Tesco looks to Booker for growth as profits rebound

Tesco expects to grow its revenues by an additional £2.5bn by integrating its recent acquisition Booker, as the supermarket beat City forecasts with its first set of accounts since the £3.7bn deal.

The UK's biggest retailer posted pre-tax profit of £1.3bn in the year to Feb 24, up 795.2pc on the previous year's £145m and above analyst expectations of £1.2bn. Group sales were up 2.3pc at £51bn last year compared with the previous year.

Despite the massive jump from last year, the figures still come in below Tesco’s 2013-2014 peak, when it reported £3bn in underlying pre-tax profits.

It will pay a final dividend of 2p a share, which combined with the half-year payout amounts to 3pc a share for the year, its first end-of-year dividend in five years.

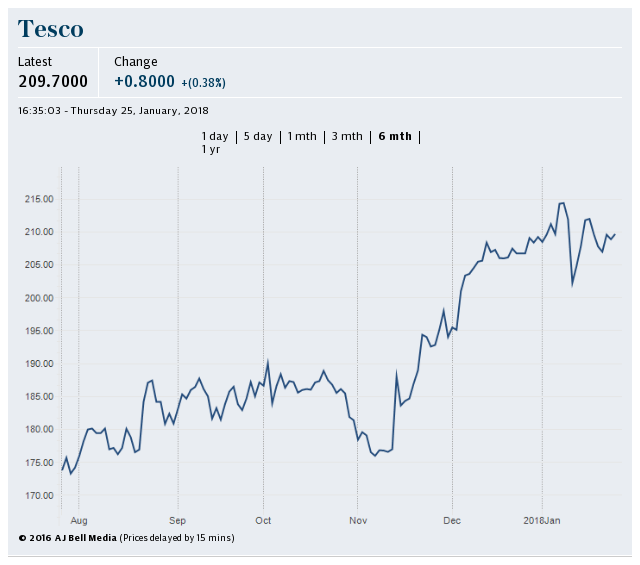

Tesco shares climbed 5pc in morning trade to 221.6p, their highest level in three years.

The results cement the turnaround steered by Tesco chief executive Dave Lewis, who has led a massive overhaul of the business, selling off overseas divisions, cutting thousands of management jobs and slashing prices in a bid to lure back customers.

The retailer completed its £3.7bn acquisition of Booker last month and said that its integration with the wholesaler was "well under way". The company also identified a £2.5bn revenue growth "opportunity" from the tie-up and expects synergies of £60m within the first year. These would grow to around £140m by the second year and reach £200 each year by the end of the third year, though it dampened analyst expectations of more savings.

Sales at Booker outlets open for more than a year were up 9.9pc. Tesco said it expected Booker's operating profit before exceptional items for the year to March 30 to come in at about £195m.

Mr Lewis said “The performance of the Booker business has been fantastic over the long period [and during] the merger process”.

After years of falling prices grocers have been performing better of late, in stark contrast to non-food retailers, which have struggled on the high street. This year has seen the closure of Toys R Us and Maplin while a number of clothing retailers and restaurant chains have been forced to renegotiate rents and close sites.

In the UK, Tesco's biggest market, sales at shops open more than a year rose 2.2pc, marking its ninth consecutive quarter of growth. UK sales rose for the second year in a row, to £38.7bn.

Tesco credited the popularity of its own-brand food, which chalked up like-for-like sales growth of 4.2pc during the year. It revamped 10,000 products, starting with its ready meals.

It has also invested in its "farm brands", growing sales to £550m in three years - despite controversy at the outset, when it was revealed its packaging alluded to fictional farms. Critics had claimed the “disingenuous” branding gave the impression it came from real farms.

"The decision to invest in the farm brands was a big deal," said Mr Lewis. "It was an awful lot of money."

But he said that it had been a "phenomenal" category for the food division.

The supermarket has also cut 5,900 management roles in the past three years, adding 18,443 more customer-facing staff and, after freezing wages three years ago, it is resuming paying bonuses and pay rises, Mr Lewis said.

“We’re more competitive now than we were three years ago,” he said.

The company has also been working to reduce its debt burden, halving its pension deficit to £2.7bn from £5.5bn.

Last year's profits were dented by a £129m fine from the Serious Fraud Office, as part of a deferred prosecution agreement that meant the grocer itself avoided prosecution over an accounting scandal in 2014. It also agreed to pay £85m in compensation to shareholders.

The SFO is seeking a retrial of three former Tesco bosses over allegations of fraud and false accounting, after the previous trial was abandoned when one of the accused suffered a heart attack.

The former executives are accused of cooking the retail giant’s books, leaving it with a £250m accounting black hole. The discovery wiped £2bn from Tesco’s market value. All three have denied wrongdoing.

The results were well received by the market. Retail analyst Thomas Brereton, of GlobalData, said that the "whopping" profit leap indicates "that the grocer has successfully fought intense competition from both discounters Lidl and Aldi and has seemingly shrugged off macro-economic issues that have affected the majority of UK retailers".

"Tesco looks well placed to maintain its position as the formidable force in UK retail and weather future troubles that may extinguish other household names," he added.

Yahoo Finance

Yahoo Finance