Teleflex (TFX) Expands Vascular Access Portfolio With New Launch

Teleflex TFX recently launched the Arrow EZ-IO Intraosseous Access Procedure Tray, which contains all the components required for the IO access procedure. The tray includes the first FDA-cleared sterile, single-use, battery-powered driver, which provides clinicians with an IO access option that can be used in a sterile field in the operation room and any other area of the hospital that requires a sterile field.

Enabling a streamlined clinician workflow, the latest development is also expected to enhance the company’s Vascular Access product category.

News in Detail

Teleflex’s newest IO access product reflects its commitment to innovation, helping clinicians and elevating patient care in challenging vascular access situations. Delayed vascular access can result in treatment delays, which can lead to adverse outcomes. The Arrow EZ-IO Intraosseous Access System can be used when intravenous access is difficult or impossible to obtain in emergent, urgent or medically necessary cases.

The tray is packaged with an Arrow EZ-IO Intraosseous Needle Set (15mm, 25mm or 45mm), which is designed to help ensure a fast, precise and steady insertion. Additional components include a Ppre-filled saline syringe and a ChloraPrep Frepp Clear applicator, EZ-Stabilizer Dressing, an EZ-Connect Extension Set, a SharpsAway II Locking Sharps Disposal Cup and an EZ-IO Patient Wristband. Alongside this, a quick reference guide is printed on the underside of every tray lidstock.

Image Source: Zacks Investment Research

Teleflex developed the Arrow EZ-IO Procedure Tray in response to healthcare professionals' daily challenges, aiming to introduce a solution that combines their industry-backed IO access device with enhanced convenience. The design of the tray is suitable for compact storage on hospital shelving and is small enough to fit in any code cart. Clinicians now have a choice between the reusable Arrow EZ-IO Power Driver and the new single-use tray.

Industry Prospects

Per a Research report, the Intraosseous Infusion device market was valued at $1 billion in 2023 and is likely to surge at 5.4% CAGR through 2030.

The market is rapidly growing owing to an increase in emergency care cases and the prevalence of chronic conditions such as severe accidents and cardiovascular ailments, among others. Moreover, the rising incidences of cardiovascular disorders, along with technologically advanced new products and approvals, are set to fuel future growth.

Notable Developments

In the first quarter of 2024, the Vascular Access division reported underlying growth in PICCs (Peripherally Inserted Central Catheters), Central Access and EZ-IO Intraosseous Vascular Access System, partially impacted by the Endurance recall. Teleflex continues to see opportunities for share gains in peripheral access markets, and the new product initiatives are likely to play a role.

Last month, the company expanded its structural heart portfolio through the limited market release of the Wattson Temporary Pacing Guidewire. Featuring a simple design to create procedural efficiencies, the bipolar Guidewire offers dual functionality, supporting both valve delivery and ventricular bipolar pacing during structural heart procedures, including transcatheter aortic valve replacement (TAVR) and balloon aortic valvuloplasty (BAV).

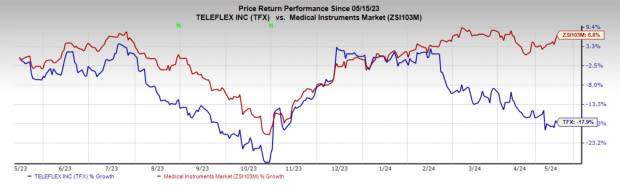

Price Performance

In the past year, TFX shares have decreased 17.9% against the industry’s rise of 6.8%.

Zacks Rank and Key Picks

Teleflex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, High Tide HITI and ResMed RMD. While Hims & Hers Health and High Tide each sport a Zacks Rank #1 (Strong Buy), ResMed carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hims & Hers Heath stock has increased 14.1% in the past year. Earnings estimates for the company have risen from 10 cents to 18 cents in 2024 and from 23 cents to 32 cents in 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for High Tide’s 2024 earnings per share have remained breakeven in the past 30 days. Shares of the company have surged 72% upward in the past year against the industry’s fall of 3.2%.

HITI’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 91.7%. In the last reported quarter, it delivered an earnings surprise of 100%.

Estimates for ResMed’s fiscal 2024 earnings per share have moved up 2% to $7.59 in the past seven days. Shares of the company have fallen 8% in the past year compared with the industry’s 3.2% decrease.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 2.8%. In the last reported quarter, it delivered an average earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

High Tide Inc. (HITI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance