Telephone and Data Systems Inc (TDS) Q1 2024 Earnings: Revenue Declines but Net Income Surges, ...

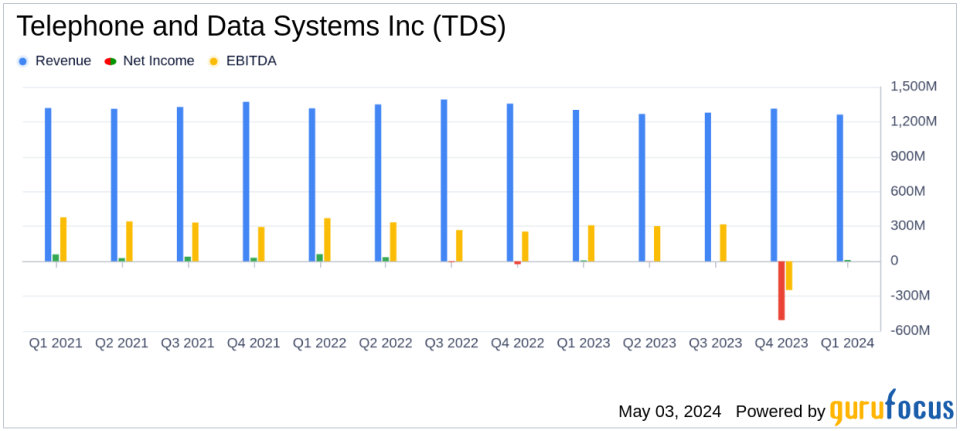

Revenue: Reported $1,262 million for Q1 2024, a decrease from $1,303 million in the previous year, exceeding estimates of $1,255.79 million.

Net Income: Achieved $12 million, significantly surpassing the estimated $10 million.

Earnings Per Share (EPS): Recorded at $0.10, exceeding the estimated -$0.05.

UScellular Segment: Noted a 2% decrease in service revenues, but postpaid ARPU grew by 3% and net income showed significant improvement.

TDS Telecom Segment: Delivered 28,000 fiber service addresses in Q1, with residential broadband connections up by 6% and operating revenues growing by 5%.

Strategic Review: Exploration of strategic alternatives for UScellular continues, aiming to enhance shareholder value.

2024 Guidance: Reaffirmed, with no changes to previous estimates for both UScellular and TDS Telecom segments.

On May 3, 2024, Telephone and Data Systems Inc (NYSE:TDS) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company, a diversified telecommunications operator known for its UScellular and TDS Telecom segments, reported a mixed financial performance with a notable increase in net income despite a slight revenue decline.

Financial Overview

For Q1 2024, TDS posted operating revenues of $1,262 million, a decrease from $1,303 million in the same quarter the previous year. However, the company experienced a significant turnaround in profitability, with net income attributable to common shareholders rising to $12 million, or $0.10 per share, compared to a loss of $9 million, or -$0.08 per share, in Q1 2023. These figures are consistent with analyst expectations, which anticipated an earnings per share of -$0.05 and a net income of $0.10 million.

The revenue of $1,262 million, although slightly below the estimated $1,255.79 million, reflects the competitive pressures and operational challenges in the telecommunications industry.

Segment Performance and Strategic Initiatives

UScellular, TDS's largest revenue generator, reported a 2% decrease in service revenues, although it achieved a 3% growth in postpaid Average Revenue Per User (ARPU) and a significant reduction in postpaid churn rate by 4%. The segment also saw a 42% increase in fixed wireless customers, now totaling 124,000. Despite losing postpaid customers, improvements in ARPU and cost optimization efforts have bolstered profitability.

TDS Telecom demonstrated robust growth, particularly in the residential broadband sector, where connections grew by 6%. This segment delivered 28,000 new fiber service addresses in the quarter and is on track to meet its annual target of 125,000. The growth in residential revenues, which increased by 10%, and a significant rise in Adjusted EBITDA, underscore the successful expansion and customer acquisition strategies in place.

Exploration of Strategic Alternatives for UScellular

In a major strategic move, TDS and UScellular are exploring a range of strategic alternatives for UScellular to enhance shareholder value. This review is ongoing and reflects the company's proactive approach to navigating a highly competitive market landscape.

Outlook and Guidance

TDS has reaffirmed its full-year 2024 guidance for both UScellular and TDS Telecom, indicating confidence in its strategic plans and operational adjustments. The company expects unchanged service revenues and Adjusted EBITDA for UScellular and stable operating revenues and Adjusted EBITDA for TDS Telecom.

Conclusion

Telephone and Data Systems Inc's first quarter results of 2024 reflect a resilient operational model capable of navigating industry challenges. With strategic reviews and robust segment performances, particularly in broadband expansion, TDS is positioning itself for sustainable growth. Investors and stakeholders may find reassurance in the company's steady guidance and strategic initiatives aimed at long-term value creation.

For detailed financial metrics and further information, visit TDS's investor relations page or access the full earnings report through the provided link above.

Explore the complete 8-K earnings release (here) from Telephone and Data Systems Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance