Tesco aims to cut prices in buying tie-up with French giant Carrefour

The UK’s biggest retailer Tesco revealed plans for a buying alliance with its even-larger French counterpart Carrefour as the two supermarket chains battle against tough competition in the sector.

The duo said that working together to buy branded and own-brand products as well as other supplies such as trollies and shop fittings would allow them to lower prices as well as improving the quality and range of goods available.

The planned deal, expected to be formally ironed out in the next two months, follows a similar arrangement between French chains Casino, Auchan and Schieve, and Germany’s Metro, which emerged on Friday.

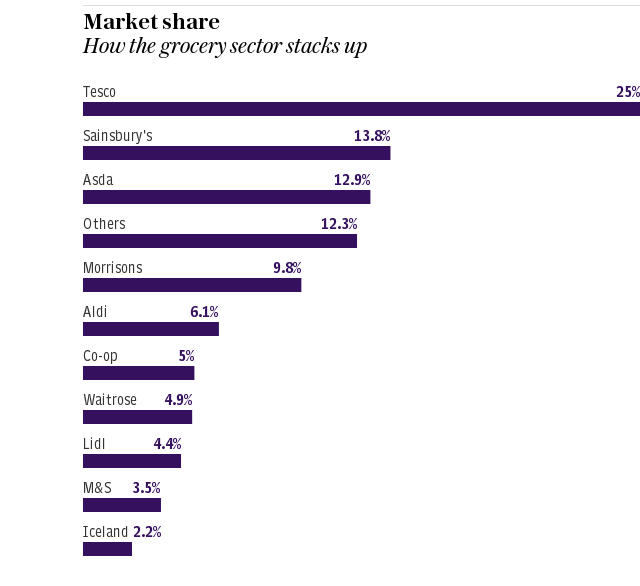

Analysts said the move was likely inspired by the proposed merger of Tesco’s two largest rivals, Asda and Sainsbury’s, which was announced in May. If that goes ahead then the new combined company would supplant Tesco as the biggest player in UK groceries.

Carrefour is larger than Tesco, with 12,300 stores in 30 countries as far and wide as Argentina and China. The two giants have combined revenues of £140bn.

Analysts at Jefferies said the three-year agreement could be aiming to find total savings of around £400m, with Carrefour standing to benefit the most because of its lower margins.

The sector’s big players are all having to fight against competition from low-cost German discounters Aldi and Lidl and are also braced for ecommerce giant Amazon to expand its food business after it bought Whole Foods Market last year.

Laith Khalaf, an analyst at Hargreaves Lansdown, said a price war was likely to benefit consumers but posed a risk for shareholders.

He added: “In theory, the big supermarkets can use greater firepower in the supply chains to lower prices, drive more sales, and perhaps even keep a bit more margin for themselves.

Mr Khalaf warned that there was a risk of a "tit for tat price war" spiraling out of control, which could end up lowering profit margins across the industry.

Tesco’s chief executive Dave Lewis said: “By working together and making the most of our collective product expertise and sourcing capability, we will be able to serve our customers even better, further improving choice, quality and value."

Shares in Tesco were up 0.1pc at 257p in morning trade.

Yahoo Finance

Yahoo Finance