Tesco's record festive trading hurt by Palmer & Harvey collapse

Tesco has fallen short of City expectations after record Christmas food sales were blown off course by lost tobacco sales caused by the demise of wholesaler Palmer & Harvey.

Britain’s biggest retailer recorded a 2.1pc rise in UK like-for-like sales in the 19 weeks to January 6, below forecasts. Analysts had been expecting Tesco to be crowned the festive winner with much higher sales of 2.8pc.

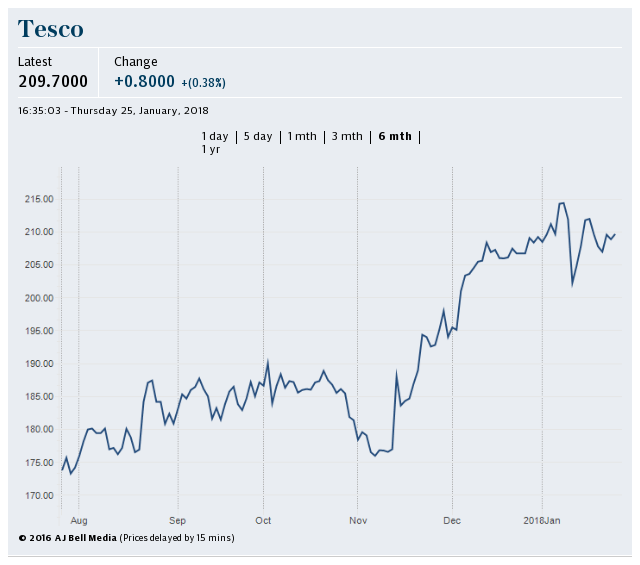

Shares in Tesco dipped by 4.5pc to 202.3p.

The supermarket said that it had enjoyed record sales and volumes in the four weeks leading up to Christmas as its fresh food sales jumped by 4pc, outperforming the market. Tesco credited the strength of its party food offer, which included cheese boards, sales of whole smoked salmon and its "Free From" range, contributing to an overall 3.4pc lift in food sales over the 19 weeks.

However its strong grocery performance was held back by a 0.6pc fall in general merchandise after lacklustre sales of laptops and video consoles and another 0.6pc hit from lost tobacco sales.

Palmer & Harvey, which counted on Tesco for 40pc of its revenues, tumbled into administration in November, triggering the immediate loss of 2,500 jobs. The supermarket has now revealed the disruption to the business caused by trying to replicate the wholesaler's distribution network and source cigarettes and rolling papers directly from the tobacco makers.

Dave Lewis, Tesco chief executive, said that the lost tobacco sales "took the shine off an otherwise outstanding performance for the period as a whole".

He added that the complexity of having to arrange alternate deliveries to replace the service previously supplied by Palmer & Harvey during the peak period was "challenging" and put "further strain into our distribution network, particularly post-Christmas". Mr Lewis said that the issues had now been resolved, indicating that there would be no impact in the following quarter.

The Tesco boss said that he was still confident for the full-year. “The long-term momentum in our business continues,” he added after posting a fourth consecutive rise in Christmas sales.

Tesco also revealed that it had enjoyed the strongest quarterly performance at its vast Extra hypermarkets, with like-for-like sales up by 1.8pc over the period, a 2.3pc rise in its convenience shops and 5pc growth online with over four million orders over the six weeks leading up to Christmas.

Mr Lewis said that “consumer sentiment has changed” in the past year as household budgets were squeezed by rising food and fuel prices but he added that he saw “inflation was abating” in the second half of the year.

Tesco said that it had passed on less inflation than its competition, but did not include discounters Aldi or Lidl in its analysis.

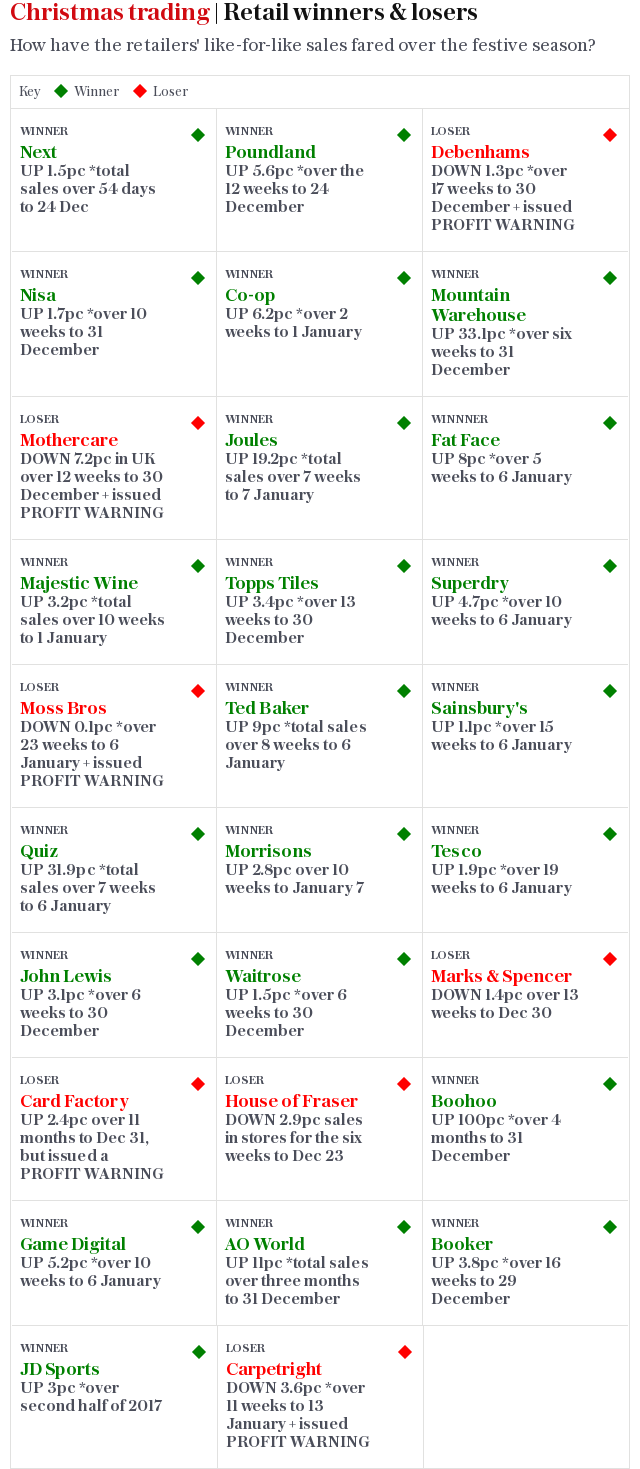

Rival Sainsbury's on Wednesday recorded a 1.1pc lift in like-for-like sales after slowing growth in its Argos division while Morrisons beat City forecasts with a 2.8pc rise in like-for-like sales.

Grocers have performed better than fashion retailers over the festive period as shoppers have reined in spending amid rising fuel and food prices. Figures from Nielsen said shoppers spent £10.5bn on groceries in the four weeks to December 30, 3.7pc more than last year.

Meanwhile Booker, the wholesaler that Tesco is buying for £3.7bn, recorded a 3.8pc lift in group like-for-like sales over the 16 weeks to December 29. Stripping out tobacco sales, which continue to be a drag on the business, like-for-like sales rose by 6.2pc, helped by "good progress" at its Premier, Londis and Budgens convenience shop brands.

Yahoo Finance

Yahoo Finance