Technical Outlook For USD/CHF, EUR/CHF, AUD/CHF & CAD/CHF: 04.10.2018

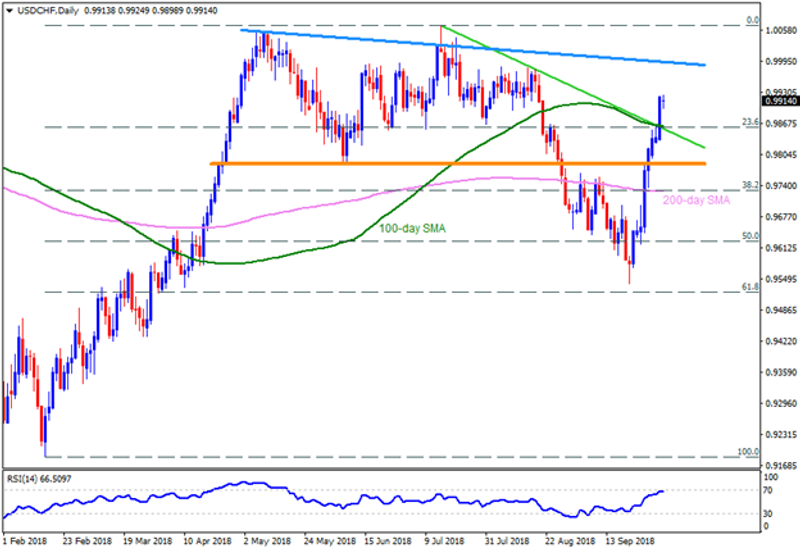

USD/CHF

Break of three-month old descending trend-line, also encompassing 100-day SMA, signal brighter chances for the USDCHF’s further upside towards 0.9945-50 multiple resistance area. However, a bit broader downward slanting TL, at 1.0000 psychological magnet, can confine the pair’s advances past-0.9950, if not then 1.0040 & 1.0070 may gain traders’ attention. In case the quote continue rising beyond 1.0070, the 1.0100 & 1.0170 could entertain the Bulls. Alternatively, the 0.9865-55 resistance-turned-support region might become important support if the pair take a U-turn from present levels, breaking which 0.9820 & 0.9790-80 seem crucial to observe. Assuming the pair’s extended downturn below 0.9780, the 200-day SMA level of 0.9730 & 0.9700 round-figure could flash in the Bears’ radar to target.

EUR/CHF

Alike USDCHF, the EURCHF also cleared immediate resistance-line and may rise in direction to few more north-side barriers, namely the 1.1450 and the 100-day SMA level of 1.1480. Given the pair’s ability to close above 1.1480, the 1.1560 & 200-day SMA level of 1.1610 might play their roles. Meanwhile, there are multiple supports between the 1.1325 and 1.1315, which if broken could drag prices to 1.1220 & 1.1180 levels. Should there be additional weakness on the pair’s part beneath 1.1180, the 61.8% FE level of 1.1100 might become sellers’ favorite.

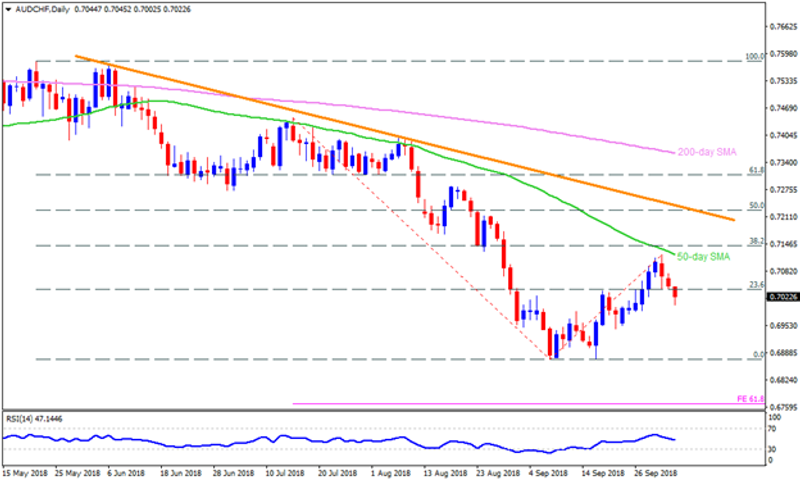

AUD/CHF

Failure to surpass 50-day SMA portrayed the AUDCHF’s weakness that currently fetches it to 0.6980 and then to the 0.6950 supports. If the pair keep trading southwards below 0.6950, the 0.6900 and the 0.6870 can offer intermediate halts during its plunge to 61.8% FE level of 0.6765. On contrary, the 0.7065 and the 50-day SMA level of 0.7125 are likely immediate resistances that the pair needs to surpass in order to justify its short-term strength. Though, the 0.7200 becomes the only number that can please buyers above 0.7125 as four-month old descending TL, at 0.7240, might disappoint optimists afterwards.

CAD/CHF

With the 0.7705-15 horizontal-resistance still unbroken, not to forget about overbought RSI, the CADCHF is expected to re-test the 0.7670, the 0.7625 and the 0.7600 rest-points but 100-day & 200-day SMA confluence, around 0.7550-60, could limit its following declines. In case the pair refrains to respect the 0.7550, the 0.7500 and the 0.7425 may mark their presence on the chart. Given the pair’s ability to close beyond 0.7715, its rise to 0.7740 & 0.7770 can become imminent whereas a year-long resistance-line, at 0.7810, may restrict the advances then after. If at all the quote rallies above 0.7810, the 0.7865, the 0.7910 & 0.7960 are likely consecutive resistances to grab limelight.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance