Teladoc Stock Rises 12% as Jefferies Boosts Price Target on BetterHelp

Teladoc Health’s TDOC shares rose nearly 12% on Tuesday after Jefferies raised its price target from $8 to $10 per share. Improving web traffic for BetterHelp, its mental health platform, was cited as the reason for the price target increase. Jefferies analyst team highlighted a 12% increase in BetterHelp's web traffic in July and August 2024, marking a huge reversal after a year of declines.

Jefferies maintained a bullish stance on Teladoc, focusing on the BetterHelp brand's short-term potential while cautioning against aggressive EBITDA estimates. However, despite the optimistic price target, concerns linger around the company's long-term growth trajectory. BetterHelp paying users declined 14.5% year over year in the second quarter of 2024. Higher traffic is expected to benefit TDOC with more sign-ups and conversions, leading to improved performance of the BetterHelp segment.

BetterHelp’s top line and adjusted EBITDA declined 9% and 26%, respectively, in the second quarter of 2024. TDOC withdrew its full-year 2024 guidance, BetterHelp guidance, and the three-year outlook. These are concerning factors for investors. However, chronic care program enrollment coupled with improving performance in the BetterHelp segment, might provide some respite to the company’s top line in the future. Teladoc Health’s operating revenues declined 1.5% year over year in the second quarter of 2024.

Teladoc's shares have seen significant volatility over the past year. The stock rose significantly during the COVID-19 period, and it has declined around 97% from its all-time high of $294. Improving prospects of the company might aid in restoring investor confidence in the stock and bringing stability to its stock price.

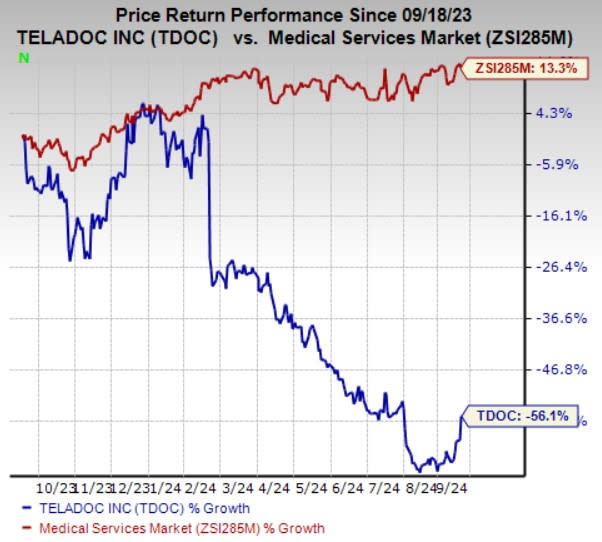

TDOC’s Zacks Rank & Price Performance

Teladoc currently carries a Zacks Rank #3 (Hold).

Shares of Teladoc have plunged 56.1% in the past year against the 13.3% growth of the industry.

Image Source: Zacks Investment Research

Stocks to Consider

Investors can look at some better-ranked stocks in the broader Medical space, like Universal Health Services, Inc. UHS, Tenet Healthcare Corporation THC and CareDx, Inc. CDNA. While Universal Health and Tenet Healthcare currently sport a Zacks Rank #1 (Strong Buy), CareDx carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Universal Health Services’ 2024 bottom line suggests 51% year-over-year growth. UHS witnessed seven upward estimate revisions over the past 60 days against no movement in the opposite direction. It beat earnings estimates in each of the last four quarters, with the average surprise being 14.6%.

The Zacks Consensus Estimate for Tenet Healthcare’s 2024 bottom line is pegged at $10.72 per share, which indicates 53.6% growth from a year ago. During the past 60 days, THC witnessed seven upward estimate revisions against none in the opposite direction. It beat earnings estimates in each of the last four quarters, with the average surprise being 58.5%.

The Zacks Consensus Estimate for CareDx’s current-year earnings implies a 140.6% improvement from the year-ago reported figure. CDNA beat earnings estimates in each of the last four quarters, with an average surprise of 114.6%. The consensus mark for its current-year revenues is pegged at $324.5 million, which indicates a 15.7% year-over-year increase.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Teladoc Health, Inc. (TDOC) : Free Stock Analysis Report

CareDx, Inc. (CDNA) : Free Stock Analysis Report