Tesla loses a third of its value in a week after missing out on S&P 500

Tesla’s brutal losing streak accelerated on Tuesday as the company’s snub from the S&P 500 and news of increased competition from General Motors meant it lost almost a fifth of its value.

Elon Musk’s electric car company declined by more than 20pc, meaning it has lost around a third of its value since the start of last week.

Tesla has been one of the biggest victims of a Wall Street sell-off in recent days that continued on Tuesday after Monday’s market holiday. The tech-heavy Nasdaq dropped another 1.8pc while Apple, the world’s biggest public company, fell by 4.4pc, its value slipping below the $2 trillion value it had hit just weeks earlier.

SEB analyst Lara Mohtadi said the sell-off was driven by investors seizing “an opportunity to lock in gains”, with Deutsche Bank labelling a knock for America’s ascendant Big Tech companies the “main culprit” behind the losses.

Tesla’s fall was especially sharp after the company was surprisingly denied entry to the S&P 500 in a reshuffle of the US blue-chip index on Friday.

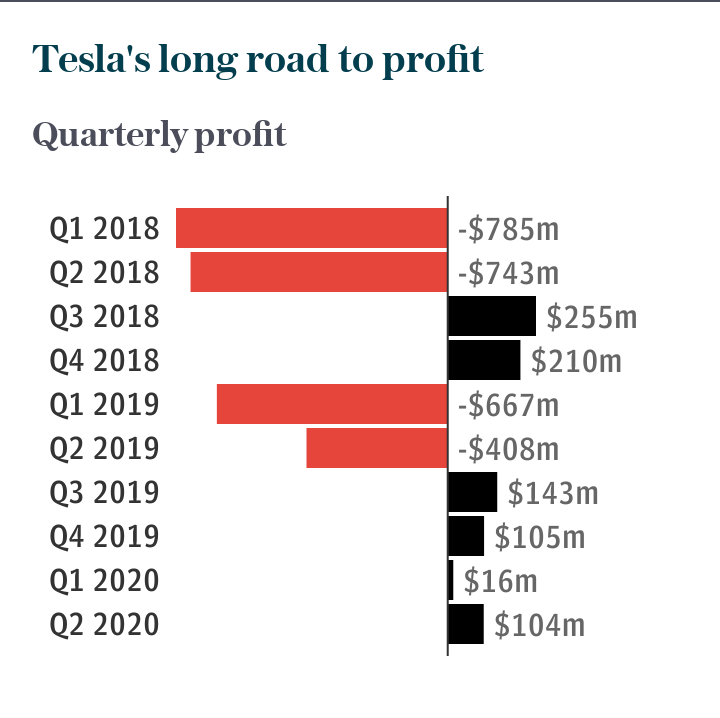

Many investors had expected Tesla’s recent stock split and profit – the first time it has had four consecutive quarters in the black – to clear the way for entry, something that would see a rush of index-linked purchases of Tesla shares.

Tesla shares have soared in recent months, partly on anticipation of being included in the S&P 500. However, the company was passed over on Friday, with online retailer Etsy, robotics maker Teradyne and pharmaceutical company Catalent making the grade.

Separately, General Motors announced a major push into electric vehicles, saying it would start manufacturing electric pickup trucks developed by Tesla rival Nikola as well as taking an 11pc stake in the company. Nikola’s Badger truck, which is due to enter production in 2022, will compete with Tesla’s Cybertruck.

Tesla’s recent slump has knocked around $145bn (£111bn) off its value since last Monday, personally costing Mr Musk almost $30bn.

Despite the decline, Tesla shares have still almost tripled since the start of this year.

Yahoo Finance

Yahoo Finance