Should You Be Tempted To Sell YouGov plc (LON:YOU) Because Of Its P/E Ratio?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll show how you can use YouGov plc's (LON:YOU) P/E ratio to inform your assessment of the investment opportunity. YouGov has a P/E ratio of 50.49, based on the last twelve months. That is equivalent to an earnings yield of about 2.0%.

Check out our latest analysis for YouGov

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for YouGov:

P/E of 50.49 = £5.52 ÷ £0.11 (Based on the year to January 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each £1 the company has earned over the last year. That isn't a good or a bad thing on its own, but a high P/E means that buyers have a higher opinion of the business's prospects, relative to stocks with a lower P/E.

Does YouGov Have A Relatively High Or Low P/E For Its Industry?

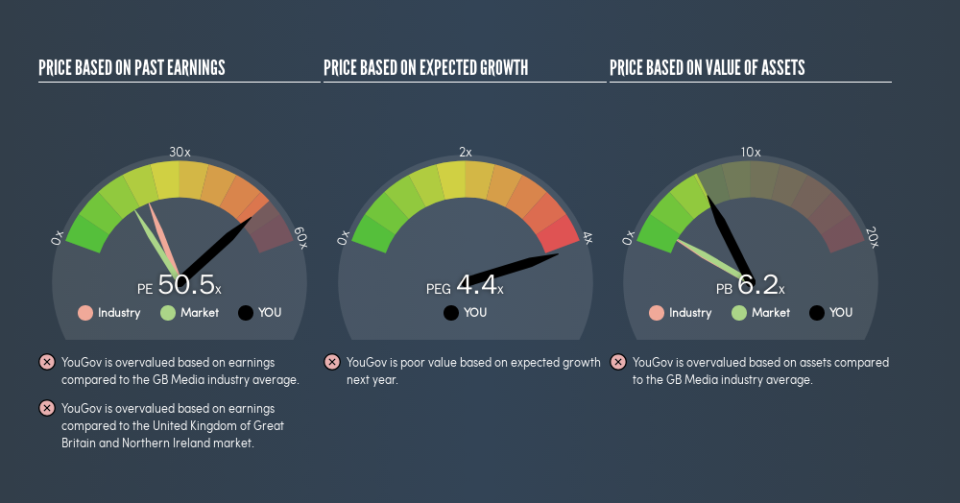

We can get an indication of market expectations by looking at the P/E ratio. The image below shows that YouGov has a higher P/E than the average (20.9) P/E for companies in the media industry.

YouGov's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Shareholders are clearly optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means unless the share price increases, the P/E will reduce in a few years. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

YouGov's 108% EPS improvement over the last year was like bamboo growth after rain; rapid and impressive. The sweetener is that the annual five year growth rate of 47% is also impressive. With that kind of growth rate we would generally expect a high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

How Does YouGov's Debt Impact Its P/E Ratio?

YouGov has net cash of UK£25m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Verdict On YouGov's P/E Ratio

With a P/E ratio of 50.5, YouGov is expected to grow earnings very strongly in the years to come. The excess cash it carries is the gravy on top its fast EPS growth. To us, this is the sort of company that we would expect to carry an above average price tag (relative to earnings).

Investors have an opportunity when market expectations about a stock are wrong. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

But note: YouGov may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance