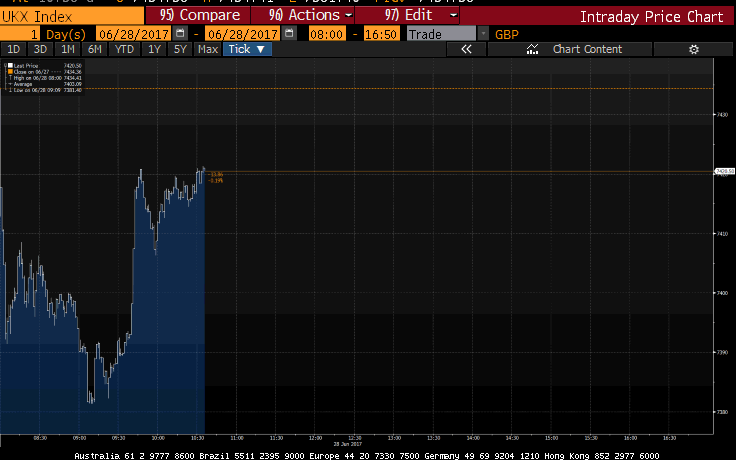

Pound spikes after Mark Carney says higher interest rates likely to become 'necessary'

Pound soars over $1.29 after Bank of England governor Mark Carney says higher interest rates likely to become "necessary"

Asset management shares fall after FCA report proposes shake-up

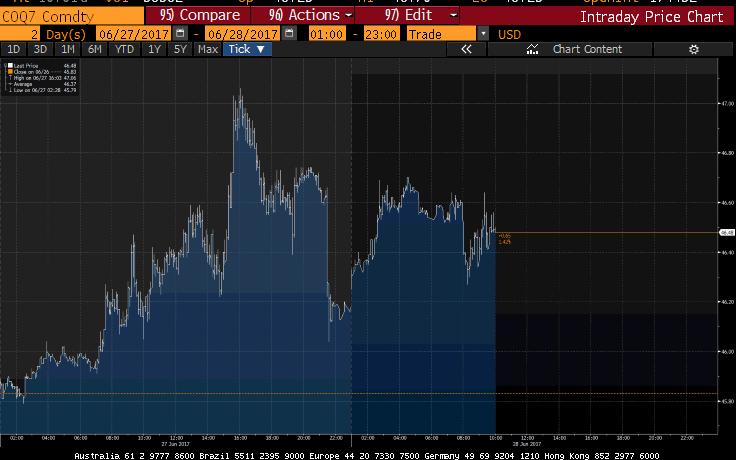

Energy stocks hit by oil price drop on back of fresh US stocks data

Summary

Roundup

The pound soared over $1.29 this afternoon after Bank of England governor Mark Carney said that interest rate rises will be "necessary" if the global recovery spurs an investment revival and leads to stronger wage growth. He added that the global recovery was becoming "broad-based" and that "some removal of monetary stimulus is likely to become necessary if the trade-off facing the MPC continues to lessen and the policy decision accordingly becomes more conventional".

Asset management shares were hit by the FCA report today that proposed a radical industry shake-up. Hargreaves Lansdown was among the worst performers on the FTSE 100, its shares dropping by 2.3pc. The changes will compel fund managers to provide better value for money, offer greater protection for investors, and drive competition in the market.

Chris Beauchamp, chief market analyst at IG, commented on today's market movements:

"The sooner this central bank conference in Portugal comes to an end, the better. Yesterday was bad enough, but today has been even more eventful. After supposedly showing his hawkish colours Mr Draghi let it be known that his speech yesterday had been ‘misinterpreted’, causing the euro to slump and causing European markets to regain lost ground.

"That wasn’t all. As if to go one better, Mark Carney, everyone’s favourite dovish BoE governor, suddenly declared that the bank might need to raise rates. As a result, the pound surged above $1.29 for the first time since its election night drubbing, and this prompted the FTSE 100 to drop back to the lows of the day."

Coming off the back of the 5-3 split at the last meeting and hawkish comments from the Bank’s chief economist, Andy Haldane, it’s the clearest signal yet that the Bank is minded to tighten. There is a sense the MPC may wish to ‘correct’ its rate cut last summer in light of a surprisingly resilient UK economy and rising inflation, which is accelerating quicker than the Bank expected.

Neil Wilson, ETX Capital

European stock markets at close of play

FTSE 100: 7,387 (-0.63pc)

FTSE 250: 19,476 (-0.26pc)

Euro Stoxx 50: 3,536 (-0.05pc)

DAX: 12,647 (-0.19pc)

CAC 40: 5,252 (-0.11pc)

FTSE 100 Risers

IAG (+3.87pc)

eayJet (+2.18pc)

BT (+1.94pc)

Antofagasta (+1.74pc)

J Sainsbury (+1.69pc)

FTSE 100 Fallers

Burberry (-3.45pc)

Shire (-2.52pc)

Hargreaves Lansdown (-2.32pc)

Segro (-2.08pc)

Scottish Mortgage Investment (-2.03pc)

Exchange rates

GBP/USD: $1.2936 (+1.20pc)

GBP/EUR: €1.1383 (+0.74pc)

FTSE 100 drops in reaction to pound gains

After being flat for most of the day the internationally-focused FTSE 100 has tumbled in the last half an hour as Mark Carney's comments pushes the pound upwards. The more domestically FTSE 250 has also dropped but to a lesser extent following the speech at the ECB forum. The US markets are now open with the Dow, S&P 500 and Nasdaq all up around 0.5pc. Following yesterday's sell-off, tech and healthcare shares are up today but are still the among the worst performing sectors.

Connor Campbell at Spreadex has provided some analysis on Mr Carney's affect on the markets today:

"A caveat-laden statement from Mark Carney – speaking at the ECB Forum in Portugal – caused a super-surge from sterling this Wednesday. Investors were uninterested in the nuances of what Carney was actually saying, focusing on the fact that the BoE chief said ‘some removal of monetary stimulus is likely to become necessary’ but ignoring that the central banker made it clear A LOT of things, like UK wage growth and business investment (not to mention Brexit), need to move in the right direction for that to happen.

"With the dollar already weakened thanks to Donald Trump’s latest healthcare reform setback the pound found it easy to expand on its early growth, cable climbing more than 1% to cross $1.295 for the first time since the day of the general election. Against the euro, meanwhile, sterling overturned its initial losses to rise by 0.8%, rocketing away from the 7 and a half month nadir struck earlier in the day (the euro was also softened up slightly by ECB sources claiming investors had ‘over-interpreted’ Draghi’s hawkish-ish comments from Tuesday)."

Pound soars over $1.29 after Mark Carney speaks at the ECB Forum

Mark Carney has said that higher interest rates will be "necessary" if the global recovery spurs an investment revival and leads to stronger wage growth.

The Governor of the Bank of England said there were signs that a recent period of weak investment growth was coming to an end.

He said the global recovery had started to become "broad-based" creating "the possibility of a self-reinforcing revival in investment".

UK output was now "in sight of potential", he added, suggesting that a pick up in growth could lead to stronger domestic inflationary pressures.

He said policymakers on the Monetary Policy Committee (MPC) would continue to balance the trade off between supporting growth and jobs as well as keeping a lid on inflation.

"Some removal of monetary stimulus is likely to become necessary if the trade-off facing the MPC continues to lessen and the policy decision accordingly becomes more conventional," he told a conference organised by the European Central Bank in Portugal.

"In order to expand, companies will increasingly need to invest," he said.

"After an expansion that has relied overly on consumption, the rotation to other components of demand, particularly investment, will be important to sustain momentum."

"Globally, there are signs that such a rotation may be beginning."

Earlier this month Mark Carney said now was "not yet the time" to start raising rates as he warned that the "reality of Brexit negotiations" were yet to hit the economy.

However, Wednesday's speech suggests that he believe that some of these "mixed signals" on consumer spending would become less of an issue of investment starts to pick up.

More time to assess the outlook: Cunliffe

It came as Sir Jon Cunliffe, the Bank's deputy governor for financial stability, said policymakers had more time to assess the UK economic outlook before they needed to decide whether to raise interest rates.

Sir Jon admitted that current projections for higher inflation over the next three years were "not a comfortable place" for the eight members of the Monetary Policy Committee (MPC).

Sir Jon said there was evidence that consumer spending, which powered economic growth at the end of last year, was slowing as households' real incomes are squeezed by higher inflation, which currently stands at 2.9pc.

This is well above the Bank's 2pc target.

While officials expect some of this slowdown to be offset by growth in business investment and rising exports, he told the BBC: "I want to see how that plays out".

He said the Bank was monitoring domestic inflationary pressures, including pay growth, carefully.

"I think that on the data we have at the moment, that gives us a bit of time to see how this evolves," said Sir Jon.

Three MPC members voted to raise interest rates at the Bank's latest policy meeting.

Andy Haldane, the Bank's chief economist, has signalled he would also vote for a rate rise in the second half of this year if the economy continued its steady expansion.

Euro drops against the pound

The euro has dropped into negative territory against the pound for the first time today after a report by Bloomberg that Mario Draghi believes his speech was misjudged by the markets.

Earlier in the day ECB vice-president Victor Constancio had also said words to that effect, telling the ECB Forum that Mr Draghi's comments yesterday were in line with the central bank's monetary policy.

GBP/EUR: €1.1321 (+0.18pc)

GBP/USD: £1.2834 (0.41pc)

Do Constancio's comments qualify as ECB tapering? #eurpic.twitter.com/BoVJFd0OCI

— Mike van Dulken (@Accendo_Mike) June 28, 2017

Spreadex Connor Campbell commented that sterling's situation is a "bit more complicated".

He added: "Though the pound now finds itself above $1.28 for the first time since the shock election result at the start of the month, this is firmly due to dollar-weakness rather than the currency’s own strength. That’s captured in its performance against the euro, where it is now at its worst price since last November after falling a further 0.1% (a drop inspired by BoE deputy governor Jon Cunliffe’s dovish comments this morning)."

Stagecoach shares dive after predicting losses on East Coast franchise

Stagecoach shares have plummeted by 17.6p, or 9pc, to 185.9p today after the bus and rail group decided to account for £84.1m of losses it expects to suffer in the next two years on the East Coast franchise, which runs between London and Scotland.

Discussions are ongoing with the Department for Transport (DfT) about changing the terms of the franchise, which alongside forthcoming infrastructure changes and newer trains have led the company to expect the franchise to be profitable in 2019.

But talks of a deal failed to reassure investors with the company’s shares falling 10pc to 184p on the back of the results, which showed pre-tax profits slumped to £17.9m for the year to April 29, compared to £104.4m the year before. Sales rose 1.8pc to £3.94bn.

Bradley Gerrard's full report on Stagecoach can be read here

Co-op Bank finally agrees £700m rescue deal with its hedge fund owners

The Co-operative Bank has finally agreed a £700m rescue deal with its hedge fund investors that will avert a collapse and will effectively end the historic relationship between the troubled lender and the wider Co-operative Group.

The loss-making ethical bank has announced a financing package that will see it raise at least £443m in a debt-for-equity swap and a further £250m in new equity from the hedge funds that hold its bonds and shares. The Co-op Group’s 20pc stake in the business will shrink to about 1pc.

The relationship agreement between group and bank which covers, among other things, the promotion of bank services to members of group, will naturally fall away and come to a formal end in 2020

Co-op Group

In a pivotal move, the Group said that the “the relationship agreement between group and bank which covers, among other things, the promotion of bank services to members of group, will naturally fall away and come to a formal end in 2020”. The lender will continue to bear the Co-op name and its current branding, however.

Read the full report by Ben Martin here

Tesco to axe 1,200 jobs at its head office

Tesco is to axe 1,200 jobs at its head office as part of a major cost-cutting drive.

The supermarket giant informed affected staff on Wednesday morning about the cull, which amounts to 25% of employees at offices in Welwyn Garden City and Hatfield.

Tesco is in the midst of a turnaround plan under chief executive Dave Lewis and last week said 1,100 jobs would be axed after confirming plans to shut its call centre in Cardiff.

Mr Lewis, dubbed "Drastic Dave", has been hailed for leading a turnaround of the supermarket since taking the helm in 2014.

But earlier this month, the chief executive warned of "tough market conditions" as soaring inflation results in higher shop prices and squeezes consumer spending.

Nevertheless, Tesco boasted of "significant market out-performance" as it notched up UK like-for-like sales growth of 2.3% in the first quarter.

Report by Press Association

Lunchtime summary

On the FTSE 100, Hargreaves Lansdown has pared some the losses it made this morning following the FCA's announcement but the stock is still the worst performing on the blue chip index. The FTSE 100 is now flat and the FTSE 250 has dipped slightly after being dragged down by energy and technology shares during the morning. Oil and gas stocks have, however, recovered as the two benchmarks made gains after falling by around half a dollar overnight.

The pound has been relatively steady this morning against the dollar but is now 0.18pc down against the euro in choppy trade.

In the last half an hour, the Co-op bank has agreed a rescue deal with its hedge fund owners. A full report will follow later from our banking correspondent Ben Martin.

European stock markets at noon

FTSE 100: 7,433 (-0.01pc)

FTSE 250: 19,502 (-0.12pc)

Euro Stoxx 50: 3,523 (-0.42pc)

DAX: 12,605 (-0.52pc)

CAC 40: 5,243 (-0.29pc)

Currencies

GBP/USD: $1.2826 (+0.34pc)

GBP/EUR: €1.1293 (-0.06pc)

Dixons Carphone shares fall following record full-year profits

Dixons Carphone has posted record full-year profits of more than half a billion pounds as the retailer remained resilient in the face of a consumer slowdown.

The FTSE 250 company, which is behind Currys, PC World and Carphone Warehouse, said profits before tax in the year to April 29 were up 10pc from £457m to £501m.

“Over the last few years a great deal of work has been done to make the company stronger, lower risk and more resilient,” said chief executive Seb James.

Shares are down 2.9p to 293p, a 1.5pc drop.

Read Sam Dean's full report here

Neil Wilson, ETX Capital senior market analyst, said on the results:

"The fall in the pound does make life tough when everything you sell is made abroad, but with over a third of sales coming from the Nordics and Southern Europe the effect is offset to a degree. So a 5% rise in sales in European markets becomes a 20% jump in sterling terms and that helped lift profits.

"Market share is improving on many fronts (we note that competitor AO World shares are down 0.4% following today’s results), although the mobile phone market proved tougher thanks to Samsung’s exploding smartphones and the absence of major product refreshes."

More reaction to Jon Cunliffe's comments this morning

The Bank of England is clearly very divided, with deputy governor Cunliffe this morning sending rather mixed signals

Marc Oswald, ADMISI strategist

Marc Ostwald, FX, Rates & EM Strategist at ADM Investor Services International, said that Cunliffe was "ostensibly backing Carney by saying this was not the time to raise interest rates, but also noting '(We) do have to look at what's happening to domestic inflation pressure, and I think that on the data we have at the moment, gives us a bit of time to see how this evolves' - 'a bit of time' being the key observation."

FTSE 100 helped by Cunliffe comments

Bank of England deputy governor Jon Cunliffe's backing of Mark Carney's position on interest rates has helped the FTSE 100 recover early losses this morning, according to IG market analyst Josh Mahony. Mr Cunliffe said earlier today that now was not the time for an interest rate rise.

Mr Mahony on the markets this morning and overnight:

"The relative lack of volatility seen in markets over the past few weeks means that any sudden drop looks more impressive than it actually is.

"It was only natural to see tech stocks turn south as Fed members began opining once more about valuations, but the Dow fall was only around 1%, and already this morning markets are moving off their lows. It looks like this is just a market being jolted out of its complacency, and it will take something more than a few comments from the Fed to really make investors worry."

Healthcare is one of the worst performing sectors on the blue chip index today, having been weakened by US president Donald Trump's stalling healthcare plans. ConvaTec has fallen 1.27pc while Shire has dropped just under 1pc.

FCA asset management shake-up reaction

I firmly believe these remedies will not only benefit customers but ultimately strengthen confidence and competitiveness in the UK asset management industry.

Martin Gilbert, Aberdeen Asset Management chief executive

Aberdeen Asset Management chief executive Martin Gilbert has welcomed the FCA's report which aims to build trust in the asset management industry.

“The industry now needs to engage with the regulator to discuss and coordinate the implementation of the recommendations," said Mr Gilbert.

He added:

“I strongly welcome the FCA’s Market Study as it provides clear guidance on how the FCA wishes the industry to operate in the future. Its recommendations to improve investor protections through better governance and to drive competition through greater transparency of fees and fund objectives are constructive and sensible.

"With investment risk increasingly being passed down from governments and employers to individuals, it is crucial that asset management evolves to meet this new world."

David Morrey, partner and head of investment management at Grant Thornton, said that the FCA release "holds few surprises".

He commented:

"The regulator has shown itself to be largely impervious to the lobbying efforts of the industry, who found fault in both the analysis and conclusions of the interim report published by the FCA in late 2016. If you didn’t like the interim report, you won’t like the final report."

Lucy Burton's full report on the FCA release can be found here

Energy shares hit by US inventory data

Energy shares on the FTSE 100 and FTSE 250 have fallen this morning after the price of oil was hit last night by the American Petroleum Institute revealing that US crude stocks climbed by 851,000 when analysts were expecting a decline. Prices had recovered to above $46 per barrel after Brent crude entered a bear market last Wednesday.

FTSE 100

BP: 458.4p (-0.45pc)

Shell: 2078.5p (-0.5pc)

FTSE 250

Cairn Energy: 170.1p (-0.9pc)

Nostrum Oil & Gas: 471.4p (-1.7pc)

Tullow Oil: 150p (-1.1pc)

Traders digest latest comments from Bank of England official

The pound's current strength against the dollar and weakness against the euro is largely down to factors out of its control. The greenback is down against most of the major currencies today as president Donald Trump's healthcare reforms stumble and confidence in his ability to pass reforms to aid the US economy falls.

The euro's strength against the pound, however, can be attributed to the bullish Mario Draghi speech made at the ECB Forum in Sintra yesterday. Spreadex analyst Connor Campbell said that his "subtle shift in language when discussing stimulus was a (very, very) slight nudge towards hawkishness."

Accendo Markets analyst Mike Van Dulken commented:

" Strong GBP/USD is down to USD weakness rather than GBP strength, driven by a combination of ECB President Draghi driving the EUR higher with surprisingly hawkish rhetoric yesterday, more disappointing US data yesterday and yet another vote delay for Trump’s US healthcare bill sapping yet more confidence in his grand policy and stimulus plans."

Traders will also be digesting the latest comments from Bank of England deputy governor Sir Jon Cunliffe who has toed Mark Carney's line and said that now is not the right time for an interest rate rise. His comments come after the pound was boosted last week by the central bank's chief economist Andy Haldane saying that he might vote for a rate rise this year.

BoE's Cunliffe says sterling weakness makes rate-setting harder #Brexithttps://t.co/VPESXv7nX7

— Pedro da Costa (@pdacosta) November 16, 2016

Asset management shares fall following FCA proposal

Shares in asset management companies have fallen this morning after the Financial Conduct Authority proposed sweeping changes that will compel fund managers to provide better value for money, offer greater protection for investors, and drive competition in the market.

Hargreaves Lansdown has been the hardest hit this morning and is currently the worst performer on the FTSE 100. Its shares are down 42p, or 3.14pc, to 1295p.

Fascinating @TheFCA#assetmanagement paper this morning. Damning incitement of collusive industry?

— Alasdair Walker (@financialwalker) June 28, 2017

Read the full report by Jon Yeomans here

Overnight roundup and looking ahead

Overnight roundup

Technology stocks pulled down markets in the United States and Asia overnight with Alphabet, Google's parent company, dropping by 2.5pc on the Nasdaq following a record £2.1bn fine for abusing its internet search monopoly by promoting its own shopping comparison service.

US Federal Reserve chair Janet Yellen spoke in London after the markets closed yesterday and said that major reforms put in place after the global financial crisis had made another banking meltdown unlikely "in our lifetimes". The speech offered little comfort to the dollar which was down around 0.6pc against a basket of the ten leading currencies. The pound was relatively steady against the dollar overnight, holding onto gains made yesterday. The full report on Yellen's speech by Szu Ping Chan can be found here.

Good morning from Berlin! Tech rout hits Asia stocks. Bonds fall on rate bet. CenBanks key driver for markets. Draghi-inspired euro advance. pic.twitter.com/WNPKHuNWXj

— Holger Zschaepitz (@Schuldensuehner) June 28, 2017

Asia

NKY: 20,130 (-0.47pc)

HSI: 25,689 (-0.59pc)

SHZ300: 3,646 (-0.78pc)

United States

Dow: 21,310 (+0.07pc)

S&P 500: 2,419 (-0.81pc)

Nasdaq: 6,247 (-1.61pc)

Looking ahead

ECB president Mario Draghi's upbeat speech at the ECB Forum lifted the euro to a ten-month high against the dollar and to its highest rate against the pound since last November. Mr Draghi is due speak again later this afternoon as will Bank of England governor Mark Carney, who spoke yesterday after the central bank's release of its annual Financial Stability Report.

On the economics calendar the highlight is Nationwide's House Price Index, which showed that in June prices regained momentum, increasing by 1.1pc after three months of consecutive falls. Real estate stocks on the FTSE 100 have fallen this morning as investors digest the fresh data. Technology stocks have also started today's session down following last night's sell-off in the United States and Asia.

Sophie Christie's full report on the new house price data can be read here

Another busy day of CB speakers with ECB's Draghi, BoE's Carney & BoJ's Kuroda taking part in panel discussion at ECB Forum via @RANsquawkpic.twitter.com/dCbpolU2Yk

— Anthony Cheung (@AWMCheung) June 28, 2017

Full-year results: Xafinity, Imimobile, Creightons, Dixons Carphone, Stagecoach

Trading update: Bunzl, Tullow Oil, Kier Group

AGM: Medica Group, Air Partner, BNN Technology, President Energy, Katoro Gold Mining, EJV Investments

Economics: Nationwide HPI m/m (UK), goods trade balance (US), preliminary wholesale inventories m/m (US), pending home sales m/m (US), private loans y/y (EU), M3 money supply y/y (EU)

Yahoo Finance

Yahoo Finance