Telecom Stock Roundup: AT&T's AppNexus Buyout, BlackBerry Q1 Results & More

In the last five trading days, telecom stocks declined initially but recovered steeply thereafter, only to partially lose ground later in the week due to the still looming trade war fears with China.

The on-again off-again trade war between the United States and China continued to keep the stocks in hot water as both the warring nations vowed to impose tariffs and retaliatory tariffs on each other. The issue got even murkier as other European Union nations as well as allied countries like India and Canada decided to join in the fray and impose counter tariffs against the United States. The never-ending saga is likely to have no near-term solution as President Trump has threatened ‘reciprocity’ against trade partners who retaliate against it.

Meanwhile, some U.S. lawmakers continued to stonewall China’s telecom firm Huawei Technologies Co. Ltd. by urging Alphabet Inc.’s Google to reconsider its decision to maintain business relationship with it. Citing national security threats, they pleaded the telecom behemoth to sever ties with Huawei and protect the unlawful use of sensitive client data.

Regarding company-specific news, technology collaborations, acquisitions and new product launches ruled the roost over the last five trading days.

Recap of the Week’s Most Important Stories

1. Confirming industry grapevines, AT&T Inc. T has inked an agreement to acquire AppNexus, a technology firm that operates the world’s largest independent marketplace for digital advertising. The transaction is likely to be completed by the third quarter of 2018, subject to regulatory approvals and other mandatory closing conditions.

The acquisition will also offer the requisite wherewithal to better compete against its rival Verizon Communications Inc. VZ, which already has a significant presence in online advertising after its 2015 acquisition of AOL for $4.4 billion. (Read more: AT&T Acquires AppNexus to Boost Digital Advertising Business)

2. BlackBerry Limited BB reported solid financial results for first-quarter fiscal 2019 (ended May 31, 2018), driven by strong customer demand for its security-focused products, resulting in double-digit year-over-year software and services billing growth.

Non-GAAP net income was $17 million or 3 cents per share and beat the Zacks Consensus Estimate by a couple of cents. Quarterly GAAP revenues decreased 9.4% year over year to $213 million. The top line, however, surpassed the Zacks Consensus Estimate of $206 million. (Read more: BlackBerry Q1 Earnings & Revenues Top on Software Sales)

3. Viasat, Inc. VSAT has launched the fastest satellite Internet service for businesses across the United States. It is offering unlimited and metered data plan services with download speed ranging from 35 Megabits per second (Mbps) across most parts of the nation to 100 Mbps in select areas.

The ViaSat-2 service provides broadband speed across all plans with better coverage and enables businesses to stay connected for increased profitability. With the company’s broadband Internet plans, firms in far locations can leverage essential business applications. (Read more: Viasat Unveils the Fastest Satellite Internet Services in US)

4. Nokia Corporation NOK recently announced that it has entered into an agreement with IT firm, HCL Technologies, to streamline and modernize its outsourced IT management services. Per the five-year deal, HCL will integrate the services of four current vendors into a single IT services delivery and design framework with the help of a transformation roadmap.

With the synergistic partnership, Nokia expects to boost operational efficiencies and fulfill the previously set targets. The company believes that this deal is a strategic milestone in its transformation efforts, both in terms of increasing the efficiency of its IT operations as well as augmenting service delivery to customers. (Read more: Nokia Inks Deal With HCL to Transform IT Infrastructure)

5. Qualcomm Incorporated QCOM recently announced that it has launched the Snapdragon Wear 2500 platform, designed specifically for children’s smartwatches.

Watches built with this chip will support 4G connection and help children stay in touch with family, learn from its rich multimedia content, play games and stay active throughout the day. The optimized version of Android used in the platform will protect the wearers from malicious Internet content. (Read more: Qualcomm Unveils Snapdragon Wear 2500 Chip for Kids' Watches)

Price Performance

The following table shows the price movement of some of the major telecom stocks over the past week and during the last six months.

In the last five trading days, SBA Communications Corporation SBAC was the major gainer with its share price increasing 3.3%. Qualcomm was the major decliner with its stock losing 6.6%.

Over the last six months, Motorola Solutions, Inc. MSI was the best performer with its stock appreciating 21.7% while AT&T declined the most with its shares falling 22.8%.

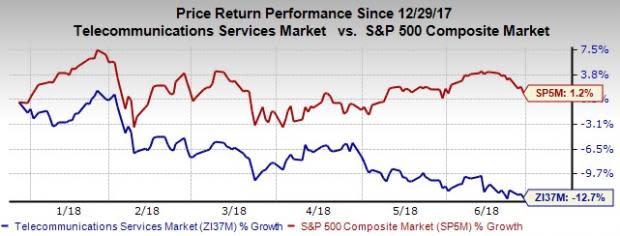

Over the last six months, the Zacks Telecommunications Services industry has underperformed the benchmark S&P 500 Index with a decline of 12.7% against a rise of 1.2% for the latter.

What’s Next in the Telecom Space?

In addition to continued product launches and deployment of 5G technologies, all eyes will remain glued to how the escalating U.S. tariffs reshape the trade relationships with other countries.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance