TEGNA (NYSE:TGNA) Misses Q1 Revenue Estimates

Broadcasting and digital media company TEGNA (NYSE:TGNA) missed analysts' expectations in Q1 CY2024, with revenue down 3.5% year on year to $714.3 million. It made a non-GAAP profit of $0.45 per share, down from its profit of $0.46 per share in the same quarter last year.

Is now the time to buy TEGNA? Find out in our full research report.

TEGNA (TGNA) Q1 CY2024 Highlights:

Revenue: $714.3 million vs analyst estimates of $718.9 million (small miss)

EPS (non-GAAP): $0.45 vs analyst estimates of $0.44 (3.2% beat)

Gross Margin (GAAP): 39.7%, down from 42.3% in the same quarter last year

Market Capitalization: $2.58 billion

“TEGNA remains focused on maximizing long-term value for our shareholders and delivering on our key priorities. We returned more than $100 million of capital to shareholders during the quarter and announced today that we are increasing our quarterly dividend by 10%,” said Dave Lougee, president and chief executive officer.

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Sales Growth

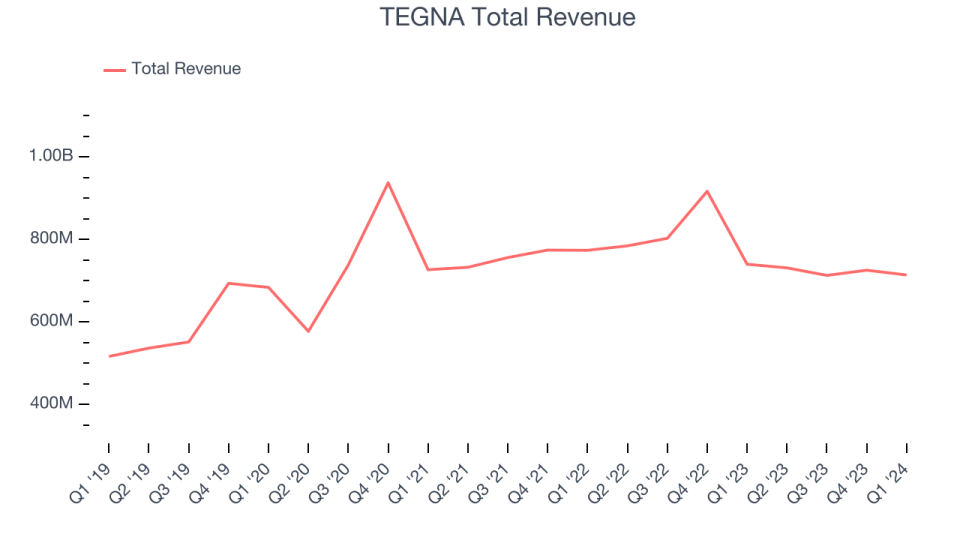

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. TEGNA's annualized revenue growth rate of 5.4% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. TEGNA's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 2.6% over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Subscription and Advertising, which are 52.5% and 41.8% of revenue. Over the last two years, TEGNA's Subscription revenue (access to content) was flat while its Advertising revenue (marketing services) averaged 6.2% year-on-year declines.

This quarter, TEGNA missed Wall Street's estimates and reported a rather uninspiring 3.5% year-on-year revenue decline, generating $714.3 million of revenue. Looking ahead, Wall Street expects sales to grow 12.4% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

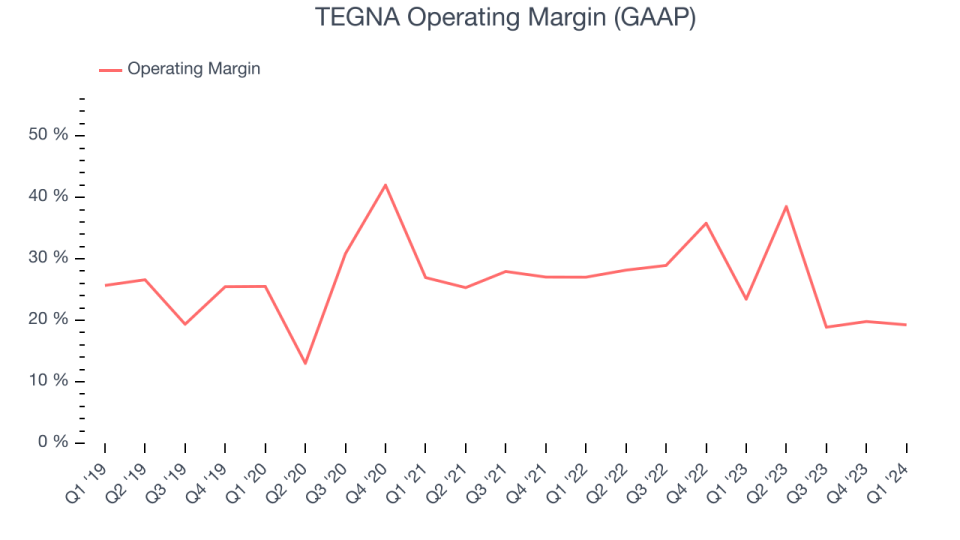

TEGNA has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 27%.

This quarter, TEGNA generated an operating profit margin of 19.3%, down 4.2 percentage points year on year.

Over the next 12 months, Wall Street expects TEGNA to become more profitable. Analysts are expecting the company’s LTM operating margin of 24.2% to rise to 27.8%.

Key Takeaways from TEGNA's Q1 Results

It was encouraging to see TEGNA slightly top analysts' EPS expectations this quarter. On the other hand, its Advertising revenue unfortunately missed and its operating margin fell short of Wall Street's estimates. Overall, the results could have been better. The stock is flat after reporting and currently trades at $14.65 per share.

TEGNA may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance