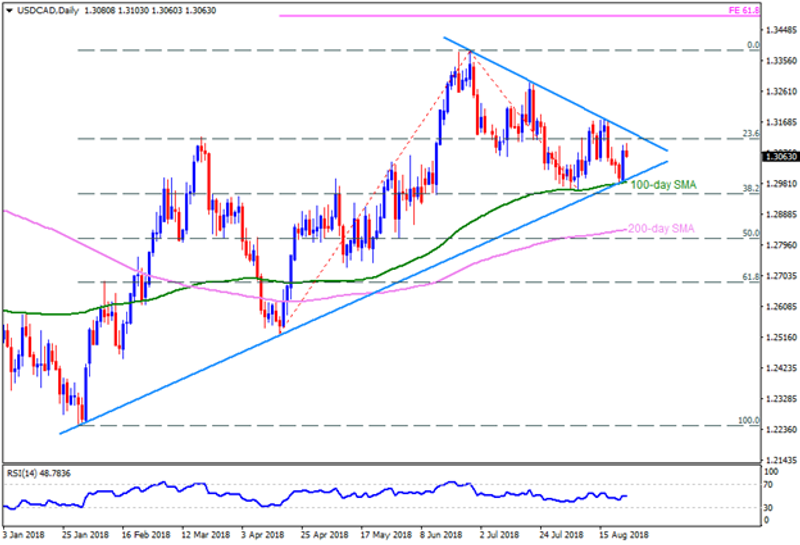

Technical Update For USD/CAD, EUR/CAD & CAD/JPY: 24.08.2018

USD/CAD

USDCAD’s another bounce off the 100-day SMA & seven-month old ascending trend-line indicates its readiness to confront the downward slanting TL stretched since late-June, at 1.3145. Should the pair registers a daily closing beyond 1.3145 barrier, the 1.3215 and the 1.3255 are likely intermediate halts that it could avail prior to aiming the 1.3385 mark. In case Bulls keep ruling the trade-sentiment past-1.3385, the 61.8% FE level of 1.3490 may prove its worth as strong resistance. Alternatively, the 1.2990-85 support-zone, comprising 100-day SMA & aforementioned trend-line, may restrict the pair’s near-term declines, failing to which can drag the quote to 1.2915 and the 200-day SMA level of 1.2840. Given the pair’s additional downturn beneath the 1.2840, the 1.2750-45 and the 1.2700 might please the sellers.

EUR/CAD

Even after recovering from 1.4800, the EURCAD might find it hard to remain strong for longer as the 1.5170-75 and the 1.5290 descending trend-line still stand tall to challenge the pair buyers. If prices rise above 1.5290, the 1.5320, the 1.5370 and the 1.5440 are expected consecutives hurdles that needs to be cleared in order to target the 1.5500 round-figure. Meanwhile, the 1.5050 and the 1.5025 support-line may limit the pair immediate drops, breaking which the 1.5000, the 1.4915 and the 1.4800 can witness market attention.

CAD/JPY

Having repeatedly defeated by the 200-day SMA, CADJPY again looks to question the strength of 85.55 SMA figure, which holds door for the pair’s advances towards 86.05 trend-line. However, pair’s successful trading above 86.05 can fuel it to the 86.75 and the 87.20 resistances. On the downside, the 84.70, the 84.25 and the 83.70 could continue troubling the pessimists, breaking which an ascending trend-line, at 83.10, might become crucial to observe. Assuming the pair’s extended south-run below 83.10, the 82.15 and the 81.35 may appear in the Bears’ radars.

This article was originally posted on FX Empire

More From FXEMPIRE:

GBP/USD Daily Price Forecast – GBP/USD Consolidates above 1.28 Handle Ahead of Powell’s Speech

E-mini S&P 500 Index (ES) Futures Technical Analysis – August 24, 2018 Forecast

Gold Price Futures (GC) Technical Analysis – August 24, 2018 Forecast

Price of Gold Fundamental Daily Forecast – A Hawkish Powell Could Crush Gold Prices

USD/CAD Daily Price Forecast – CAD Breaches 1.30 Handle on Weak USD And NAFTA Related News

Yahoo Finance

Yahoo Finance