the pair’s break of 1.6600, the 1.6530, the 1.6470 and the 1.6390 can offer intermediate halts during its plunge to revisit the 1.6360-50 horizontal-line. Alternatively, break of 1.6720 TL resistance can activate the pair’s advances to 1.6795–1.6800 and then to the 1.6910 numbers to the north. Also, if the 1.6910 is broke, the 1.6980 and the 1.7025 can become buyers’ favorite.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

More From FXEMPIRE:

Daily Market Forecast, November 9, 2017 – EUR/USD, Gold, Crude Oil, USD/JPY, GBP/USD

Technical Update For GBP/USD, GBP/JPY, GBP/NZD & GBP/CAD: 09.11.2017

E-mini S&P 500 Index (ES) Futures Technical Analysis – November 9, 2017 Forecast

E-mini Dow Jones Industrial Average (YM) Futures Analysis – November 9, 2017 Forecast

Yahoo Finance

Yahoo Finance