Texas Instruments Announces Pricing of Senior Notes Due 2025

Texas Instruments Incorporated TXN or TI recently announced an offering of senior unsecured notes aggregating $750 million. The notes carry an interest rate of 1.375% and are scheduled to mature on Mar 12, 2025.

The company stated that the transaction proceeds will be used for general corporate purposes. In addition, TI will use the proceeds to repay $500 million principal amount of 1.75% notes due May 1, 2020.

BofA Securities, MUFG Securities Americas Inc., Barclays Capital, Citigroup Global Markets, J.P. Morgan Securities LLC, Mizuho Securities USA LLC, and Morgan Stanley & Co. LLC are acting as joint book-running managers for the purpose.

Cash Position

At the end of fourth-quarter 2019, cash and short-term investments balance came in at $5.4 billion, which increased from $5.1 billion as of Sep 30, 2019. Long-term debt was $5.303 billion, up from $5.302 billion in the prior quarter.

The company generated $1.8 billion of cash from operations, down from $1.9 billion in the previous quarter. Capex was $163 million in the fourth quarter. Further, free cash flow came in at $1.6 billion. Texas Instruments paid out dividends worth $841 million during the reported quarter. Further, it repurchased shares worth $489 million.

We believe that the company has a strong balance sheet, which will help it to capitalize on investment opportunities and pursue strategic acquisitions, further improving prospects. In our view, the senior notes’ offering will bring down the company’s cost of capital, in turn strengthening the balance sheet and supporting growth.

These notes should provide financial flexibility and propel long-term growth.

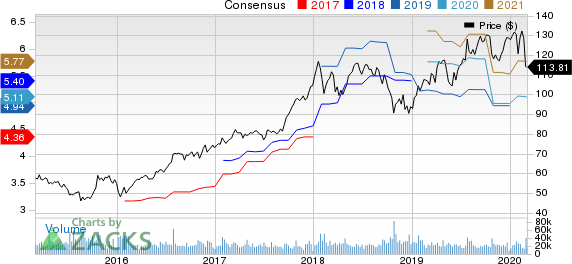

Texas Instruments Incorporated Price and Consensus

Texas Instruments Incorporated price-consensus-chart | Texas Instruments Incorporated Quote

Bottom Line

Texas Instruments is one of the largest suppliers of analog and digital signal processing integrated circuits. The company’s compelling product line-up, increasing differentiation in business and low-cost 300mm capacity are anticipated to drive long-term earnings.

Its focus on innovation of the product portfolio across both the segments is evident from growing research and development spending. This continues to be a key catalyst. Further, Texas Instruments continues to increase investments in automotive and industrial markets, which are anticipated to bode well in the long run.

The company remains confident on portfolio strength, efficient manufacturing strategies and optimized capital allocation in growth areas.

Persistent weakness in end-market conditions impacted TI’s Analog and Embedded Processing segments in the last reported quarter. Also, increasing competition from Analog Devices, NVIDIA Corporation and Applied Materials remains a concern.

Zacks Rank and Stocks to Consider

Texas Instruments currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. STMP, eBay Inc. EBAY and Atlassian Corp. TEAM. While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Atlassian carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Stamps.com, Atlassian and eBay is currently projected at 15%, 22.3% and 11.3%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance