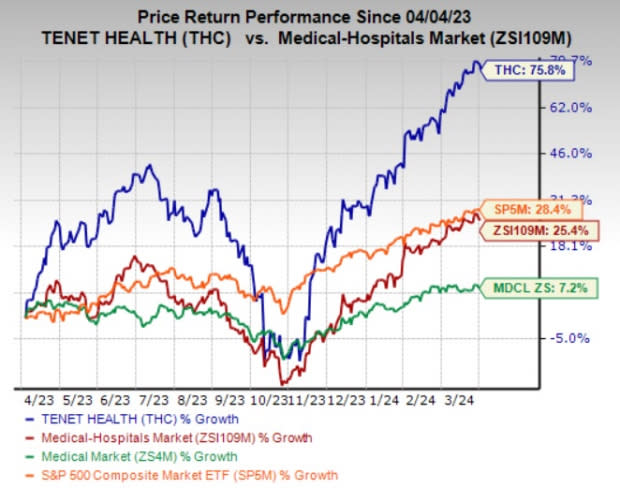

Tenet Healthcare (THC) Soars 76% in a Year: What Lies Ahead?

Shares of Tenet Healthcare Corporation THC have surged 75.8% in the past year compared with the industry’s 25.4% increase. The Medical sector has gained 7.2% while the S&P 500 composite index has risen 28.4% in the said time frame. With a market capitalization of $10.3 billion, the average volume of shares traded in the last three months was 1.2 million.

Growing admissions and hospital surgeries, acquisitions, divestitures of facilities not core to its long-term growth and an impressive financial position continue to drive Tenet Healthcare.

This diversified healthcare services company, carrying a current Zacks Rank #3 (Hold), boasts an impressive track record of beating estimates in each of the trailing four quarters, the average surprise being 31.58%.

Image Source: Zacks Investment Research

Can THC Retain the Momentum?

The Zacks Consensus Estimate for 2024 earnings is pegged at $6.09 per share, which has witnessed four upward estimate revisions in the past 60 days against three in the opposite direction. The estimate has improved 3.6% during this period.

The consensus estimate for 2025 earnings is $6.71 per share, which indicates an improvement of 10.2% from the 2024 estimate. The consensus mark for revenues is pegged at $21 billion, suggesting 4.2% growth from the 2024 estimate.

Revenues of Tenet Healthcare continue to benefit from growth in adjusted admissions and hospital surgeries. In 2023, the metrics improved 2.5% and 0.6%, respectively, on a year-over-year basis. Improved patient volumes bode well for any healthcare facility operator like THC.

Management anticipates revenues between $19.9 billion and $20.3 billion for 2024. The resumption of deferred elective procedures is likely to sustain growing revenues from THC’s extensive network of surgery centers in the days ahead. At the end of 2023, Tenet Healthcare’s subsidiary, USPI, had interests in more than 460 ambulatory surgery centers (ASCs) and 24 surgical hospitals across 35 states.

Tenet Healthcare resorts to acquisitions and partnerships to bolster its capabilities, grow the care network and expand its geographical presence. It purchased controlling ownership interests in 20 ASCs and inaugurated nine de novo ASCs in 2023.

To refine its portfolio and better direct capital to areas that fetch a higher return, THC undertakes divestitures and targets to get rid of business units not core to the long-term growth strategy. The proceeds derived from divestitures are often used for paying off the debt level and bringing down the mounting interest expense. Since the beginning of 2024, it had sold four Orange County and Los Angeles County hospitals to UCI Health, two San Luis Obispo County hospitals to Adventist Health and three South Carolina hospitals to Novant Health.

To pursue business investments, a solid financial position is a dire need. Tenet Healthcare’s financial strength is substantiated by a strong cash balance and robust cash-generating abilities. The healthcare provider generated cash from operations worth $2.4 billion in 2023, which more than doubled year over year. Its leverage ratio has been improving for four straight years. Total debt to total capital of 82.8% at the fourth-quarter end remained below the industry’s figure of 92.7%.

Tenet Healthcare boasts an impressive VGM Score of A. VGM Score helps identify stocks with the most attractive value, the best growth and the most promising momentum.

Stocks to Consider

Some better-ranked stocks in the Medical space are Ligand Pharmaceuticals Incorporated LGND, Edwards Lifesciences Corporation EW and The Pennant Group, Inc. PNTG. While Ligand Pharmaceuticals currently sports a Zacks Rank #1 (Strong Buy), Edwards Lifesciences and Pennant carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand Pharmaceuticals’ earnings surpassed estimates in each of the last four quarters, the average surprise being 84.81%. The Zacks Consensus Estimate for LGND’s 2024 earnings indicates an improvement of 12.3% from the prior-year tally. The consensus mark for revenues suggests an improvement of 6% from the year-ago actual. The consensus mark for LGND’s 2024 earnings has moved 3.2% north in the past 30 days.

The bottom line of Edwards Lifesciences beat estimates in two of the trailing four quarters and missed the mark twice, the average beat being 0.80%. The Zacks Consensus Estimate for EW’s 2024 earnings indicates a rise of 10% from the year-ago figure. The consensus mark for revenues suggests an improvement of 8.6% from the prior-year tally. The consensus mark for EW’s 2024 earnings has moved 0.7% north in the past 60 days.

Pennant’s earnings outpaced estimates in two of the trailing four quarters, matched the mark once and missed the same in the remaining one occasion, the average surprise being 1.11%. The Zacks Consensus Estimate for PNTG’s 2024 earnings indicates an improvement of 19.2% from the year-ago actual. The consensus mark for revenues suggests 11.5% growth from the year-ago actual. The consensus mark for PNTG’s 2024 earnings has moved 1.2% north in the past seven days.

Shares of Ligand Pharmaceuticals, Edwards Lifesciences and Pennant have gained 3%, 13% and 44.4%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

The Pennant Group, Inc. (PNTG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance