Tesco and M&S tumble on retail 'Super Thursday' as festive sales suffer

Tesco and Marks & Spencer slump to the bottom of the FTSE 100 on retail 'Super Thursday' as festive sales miss City expectations; host of retailers including John Lewis, Boohoo, Card Factory and Game Digital report mixed bag of results

M&S shares slip 3.3pc after suffering declines in both its clothing and food departments as inflation-squeezed consumers tightened their belts

Tesco's sales growth misses analyst estimates; its share price tumbles 3pc

Card Factory tanks as much as 22pc on profit warning as margins tighten

Bond market jitters suppress stocks but miners help the FTSE 100 inch into positive territory

Bitcoin's slide continues on South Korea regulatory fears; shed 20pc in just four days

House of Fraser's Chinese owner pledges support despite festive sales tumble

House of Fraser's Chinese owner has reasserted his support for the struggling department store chain amid growing concerns about the health of the business and a slump in festive trading.

The department store suffered a 4pc slide in total sales over the six weeks to Dec 23 after deciding to protect profit margins by reducing its level of internet discounting.

As result store sales fell by 2.9pc while online sales tumbled by 7.5pc - putting the department store at odds with an industry trend that has seen shoppers migrate to the internet.

House of Fraser boss Alex Williamson, who joined the retailer from Goodwood in July, said that online profitability was the same as last year after reducing the amount of discounted, loss-making stock on the web.

Read Ashley Armstrong's full report here

South Korea clampdown slashes Bitcoin's price

Bitcoin is getting pummeled again https://t.co/WFbqUWpOAXpic.twitter.com/ocNX3xiBXL

— Thomas Biesheuvel (@tbiesheuvel) January 11, 2018

Analysts are pinning this week's slump in the price of Bitcoin on South Korea's plan to ban cryptocurrency trading and the digital currency is now on course for its worst week since rising to prominence.

It suffered a worse week in 2015 when the price was meandering between $200-$300 per Bitcoin but that slide is a minute blip on a graph compared to the $3,000 plunge it has suffered this week.

ETX Capital analyst Neil Wilson believes the most recent tumble should make investors sit up and take note.

He said:

"Such swings are fairly commonplace, however, so it’s worth looking at whether this move by the South Korean government is simply another minor road bump to be sped over, or is something far more serious for the crypto boom.

"In short, the world’s third largest crypto market plans to ban all trading in Bitcoin etc. We’ve seen South Korea get more nervous about the amount of speculation but this ‘nuclear option’ was a little surprising, particularly as there were reports this week that South Korea was seeking to work with Japan and China on crypto trading rules."

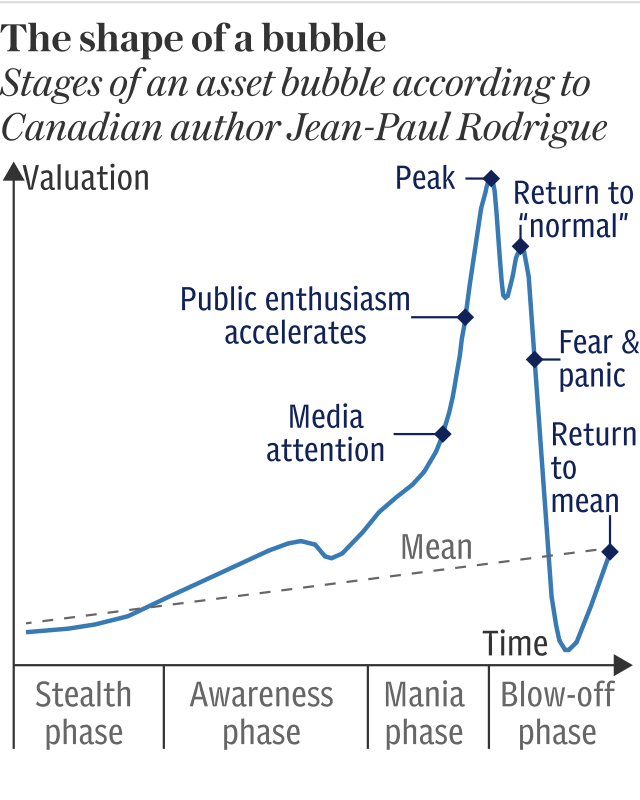

Bitcoin and asset bubble theory graphs uncannily similar

In 2008, when Dr Jean-Paul Rodrigue at Hofstra University in New York published his graph of a classic asset bubble, Bitcoin was still just a concept theorised in a paper written by a pseudonym called Satoshi Nakamoto.

Following its 20pc slide this week, the relationship between Mr Rodrigue's graph and Bitcoin's price is uncanny.

And if the graph continues to be correct, it looks like a grim 2018 for Bitcoin.

Miners help offset sliding retailers on FTSE 100

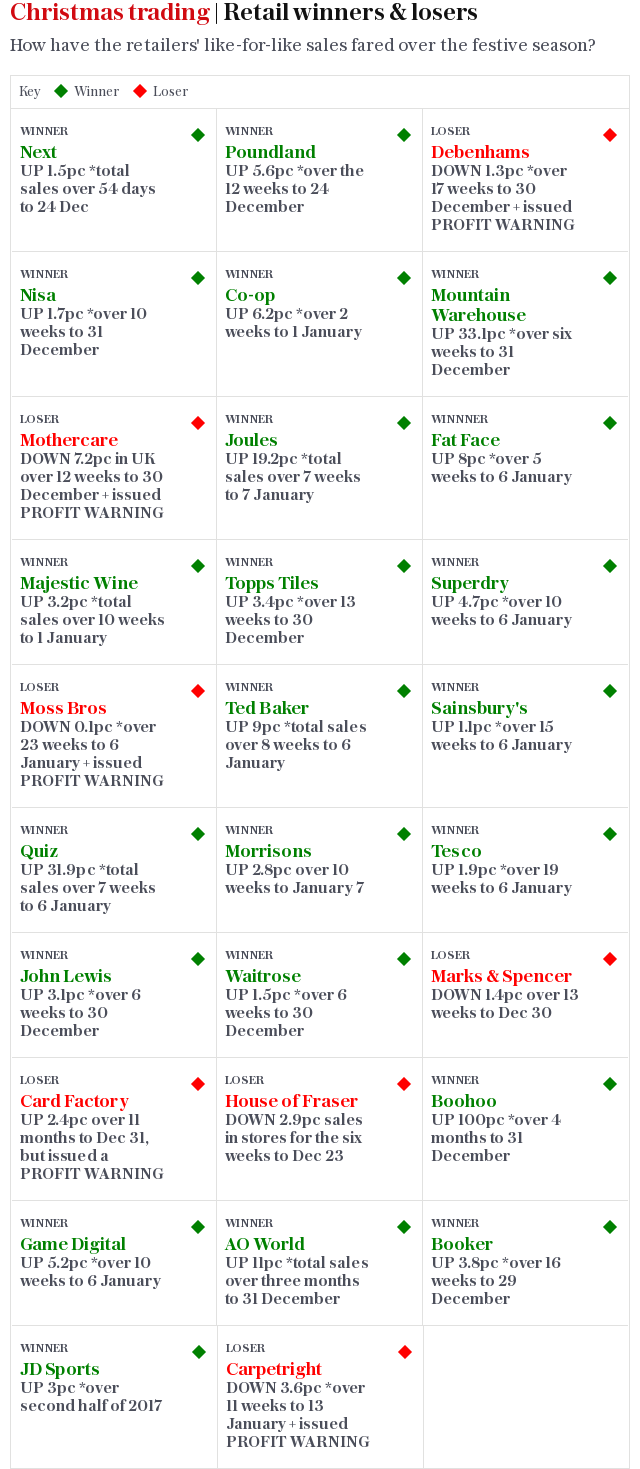

I think the greens probably have it on that handy retail sales grid below but that wash of green is undoubtedly littered with a few big red profit warnings from the likes of Debenhams and Mothercare.

We'll have the complete picture of how the sector performed over the Christmas period by the end next week with Primark owner Associated British Foods, Dunelm and JD Sports all due to report sales figures.

Tumbling retailers are weighing on the FTSE 100 this morning, which has squeezed into record breaking territory once again thanks to its heavy weighting of rising mining stocks.

IG's Chris Beauchamp gave his two cents on the results at Tesco and Marks and Spencer:

"Both these UK stalwarts have given investors reason to worry, although Tesco is perhaps more at fault for not being more conservative on guidance.

"For M&S however, the picture goes from bad to worse. Everyone seems to have abandoned their Simply Food stores for other supermarkets, removing the one real positive in the numbers over the last few years."

Who were the high street's Christmas turkeys and crackers?

If that huge batch of retail figures is a bit too much to take in, do not fear.

Here's a handy grid of who were the high street's Christmas turkeys and crackers.

Card Factory tumbles on profit warning as margins tighten

Greetings card retailer Card Factory is enduring its worst day of trading since listing after it warned that profits will be hit by tightening margins.

You would have no idea that profits were sinking from chief executive Karen Hubbard's chipper tone. She said that the company had traded well over the Christmas period in a competitive environment and added that cost headwinds putting margins under pressure should begin to ease soon unless the pound dramatically moves again.

After sinking as much as 22pc, the firm is the worst performer on London's main market this morning while yo-yoing outsourcer Carillion is close behind after tumbling 9.5pc as investors eagerly await news on its turnaround plan. The company's management was meeting with lenders and key investors yesterday but the news no-show this morning has sent its shares sliding once again.

Card Factory shares slump 20.6% after it issues a profit warning, despite the seemingly upbeat tone in its press release. Hmmm

— Garry White (@GarryWhite) January 11, 2018

Tesco extends slide on FTSE 100 despite record Christmas results

A mixed bag of retail news this morning. Xmas disappointing for M&S, clothing down again and poor performance in food. Tesco sales up, not as much as expected. John Lewis firmly in the winners camp. Waitrose sales up, but weaker than other players.

— Emma Simpson (@BBCEmmaSimpson) January 11, 2018

Great set of results far from Tesco, continued out performance versus the sector and growth on growth. What a job Dave Lewis has done.

— Steve Dresser (@dresserman) January 11, 2018

M&S and Tesco's slide on the FTSE 100 is quickening and housebuilding shares are also coming under pressure after FTSE 100 company Barratt Developments became the latest in the sector to report slowing sales.

Sales at Tesco might have hit a record high at Christmas but is missing the City's lofty expectations a blot on Tesco chief executive Dave Lewis' impressive copybook?

Accendo Markets analyst Henry Croft argued that his strategy is "yielding results" but that weak general merchandise sales dragged down strength in its food division.

The figures show that Tesco is still crucially holding its ground against fierce competition from the likes of Aldi and Lidl, however, commented Martin Lane, managing editor of Money.co.uk.

A 4.4pc share price slump for Tesco feels pretty harsh on the back of record results.

John Lewis warns of 'volatile' economy despite record Black Friday sales

A record Black Friday helped John Lewis post strong growth in the run up to Christmas but the employee-owned retailer warned intense competition and a "volatile" economy would weigh on its full-year results.

Sales at John Lewis Partnership, which includes Waitrose, climbed 2.5pc to around £2bn in the six weeks to December 30, boosted by 3.6pc growth at its department store chain.

Black Friday was the biggest day of sales in John Lewis’s history, with revenues that week up 7.2pc year-on-year. Electricals climbed 5pc across the period, and clothes were up by a similar amount, but homeware dipped 0.3pc.

Read Jack Torrance's full report here

Supermarket premium ranges snatch sales from M&S

Marks & Spencer group LFL down 1.4% disappointing -0.4% drop in clothes and -2.8% fall in clothing & home following tough October

— Ashley Armstrong (@AArmstrong_says) January 11, 2018

Marks & Spencer profits down? No wonder if they are charging £2.50 for a slice of cauliflower marketed as cauliflower steak!

— World Watcher (@world360view) January 11, 2018

Are Debenhams and Marks and Spencer's sales woe just a reflection of squeezed consumers hunting for cheaper deals?

John Lewis' Black Friday-boosted sales figures this morning suggests that there was a path to success for higher end stores.

Hargreaves Lansdown analyst Laith Khalaf argues that the sales slump at M&S is mainly due to "wider economic trends" and that the strong performance of supermarkets' premium ranges suggests that shoppers are splashing out at the likes of Morrisons and Sainsbury's rather than at M&S.

M&S sales fall as shoppers on 'tighter budgets' look elsewhere

Marks & Spencer’s revenues fell in the months leading up to Christmas as consumers with “tighter budgets” shopped elsewhere.

Sales at UK stores open more than one year dived 1.4pc in the 13 weeks to December 30, in what chief executive Steve Rowe described as a “mixed quarter”. Shares in the retailer were down 2.93pc in early trade at 314.30p.

The high street stalwart’s long-suffering clothing and home division suffered a 2.8pc like-for-like decline, which it blamed on October’s unusually warm weather.

Read Ashley Armstrong and Jack Torrance's full report here

Boohoo lifts sales guidance as revenue doubles

Online fast fashion retailer Boohoo has upped its sales guidance for the year after revenues doubled.

The company, which also owns the PrettyLittleThing and Nasty Gal brands, said it now expects revenue growth of 90pc in the financial year after sales grew 100pc to £228m in the four months to December.

Mahmud Kamani and Carol Kane, joint executives, said: “The Black Friday period was our most successful ever and we traded well throughout the period. Boohoo has continued to perform well, delivering strong revenue growth on increasingly challenging comparatives last year.”

Report by Jack Torrance

Agenda: Tesco and M&S tumble on retail 'Super Thursday' as festive sales suffer

The UK's biggest supermarket Tesco and high street stalwart Marks & Spencer have tumbled to the bottom of the FTSE 100 on retail 'Super Thursday' after their festive sales missed City estimates.

While John Lewis and fast fashion e-tailer Boohoo beat expectations, M&S joins department store Debenhams and baby retailer Mothercare on the list of retailers seeing their sales shrink as consumer tighten their belts while Tesco's sales growth came in below analyst expectations.

New Year rally in Asia petered out due to concerns about rising US protectionism, while bonds rebounded after #China called a report about Beijing slowing of its US bond buying wrong. Bitcoin plunge after South Korea said it was preparing a bill to ban trade in the cryptocurrency pic.twitter.com/ATqdNAYjG1

— Holger Zschaepitz (@Schuldensuehner) January 11, 2018

Elsewhere, investor jitters on the bond market are keeping stocks on the back foot again this morning.

The sharp rise in bond yields was sparked by the Bank of Japan trimming its government bond purchases, igniting concerns that the top central banks will taper their quantitative easing programmes quicker than the markets are expecting. The sudden rise was exacerbated yesterday by reports that China – one of the largest buyers of US Treasuries – are recommending slowing US 10-year Treasury purchases.

After stocks dipped in Asia and the US overnight, the FTSE 100 is again the sole blue-chip index on the rise in Europe but government bond yields are starting to pull back.

Trading statement: Boohoo.com, Fenner, Barratt Developments, Hays, M&S, moss Bros, Premier Oil, Spire, Tesco, Jupiter Fund Management, Rathbones, Ultra Electronics

AGM: Fenner, Debenhams, Domino's Pizza Group

Economics: BoE credit conditions survey, PPI (US), Industrial production (EU), ECB meeting minutes (EU)

Yahoo Finance

Yahoo Finance